Report of the Auditor General of Canada to the Board of Directors of the Canadian Dairy Commission—Special Examination Report—2021

Independent Auditor’s Report

Table of Contents

- Audit Summary

- Introduction

- Findings, Recommendations, and Responses

- Conclusion

- About the Audit

- List of Recommendations

- Exhibits:

- 1—The Canadian Dairy Commission

- 2—Corporate governance—Key findings and assessment

- 3—Strategic planning—Key findings and assessment

- 4—Corporate risk management—Key findings and assessment

- 5—The corporation’s programs for managing seasonal fluctuations in domestic supply and demand had substantial annual sales and fiscal year-end inventories of butter

- 6—Operational planning and performance monitoring and reporting—Key findings and assessment

- 7—Operations—Key findings and assessment

Audit Summary

We found that the Canadian Dairy Commission had good practices in managing its operations. We also identified areas for improvement in corporate management. We found that a board vacancy outside the corporation’s control amounted to a significant deficiency in corporate governance. The deficiency put at risk the ability of the board of directors to make decisions.

Introduction

Background

1. The Canadian Dairy Commission is a Crown corporation established in 1966 under the Canadian Dairy Commission Act. Its mandate is to provide efficient producers in the dairy industry with the opportunity of obtaining a fair return for their labour and investment and, at the same time, to provide consumers with a continuous and adequate supply of high-quality dairy products.

2. The corporation reports to Parliament through the Minister of Agriculture and Agri-Food and advises the Minister on matters related to the dairy industry.

3. Canada’s dairy industry operates under a supply management system involving the federal and provincial governments. The system has 3 elements: planning national production, setting milk prices, and controlling imports.

4. Among the most important roles that the corporation performs in this system are

- managing price setting for milk at the farm and helping ensure that production can meet demand

- performing calculations that determine how producers share markets and revenues

- conducting compliance audits of industry stakeholders

- facilitating the functioning of national and regional dairy committees

- administering programs on behalf of the industry that encourage innovation and market growth

- importing butter according to Canada’s World Trade Organization commitments

- administering domestic seasonality programs, which help the dairy industry cope with seasonal fluctuations in domestic supply and demand

5. The dairy industry is a major contributor to Canada’s economy. In 2019, the country had approximately 10,400 dairy farms. Of these, 81% were located in Quebec and Ontario, 13% in the West, and 6% in the Atlantic provinces. Aside from producers, other industry participants include federal government organizations, such as Agriculture and Agri-Food Canada; provincial milk marketing boards; processors; and consumers.

6. The dairy industry is facing new market conditions. These include uncertainties associated with Canada’s recent ratification of 3 major international trade agreements:

- the Comprehensive Economic and Trade Agreement with the European Union

- the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, with 10 countries in the Asia-Pacific region

- the Canada–United States–Mexico Agreement, replacing the North American Free Trade Agreement

The corporation estimates that when the agreements are fully implemented, the market access granted to foreign competitors will amount to approximately 10% of Canada’s dairy production.

7. Another source of uncertainty is the impact of the coronavirus disease (COVID-19) pandemic. With lockdowns imposed in Canada, milk demand shifted rapidly from food service businesses to retail purchases by consumers. In late March and early April 2020, Canadian dairy marketing boards asked producers to dispose of milk at the farm. The boards also put in place strict production control measures to halt such disposals. Milk production in Canada dropped by 5.5% in April, compared with March, to align with the pandemic’s impact on demand.

8. The corporation’s fiscal year runs from the beginning of August to the end of July, consistent with the industry’s dairy year. For the fiscal year that ended on 31 July 2020, the corporation’s administrative expenses amounted to $9.6 million. The government funded $3.9 million of these expenses. The balance was funded by amounts recovered from dairy producers, marketplace levies, and commercial operations.

9. The corporation had 72 employees at the end of the 2019–20 fiscal year. It is located in Ottawa, Canada (Exhibit 1).

Exhibit 1—The Canadian Dairy Commission

Photo: Canadian Dairy Commission

Focus of the audit

10. Our objective for this audit was to determine whether the systems and practices we selected for examination at the Canadian Dairy Commission were providing the corporation with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

11. In addition, section 139 of the Financial Administration Act requires that we state an opinion, with respect to the criteria established, on whether there was reasonable assurance that there were no significant deficiencies in the systems and practices we examined. We define and report significant deficiencies when, in our opinion, the corporation could be prevented from having reasonable assurance that its assets are safeguarded and controlled, its resources are managed economically and efficiently, and its operations are carried out effectively.

