2018–19 Departmental Plan

Office of the Auditor General of Canada2018–19 Departmental Plan

ISSN 2371-7661

Table of Contents

- Message from the Auditor General of Canada

- Planned results: What we want to achieve this year and beyond

- Spending and human resources

- Supplementary information

- Appendix A: Strategic framework of the Office of the Auditor General of Canada

- Appendix B: Performance measurement framework of the Office of the Auditor General of Canada

- Appendix C: Definitions

Message from the Auditor General of Canada

I am pleased to present the Office of the Auditor General of Canada’s 2018–19 Departmental Plan. In this plan, we describe our activities, our priorities, and the results we expect to achieve in the 2018–19 fiscal year, along with the measures we will use to assess our performance.

As the legislative auditor of the federal government and Canada’s three territories, we provide Parliament and the northern legislatures with independent and objective assurance, advice, and information on government expenditures and the management of government programs. In the 2018–19 fiscal year, we plan to complete 89 financial audits, 27 performance audits, and 8 special examinations.

The mission we set for ourselves is to contribute to a well-managed and accountable government for Canadians. Our vision is to be widely respected for the quality and impact of our work. We have established strategic objectives to ensure that we stay focused on that mission and vision. Each year, we review our strategic objectives and the risks we face, so that we can identify our priorities for the next fiscal year.

We have established as priorities the following three strategic objectives for the 2018–19 fiscal year:

- to ensure effective, efficient, and accountable Office governance and management;

- to be a financially well-managed organization accountable for the use of resources entrusted to it; and

- to develop and maintain a skilled, engaged, and bilingual workforce.

Our governance and management. We need to improve our governance and management of our information technology (IT). We recently completed an IT self-assessment and internal audit, both of which identified that we had not maintained our IT security controls well enough. We also need to renew the IT infrastructure that supports our audits.

We have prepared a multi-year IT plan to ensure that we appropriately maintain and update our IT systems. We have already implemented parts of that plan, but it will take us years to implement the whole plan.

Our finances. We currently have challenges in meeting our financial management objective because some significant government programs that we audit—such as employee pay, pension investments, and infrastructure investments—have become more complex. In addition, we will need to spend more of our budget on some of our support services, such as human resource management and information technology.

We have communicated our financial challenges to the Minister of Finance, who is the minister responsible for our office in Parliament. In the 2018–19 fiscal year, we intend to find a balance between the resources available to us and the work we need to do. Also, as is our normal practice, we will continue to review our work to identify whether there is anything that we do that is no longer necessary. However, the opportunities to streamline our work are fewer than the new demands that we have to meet.

Our people. We need to ensure that our staff have the skills, support, and time they need to complete their work.

We will implement the next steps in our professional development and second language plans, and we will better match our audit and support service requirements with the human resources we have available to do the work.

It will take a significant and coordinated effort by the entire office to implement these three priorities that we have set for ourselves.

I would once again like to take this opportunity to thank all of our employees for their work. Each year I am impressed by their dedication and their commitment to the Office, to Parliament, and to all Canadians.

[Original signed by]

Michael Ferguson, Chartered Professional AccountantCPA, Chartered AccountantCA

Fellow Chartered Professional AccountantFCPA, Fellow Chartered AccountantFCA (New Brunswick)

Auditor General of Canada

23 February 2018

Planned results: What we want to achieve this year and beyond

Through legislative auditing, the departmental result we seek to achieve is a well-managed and accountable government.

Our core responsibility: Legislative auditing

Description

Our audit reports provide objective, fact-based information and expert advice on government programs and activities. With our audits, we assist Parliament in its work on the authorization and oversight of government spending and operations. Our audits are also used by territorial legislatures, boards of Crown corporations and audit committees to help oversee the management of government activities and hold them to account for the handling of public funds. Financial audits assess if the annual financial statements of the government and Crown corporations are presented fairly, consistent with applicable accounting standards. Performance audits assess if government manages with due regard for economy, efficiency, and environmental impact and measures its effectiveness. Special examinations assess if Crown corporation systems and practices provide reasonable assurance that assets are safeguarded, resources are managed economically and efficiently, and operations are managed effectively.

Operating context and risks

The operating context of the Office of the Auditor General of Canada is most affected by developments in the auditing and accounting professions, and by changes in government operations.

Although we will be responding to a number of new auditing and accounting standards, we do not expect this work to require a reallocation of resources in the 2018–19 fiscal year.