12. On the basis of our risk assessment, we selected systems and practices in the following areas:

The selected systems and practices, and the criteria used to assess them, are found in the exhibits throughout the report.

13. More details about the audit objective, scope, approach, and sources of criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Corporate management practices

The corporation had a significant deficiency in corporate governance caused by a board vacancy and it needed improvements in performance measurement and risk management

14. We found a significant deficiency in the systems and practices for board appointments. We also found areas for improvement in board oversight; performance measurement; and risk mitigation, monitoring, and reporting.

15. The analysis supporting this finding discusses the following topics:

16. The board of directors is formally called “the Commission” in the Canadian Dairy Commission Act. Its responsibilities include overall stewardship of the corporation. The act provides for the board to consist of a chairperson, the corporation’s chief executive officer, and a third member. They are appointed by the Governor in CouncilDefinition 1. Appointments are therefore outside the corporation’s control.

17. When the previous chairperson’s term ended in July 2019, the third board member acted as interim chairperson until February 2020. At that time, a new chairperson was appointed to serve until December 2021. The chief executive officer is one of the board members; the incumbent’s 3-year term will expire in May 2021. The third member, who acted as interim chairperson, is serving a second 3-year term, which is due to expire in February 2023.

18. The board has an audit committee consisting of all 3 of its members.

19. Our recommendations in this area of examination appear at paragraphs 26, 31, and 36.

20. Analysis. We found that the corporation had a significant deficiency in the systems and practices for board appointments. Despite the constraints posed by the appointments process, the corporation had good practices in board independence and providing strategic direction. However, board oversight needed improvement because of weaknesses in corporate risk management (Exhibit 2).

Exhibit 2—Corporate governance—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Board appointments and competencies |

The board collectively had the capacity and competencies to fulfill its responsibilities. |

The board engaged an external advisor to provide additional expertise where needed. The corporation had an orientation program for new members. Significant deficiency Given the small size of the board and the qualifications set for different members, the vacancy in 1 position increased the risk that the board would be unable to hold meetings when necessary or make decisions. |

|

|

Board independence |

The board functioned independently. |

Board members declared any conflicts of interest at the beginning of each meeting. The board held closed sessions without the senior management team in attendance. |

|

|

Providing strategic direction |

The board provided strategic direction. |

The board provided strategic direction by reviewing and approving the annual corporate plan prepared by management. |

|

|

Board oversight |

The board carried out its oversight role over the corporation. |

The board regularly monitored the corporation’s financial status and received information on initiatives and developments affecting the corporation. Board members periodically attended dairy industry meetings, where they obtained additional industry insights. The board performed an annual self-assessment of its performance. This also included management views, given the small size of the board. Weakness Weaknesses in corporate risk management increased the difficulty for the board to fully assess how the corporation managed risks. (For our findings and recommendation on risk management, see paragraphs 33 to 36.) |

|

|

Legend—Assessment against the criteria

Met the criteria

Met the criteria, with improvement needed

Did not meet the criteria |

|||

21. Significant deficiency—Board appointments. We found that given the small size of the board and the qualifications set for different members, the vacancy in 1 position (discussed in paragraph 17) increased the risk that the board would be unable to hold meetings when necessary or make decisions.

22. The corporation’s rules of governance specified that many motions must receive at least 2 votes to pass. The vacancy increased the risk that the motions would not receive the minimum number of votes in 2 ways. First, if 1 member was unable to attend, a meeting could not take place. Second, an abstention by 1 member would cause a motion not to pass.

23. The board profile required members to have significant dairy industry experience, including in the milk production sector for one member and in the dairy processing sector for another member. However, relationships formed through members’ experience in the industry may pose a risk of real, potential, or perceived conflicts of interest. Another possible source of conflict of interest was the fact that while serving on the board, the Chief Executive Officer was responsible for managing the operations of the corporation. As a result of these circumstances, a board member was more likely to abstain from making certain decisions, and consequently decisions would not receive the 2 required votes. Because the Governor in Council appoints members to the board, appointments are outside the corporation’s control.