There have been many changes in government operations. The federal government’s budgeted program expenditures for 2017–18 were $50 billion higher than its actual program expenses in 2014–15, which has increased the size of our audit universe for both financial and performance audits. The increasing complexity in the nature of government transactions—from pension investments and derivative financial instruments to infrastructure programs and the implementation of new information technology systems—requires us to enhance our methodologies, tools, and training. We have also been given three new financial audits to conduct each year.

These ongoing and evolving changes in our operating context are putting a significant strain on the Office’s resources and ability to deliver quality products on a timely basis. In addition, our funding is stable while our operating expenses continue to increase. In particular, our information technology capacity is insufficient to address pending demands.

Planning highlights

In light of our operating context and risks, the Office of the Auditor General of Canada identified the following three strategic objectives as priority areas for the 2018–19 fiscal year:

- Ensure effective, efficient, and accountable Office governance and management.

- Be a financially well-managed organization accountable for the use of resources entrusted to it.

- Develop and maintain a skilled, engaged, and bilingual workforce.

Our governance and management

The Office’s current information technology (IT) security controls do not reduce security risk to a level acceptable to the Office. In addition, we are facing the potential failure of some of our IT systems, with an immediate need to replace our human resource management system. In response, we have developed a multi-year IT security self-assessment plan, which we are currently implementing. We have also developed a roadmap to guide the maintenance and updating of all IT systems. Both of these initiatives require additional resources to fully implement.

Our finances

The Office is facing capacity pressure in several areas, including Corporate Services and Audit Operations. This situation is affecting our ability to deliver essential services and meet compliance requirements, and it is affecting employee morale. It also means we must make near-term resource decisions that have long-term budget impacts, when future funding levels are uncertain. In response to this pressure, we submitted a funding proposal to the Minister of Finance. In the near term, we will continue with our currently planned program and outputs for the 2018–19 fiscal year, pending a decision from the federal government. The Executive Committee is providing enhanced oversight of spending decisions and developing priorities for longer-term budget allocations. The Office is also looking to eliminate work that is not necessary to fulfill the requirements of professional standards, legal and regulatory requirements, and its internal service standards.

Our people

Employees throughout the Office are dealing with a lack of capacity to deliver essential services or required products to expected quality standards in a timely manner. In addition, staff will be affected by significant changes in senior management anticipated in the coming years. The Office recognizes that its work plan is ambitious and demanding and that we must reduce the workload on our employees. We are looking at options for how to bring this situation into balance in the coming year.

Planned results

The Office has statutory responsibilities for the audit of the consolidated financial statements of the Government of Canada and each of the three territorial governments, and the financial statements of federal Crown corporations, territorial corporations, and other entities. These other entities include International Criminal Police OrganizationINTERPOL, for which the Office has been appointed auditor for 2016, 2017, and 2018; and United Nations Educational, Scientific and Cultural OrganizationUNESCO, for which the Office has been appointed auditor for the period 2018–2023. In the 2018–19 fiscal year, we will conduct more than 89 financial audits and related assurance engagements.

We plan to report the findings of 27 federal and territorial performance audits in the 2018–19 fiscal year, including performance audits conducted by the Commissioner of the Environment and Sustainable Development. A list of these performance audits appears in the “Supplementary information” section of this report.

Over a 10-year period, the Office performs special examinations of more than 40 federal Crown corporations. In the 2018–19 fiscal year, we plan to complete examinations of eight federal Crown corporations: the Canada Council for the Arts, the National Museum of Science and Technology, the Business Development Bank of Canada, the Canadian Commercial Corporation, the National Gallery of Canada, the Standards Council of Canada, Marine Atlantic incorporatedInc., and Canada Post Corporation.

We monitor and report on our operations using a framework that is built around 11 strategic objectives that guide our audit work and the administration of the Office (see Appendix A). Our performance measurement framework, presented in Appendix B, establishes our indicators and targets for each of these objectives.

On 1 July 2016, the Treasury Board’s Policy on Results came into effect. The objectives of this policy are to improve the achievement of results across government; and to enhance the understanding of the results government seeks to achieve and does achieve, and the resources used to achieve them. The policy defines results as the changes that government organizations seek to influence. It recognizes that results are often outside organizations’ immediate control.

The ultimate result that the Office seeks to influence through its legislative auditing is well-managed and accountable government for Canadians. For financial reporting, this result would be demonstrated by high-quality, timely financial information. We measure this by tracking the percentage of audit reports we issue without qualifications or “other matters” raised, and the percentage of these reports that meet statutory or other deadlines, even though we do not fully control the result.

Exhibit 1 presents the Office’s departmental result, result indicators, targets, and actual results for the 2014–15, 2015–16, and 2016–17 fiscal years.

Exhibit 1—Departmental result, result indicators, targets, and actual results for the 2014–15, 2015–16, and 2016–17 fiscal years

Departmental result: Well-managed and accountable government

| Departmental result indicators | Target | Date to achieve target | 2014–15 Actual results |

2015–16 Actual results |

2016–17 Actual results |

|---|---|---|---|---|---|

|

Percentage of audit reports on financial statements without qualifications or “other matters” raised. |

100% |

Ongoing |

Indicator not in place during the fiscal year |

94% |

98% |

|

Percentage of special examination reports with no significant deficiencies. |

100% |

Ongoing |

100% |

75% |

40% |

|

Percentage of audit recommendations/opinions addressed by entities: For financial audits, percentage of qualifications and “other matters” addressed from one financial audit report to the next. |

100% |

Ongoing |

Target not met |

Target not met |

Target not met (Audit opinion on Reserve Force Pension Plan not issued for 2014–15 and 2015–16) |

|

Percentage of audit recommendations/opinions addressed by entities: For performance audits, percentage of recommendations examined in our performance audit follow-up audits for which progress is assessed as satisfactory. |

At least |

Ongoing |

Target met |

No follow-up conducted |

Target not met (Satisfactory progress on 0 of 3 recommendations subject to follow-up) |

|

Percentage of audit recommendations/opinions addressed by entities: For special examinations, percentage of significant deficiencies reported in our special examination reports that are addressed from one examination to the next. |

100% |

Ongoing |

Target met |

Target met |

Target not met (Continuing significant deficiencies at Freshwater Fish Marketing Corporation) |

|

Percentage of audit reports to Parliament that are reviewed by parliamentary committees. |

At least |

Ongoing |

44% |

59% |

Target met |

|

Percentage of audits that meet statutory deadlines, where applicable, or our planned reporting dates: |

|||||

|

100% |

Ongoing |

96% |

90% |

Target not met (95%) |

|

At least |

Ongoing |

Target met |

Target met |

Target met |

Financial, human resources, and performance information for the Office of the Auditor General of Canada’s Program Inventory is available in the Government of CanadaGC InfoBase.

Spending and human resources

Planned spending

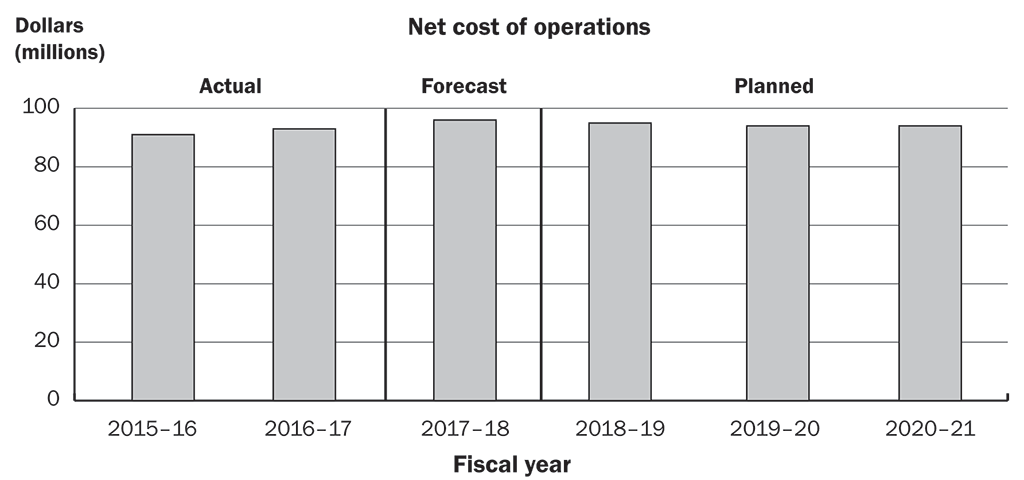

Exhibit 2 shows the Office’s spending trend for the 2015–16 to 2020–21 fiscal years. Planned spending in the 2018–19 through 2020–21 fiscal years does not include any additional funding requested in the Office’s funding proposal submitted to the Minister of Finance.

Exhibit 2—Departmental spending trend

Exhibit 2—text version

| Actual spending | Forecast spending | Planned spending | |||

|---|---|---|---|---|---|

| 2015–16 | 2016–17 | 2017–18 | 2018–19 | 2019–20 | 2020–21 |

| 90.7 | 92.5 | 96.4 | 95.0 | 93.8 | 94.0 |

Exhibit 3 provides the Office of the Auditor General of Canada’s spending summary for the same period.

Exhibit 3—Spending summary ($ dollars)

| Legislative auditing activity | Actual spending | Forecast spending | Planned spending | |||

|---|---|---|---|---|---|---|

| 2015–16 | 2016–17 | 2017–18 | 2018–19 | 2019–20 | 2020–21 | |

| Financial audits of Crown corporations, territorial governments, and other organizations, and of the summary financial statements of the Government of Canada | 43,000,000 | 42,100,000 | 45,800,000 | 45,500,000 | 46,800,000 | 46,900,000 |

| Performance audits and studies | 34,900,000 | 33,500,000 | 31,700,000 | 32,900,000 | 33,200,000 | 33,400,000 |

| Special examinations of Crown corporations | 3,500,000 | 5,400,000 | 7,200,000 | 5,900,000 | 4,200,000 | 3,800,000 |

| Sustainable development monitoring activities and environmental petitions | 1,700,000 | 2,200,000 | 2,900,000 | 1,900,000 | 1,900,000 | 1,900,000 |

| Professional practices | 9,100,000 | 9,800,000 | 9,200,000 | 9,800,000 | 9,500,000 | 9,600,000 |

| Total cost of operations | 92,200,000 | 93,000,000 | 96,800,000 | 96,000,000 | 95,600,000 | 95,600,000 |

| Less: costs recovered | (1,500,000) | (500,000) | (400,000) | (1,000,000) | (1,800,000) | (1,600,000) |

| Net cost of operations | 90,700,000 | 92,500,000 | 96,400,000 | 95,000,000 | 93,800,000 | 94,000,000 |

Planned human resources

Exhibit 4 provides the Office’s human resources planning summary for the 2015–16 to 2020–21 fiscal years.

Exhibit 4—Human resources planning summary (full-time equivalents)

| Actual 2015–16 |

Actual 2016–17 |

Forecast 2017–18 |

Planned full-time equivalents | ||

|---|---|---|---|---|---|

| 2018–19 | 2019–20 | 2020–21 | |||

| 546 | 555 | 570 | 550 | 550 | 550 |

Estimates by vote

Excluding Budget 2018, $78,224,516 funding is anticipated through the Main Estimates. Of this amount, $69,027,524 requires approval by Parliament. The remaining $9,196,992 represents statutory forecasts that do not require additional approval and are provided for information purposes.

For information on the Office of the Auditor General of Canada’s appropriations, please consult the 2018–19 Main Estimates.

Supplementary information

Corporate information

Organizational profile

Auditor General of Canada: Michael Ferguson, CPA, CA, FCPA, FCA (New Brunswick)

Main legislative authorities:

Auditor General Act, Revised Statutes of CanadaR.S.C. 1985, c. A-17

Financial Administration Act, R.S.C. 1985, c. F-11

Year established: 1878

Minister: The Honourable William F. Morneau, Privy CouncillorP.C., Member of ParliamentM.P., Minister of Finance*

* The Auditor General acts independently in the execution of his audit responsibilities, but reports to Parliament on expenditures through the Minister of Finance.

Raison d’être, mandate, and role

“Raison d’être, mandate and role: who we are and what we do” is available on the Office of the Auditor General of Canada’s website.

Operating context and key risks

Information on operating context and key risks is available on the Office of the Auditor General of Canada’s website.

Reporting framework

The Office of the Auditor General of Canada’s Departmental Results Framework and Program Inventory of record for 2018–19 are shown in Exhibit 5.

Exhibit 5—Departmental Results Framework and Program Inventory

Core responsibility: Legislative auditing

|

Description Our audit reports provide objective, fact-based information and expert advice on government programs and activities. With our audits, we assist Parliament in its work on the authorization and oversight of government spending and operations. Our audits are also used by territorial legislatures, boards of Crown corporations and audit committees to help oversee the management of government activities and hold them to account for the handling of public funds. Financial audits assess if the annual financial statements of the government and Crown corporations are presented fairly, consistent with applicable accounting standards. Performance audits assess if government manages with due regard for economy, efficiency, and environmental impact and measures its effectiveness. Special examinations assess if Crown corporation systems and practices provide reasonable assurance that assets are safeguarded, resources are managed economically and efficiently, and operations are managed effectively. |

Result and indicators |

|

Well-managed and accountable government:

|

|

|

Program Inventory |

|

|

Exhibit 6 shows the concordance between the Office of the Auditor General of Canada’s Departmental Results Framework and Program Inventory of record for 2018–19 and its Program Alignment Architecture for 2017–18.

Exhibit 6—Concordance between the Departmental Results Framework and the Program Inventory, 2018–19, and the Program Alignment Architecture, 2017–18

Core responsibility 1: Legislative auditing

| 2018–19 Core Responsibilities and Program Inventory | 2017–18 Lowest-level program of the Program Alignment Architecture | Percentage of lowest-level Program Alignment Architecture program (dollars) corresponding to the program in the Program Inventory |

|---|---|---|

| Program 1.1: Financial audit | Program 1: Legislative auditing | 53% |

| Program 1.2: Special examinations | 7% | |

| Program 1.3: Performance audit | 38% | |

| Program 1.4: Sustainable development monitoring | 2% |

Supporting information on the Program Inventory

Supporting information on planned expenditures, human resources, and results related to the Office of the Auditor General of Canada’s Program Inventory is available in the GC InfoBase.

Supplementary information tables

The following supplementary information is available on the Office of the Auditor General of Canada’s website:

- Sustainable Development Strategy for the Office of the Auditor General of Canada—2017–2020

- Practice Review and Internal Audit—Risk-Based Plan for the 2017–18 to 2019–20 Fiscal Years

- Gender-based analysis plus

- Planned evaluation coverage over the next five fiscal years

Planned reports for 2018–19

Reports to Parliament

Spring 2018: Reports of the Auditor General of Canada

- Employment Training for Indigenous People—Employment and Social Development Canada

- Consular Services to Canadians Abroad—Global Affairs Canada

- Military Justice—National Defence

- Socio-economic Gaps on First Nations Reserves—Indigenous and Northern Affairs Canada

- Implementing Phoenix

- New Champlain Bridge

- Crown Assets Disposal

Spring 2018: Reports of the Commissioner of the Environment and Sustainable Development

- Salmon Farming

- Canada’s Readiness to Implement the United Nations’ Sustainable Development Goals

- Conserving Biodiversity

Fall 2018: Reports of the Auditor General of Canada

- Broadband in Rural and Remote Regions

- Fighter Jets

- Protection of Cultural and Historic Federal Properties

- Compliance and Audit Activities—Canada Revenue Agency

- Community Supervision—Correctional Service Canada

- First Nations Children in Care on Reserves—Indigenous and Northern Affairs Canada

- Physical Security at Canadian Missions—Global Affairs Canada

- Inappropriate Sexual Behaviour—Canadian Armed Forces

Fall 2018: Reports of the Commissioner of the Environment and Sustainable Development

- Follow-up Report on Risks of Toxic Substances and Enforcing the Canadian Environmental Protection Act

- Impacts of Marine Transprot on Marine Mammals

- Departmental Progress in Implementing Sustainable Development Strategies

- Environmental Petitions Annual Report

Spring 2019: Reports of the Commissioner of the Environment and Sustainable Development

- Fossil Fuels Subsidies II

- Metal Mining Effluent Regulations

- Invasive Species

Reports to northern legislative assemblies

Fall 2018: Report of the Auditor General of Canada

- Follow-up Audit on Child and Family Services—Northwest Territories

Spring 2019: Reports of the Auditor General of Canada

- Support for Inuit Employment—Nunavut

- Kindergarten to Grade 12 Education—Northwest Territories

Organizational contact information

Office of the Auditor General of Canada

240 Sparks Street

Ottawa, Ontario

Canada, K1A 0G6

Telephone: 613-995-3708 or 1-888-761-5953

Fax: 613-957-0474

Hearing impaired only telecommunications device for the deafTTY: 613-954-8042

Email: communications@oag-bvg.gc.ca

Website: www.oag-bvg.gc.ca

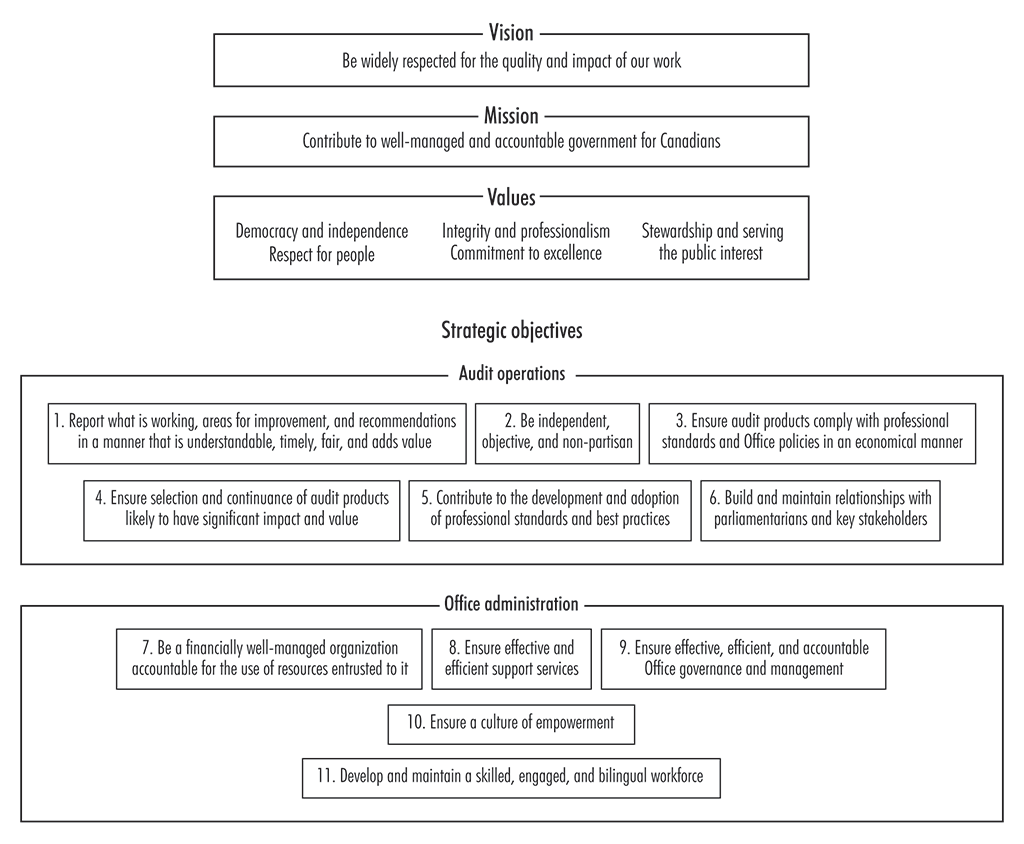

Appendix A: Strategic framework of the Office of the Auditor General of Canada

The Office of the Auditor General of Canada’s strategic framework identifies a number of client, operational, and people management objectives to help direct our work (Exhibit 7). We use this framework, together with our annual risk assessment, to establish our planning priorities and expected results.

Exhibit 7—Strategic framework of the Office of the Auditor General of Canada

Exhibit 7—text version

Vision

Be widely respected for the quality and impact of our work

Mission

Contribute to well-managed and accountable government for Canadians

Values

- Democracy and independence

- Respect for people

- Integrity and professionalism

- Commitment to excellence

- Stewardship and serving the public interest

Strategic Objectives

Audit operations

- Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, fair, and adds value

- Be independent, objective, and non-partisan

- Ensure audit products comply with professional standards and Office policies in an economical manner

- Ensure selection and continuance of audit products likely to have significant impact and value

- Contribute to the development and adoption of professional standards and best practices

- Build and maintain relationships with parliamentarians and key stakeholders

Office administration

- Be a financially well-managed organization accountable for the use of resources entrusted to it

- Ensure effective and efficient support services

- Ensure effective, efficient, and accountable Office governance and management

- Ensure a culture of empowerment

- Develop and maintain a skilled, engaged, and bilingual workforce

Appendix B: Performance measurement framework of the Office of the Auditor General of Canada

Exhibit 8—Audit operations

| Strategic objective | Performance indicators | 2018–19 Target |

2014–15 Actual results |

2015–16 Actual results |

2016–17 Actual results |

Notes |

|---|---|---|---|---|---|---|

|

1. Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, fair, and adds value. |

Percentage of audit reports on financial statements without qualifications or “other matters” raised |

100% |

Not applicableNote 1 |

94% |

98% |

|

|

Percentage of special examination reports with no significant deficiencies |

100% |

100% |

75% |

40% |

||

|

Percentage of reports to Parliament that are reviewed by parliamentary committees |

At least |

44% |

59% |

72% |

2016–17 result of 72% reflects a continuing increase from previous years |

|

|

Percentage of audit recommendations/opinions addressed by entities: |

||||||

|

100% |

Target not met |

Target not met |

Target not met |

Audit opinion on Reserve Force Pension Plan not issued for 2014–15 and 2015–16 |

|

|

At least |

Target met |

No follow-up conducted |

Target not met |

Satisfactory progress on 0 of 3 recommendations subject to follow-up |

|

|

100% |

Target met |

Target met |

Target not met |

Continuing significant deficiencies at Freshwater Fish Marketing Corporation |

|

|

Percentage of users who find that our audits are understandable, timely, fair, and add value |

At least |

Target met |

Target met |

Target not met |

||

|

Percentage of senior managers in the organizations we audit who find that our audits are understandable, timely, fair, and add value |

At least |

Target met |

Target met |

Target not met |

Senior managers concerned with balance between negative and positive observations |

|

|

Percentage of audits that meet statutory deadlines, where applicable, or our planned reporting dates: |

||||||

|

100% |

96% |

90% |

Target not met |

||

|

At least |

Target met |

Target met |

Target met |

||

|

2. Be independent, objective, and non-partisan. |

Number of founded complaints and allegations regarding failure to comply with professional standards, legal and regulatory requirements, or the Office’s System of Quality Control |

Zero |

Target met |

Target met |

Target met |

|

|

Percentage compliance with professional standards and Office policies for independence |

100% |

Target met |

Target met |

Target met |

||

|

Percentage of clients who find that we are independent, objective, and non-partisan |

At least |

Not applicableNote 1 |

Target met |

Target met |

||

|

Percentage of senior managers in the organizations we audit who find that we are independent, objective, and non-partisan |

At least |

Not applicableNote 1 |

Target met |

Target met |

||

|

3. Ensure audit products comply with professional standards and Office policies in an economical manner. |

Percentage of internal and external reviews that find engagement leaders complied with professional standards |

100% |

Target met |

Target met |

Target met |

|

|

Percentage of internal practice reviews that find the opinions and conclusions expressed in our audit reports to be appropriate and supported by the evidence |

100% |

Target met |

Target met |

Target met |

||

|

Percentage of external reviews that find our System of Quality Control to be suitably designed and operating effectively |

100% |

No data |

No data |

No data |

External peer review conducted once every 10 years (next scheduled for 2019) |

|

|

Percentage of audits that are completed on budget |

At least |

Target met for financial audits and performance audits; 67% for special examinations |

74% |

Target met |

||

|

4. Ensure selection and continuance of audit products likely to have significant impact and value. |

This strategic objective is about the long-term development of the Office’s mandate and products. Although there is no performance indicator that we measure and monitor annually, we undertake many activities that help us achieve this objective. |

|||||

|

5. Contribute to the development and adoption of professional standards and best practices. |

Percentage of commitments met to contribute to domestic and international professional standards bodies |

100% |

Not applicableNote 1 |

Target met |

Target met |

|

|

6. Build and maintain relationships with parliamentarians and key stakeholders. |

Percentage of clients who find that auditors met relationship expectations |

At least |

Not applicableNote 1 |

Target met |

Target met |

|

|

Percentage of senior managers in the organizations we audit who find that auditors met relationship expectations |

At least |

Not applicableNote 1 |

Target met |

Target met |

||

Exhibit 9—Office administration

| Strategic objective | Performance indicators | 2018–19 Target |

2014–15 Actual results |

2015–16 Actual results |

2016–17 Actual results |

Notes |

|---|---|---|---|---|---|---|

|

7. Be a financially well-managed organization accountable for the use of resources entrusted to it. |

Percentage compliance with financial management and reporting requirements |

100% |

99% |

99% |

99% |

1 of 5 criteria was not met: Of 557 contracts, 14 were reported as non-compliant in 2016–17 |

|

8. Ensure effective and efficient support services. |

Percentage of internal service standards met (human resources, information technology, security, editorial services) |

100% |

Not applicableNote 1 |

69% |

Target not met |

|

|

Percentage of internal clients who find that support services are effective and efficient |

At least |

Not applicableNote 1 |

Not available |

Not available |

Data collection started in 2017–18 |

|

|

9. Ensure effective, efficient, and accountable Office governance and management. |

Percentage of employees who find that the Office is well governed and managed |

At least |

Not applicableNote 1 |

77% |

No data |

Survey was conducted in 2017–18 |

|

Completion of the Office’s annual strategic priority projects |

All |

Not applicableNote 1 |

Not applicableNote 1 |

Target met |

||

|

10. Ensure a culture of empowerment. |

Percentage of employees who find that the Office ensures a culture of empowerment |

At least |

Not applicableNote 1 |

Target met |

No data |

Survey was conducted in 2017–18 |

|

11. Develop and maintain a skilled, engaged, and bilingual workforce. |

Percentage of employees who complete mandatory training within the allotted time frame |

100% |

Not applicableNote 1 |

Not applicableNote 1 |

Target not met |

|

|

Percentage of employees who find that the Office develops and maintains an engaged workforce |

At least |

Not applicableNote 1 |

Target met |

No data |

Survey was conducted in 2017–18 |

|

|

Percentage of employees who meet the language requirements of their positions: |

||||||

|

100% |

79% |

Target met |

Target met |

||

|

100% |

83% |

78% |

Target not met |

Two principals did not meet oral language requirements |

|

|

100% |

Not applicableNote 1 |

81% |

Target met |

||

|

Percentage of employees who find that the Office develops and maintains a bilingual workforce |

At least |

Not applicableNote 1 |

89% |

No data |

Survey was conducted in 2017–18 |

|

Appendix C: Definitions

appropriation (crédit): Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires): Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

Core Responsibility (responsabilité essentielle): An enduring function or role performed by a department. The intentions of the department with respect to a Core Responsibility are reflected in one or more related Departmental Results that the department seeks to contribute to or influence.

Departmental Plan (plan ministériel): A report on the plans and expected performance of appropriated departments over a three-year period. Departmental Plans are tabled in Parliament each spring.

Departmental Result (résultat ministériel): Any change or changes that the department seeks to influence. A Departmental Result is often outside departments’ immediate control, but it should be influenced by Program-level outcomes.

Departmental Result Indicator (indicateur de résultat ministériel): A factor or variable that provides a valid and reliable means to measure or describe progress on a Departmental Result.

Departmental Results Framework (cadre ministériel des résultats): The department’s Core Responsibilities, Departmental Results and Departmental Result Indicators.

Departmental Results Report (rapport sur les résultats ministériels): A report on the actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

experimentation (expérimentation): Activities that seek to explore, test and compare the effects and impacts of policies, interventions and approaches, to inform evidence-based decision-making, by learning what works and what does not.

financial audit (audit d’états financiers): Provides assurance that financial statements are presented fairly, in accordance with the applicable financial reporting framework.

full-time equivalent (équivalent temps plein): A measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

Gender-based Analysis Plus (GBA+) (analyse comparative entre les sexes plus [ACS+]): An analytical process used to help identify the potential impacts of policies, programs and services on diverse groups of women, men and gender-diverse people. The “plus” acknowledges that GBA goes beyond sex and gender differences. We all have multiple identity factors that intersect to make us who we are; GBA+ considers many other identity factors, such as race, ethnicity, religion, age, and mental or physical disability.

government-wide priorities (priorités pangouvernementales): For the purpose of the 2018–19 Departmental Plan, government-wide priorities refers to those high-level themes outlining the government’s agenda in the 2015 Speech from the Throne, namely: Growth for the Middle Class; Open and Transparent Government; A Clean Environment and a Strong Economy; Diversity is Canada's Strength; and Security and Opportunity.

horizontal initiative (initiative horizontale): An initiative in which two or more federal organizations, through an approved funding agreement, work toward achieving clearly defined shared outcomes, and which has been designated (by Cabinet, a central agency, etceteraetc.) as a horizontal initiative for managing and reporting purposes.

non-budgetary expenditures (dépenses non budgétaires): Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement): What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

performance audit (audit de performance): An independent, objective, and systematic assessment of how well the government is managing its activities, responsibilities, and resources.

performance indicator (indicateur de rendement): A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement): The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

planned spending (dépenses prévues): For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

plan (plan): The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

priority (priorité): A plan or project that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Departmental Results.

Program (programme): Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

Program Alignment Architecture (architecture d’alignement des programmes):Footnote 1 A structured inventory of an organization’s programs depicting the hierarchical relationship between programs and the Strategic Outcome(s) to which they contribute.

results (résultat): An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

special examination (examen spécial): A form of performance audit that is conducted within Crown corporations. The scope of special examinations is set out in the Financial Administration Act. A special examination considers whether a Crown corporation’s systems and practices provide reasonable assurance that its assets are safeguarded and controlled, its resources are managed economically and efficiently, and its operations are carried out effectively.

statutory expenditures (dépenses législatives): Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

Strategic Outcome (résultat stratégique): A long-term and enduring benefit to Canadians that is linked to the organization’s mandate, vision and core functions.

sunset program (programme temporisé): A time-limited program that does not have an ongoing funding and policy authority. When the program is set to expire, a decision must be made whether to continue the program. In the case of a renewal, the decision specifies the scope, funding level and duration.

target (cible): A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées): Expenditures that Parliament approves annually through an Appropriation Act. The Vote wording becomes the governing conditions under which these expenditures may be made.