24. Our 2011 special examination report raised the outstanding issue of the difficulty for a 3-person board to have the full range of skills needed for strong governance. We recommended that the board periodically assess members’ skills and seek outside expertise as needed. The latest board profile had been established in 2012. Recently, the board engaged an external advisor to provide additional expertise when needed.

25. In the current audit, we did not find that board meetings were cancelled or that decisions were not resolved. However, this significant deficiency matters because it poses a significant risk that the board would be unable to make decisions and operate effectively. This is especially important for the corporation because the board consists of only 3 members, 1 of whom is also the chief executive officer.

26. Recommendation. Given the small size of the board, the corporation should continue engaging with the Minister of Agriculture and Agri-Food on a timely basis to help ensure that the board continuously has a full complement of its members. It should also update its profile of potential candidates more regularly and provide it to the minister.

The corporation’s response. Agreed. The corporation is already in communication with the office of the Minister of Agriculture and Agri-Food as well as the section of Agriculture and Agri-Food Canada that is responsible for appointments, especially as the term of 1 of the board members is almost over. The profile of potential candidates will be updated by July 2021 and provided to the minister.

27. Analysis. We found that the corporation had good practices for strategic planning and performance monitoring and reporting, but performance measurement needed improvement (Exhibit 3).

Exhibit 3—Strategic planning—Key findings and assessment

28. Weakness—Performance measurement. We found that the corporation did not establish specific performance indicators to measure the achievement of some of its strategic objectives.

29. The corporate plan identified goals, strategies, objectives, and performance indicators for each of its 4 strategic themes. We found that performance indicators were presented for each of these themes rather than for specific strategic objectives. Many performance indicators could reasonably be linked to certain strategic objectives, but no performance indicators were set to measure the achievement of some strategic objectives. For example, 1 of the objectives was to acquire better expertise on current markets and regulations, and to share this information with the industry. The corporate plan did not have performance indicators that would demonstrate how the corporation was achieving the objective.

30. This weakness matters because without specific performance indicators and targets for strategic objectives, the corporation cannot systematically measure, monitor, and report on the achievement of those objectives. As a result, the board and management could not readily determine that the strategic objectives contributing to the intended outcomes had been met as planned.

31. Recommendation. The corporation should set performance indicators for each of its strategic objectives.

The corporation’s response. Agreed. The corporation will develop performance indicators for each of its strategic objectives during the 2021–22 strategic planning exercise, which started in January 2021.

32. Analysis. We found that the corporation had good practices for identifying and assessing risks. However, we also found that risk mitigation, monitoring, and reporting needed improvement (Exhibit 4).

Exhibit 4—Corporate risk management—Key findings and assessment

33. Weaknesses—Risk mitigation, monitoring, and reporting. We found that some of the corporation’s risk mitigation strategies or action plans lacked necessary detail or were not up to date. This included not having clear risk appetite statements or setting risk tolerances. As a result, the board and the corporation faced increased difficulty in fully assessing implementation of mitigation strategies.

34. For example, the mitigation strategy for 1 risk involved implementing a certain policy. Progress reports indicated that implementation had begun, but it was not possible to readily assess the pace of progress or the actions required, because the plan had not been updated and did not include a target date for completion. In another example, the corporation had a business resumption plan but had not updated it in a timely manner or provided for periodic testing to ensure the effectiveness of planned responses.

35. These weaknesses matter because without appropriately defined or updated mitigation strategies or action plans, the board and management could not ensure that the corporation had effective practices to mitigate risks to the achievement of its objectives.

36. Recommendation. To strengthen monitoring and reporting for risk mitigation strategies, the corporation should integrate risk appetites, tolerances, and timelines into its action plans, and it should update action plans regularly.

The corporation’s response. Agreed. The corporation will articulate its risk appetites and set appropriate tolerance levels, to help guide and monitor implementation of mitigation strategies. The corporation will also include timelines in all action plans and will update the plans regularly.

Management of operations

The corporation had good practices for managing its operations

37. We found that the corporation had good practices for operational planning, performance monitoring and reporting, and managing operations.

38. The analysis supporting this finding discusses the following topics:

39. To help align supply with demand in Canada’s dairy industry, the corporation works with key industry stakeholders, such as the Canadian Milk Supply Management Committee (the national body responsible for policy development and discussions of Canada’s dairy industry). The corporation monitors national production and demand monthly and recommends necessary adjustments to the national production target. The corporation also provides forecasts that help the dairy industries in individual provinces set production quotas.

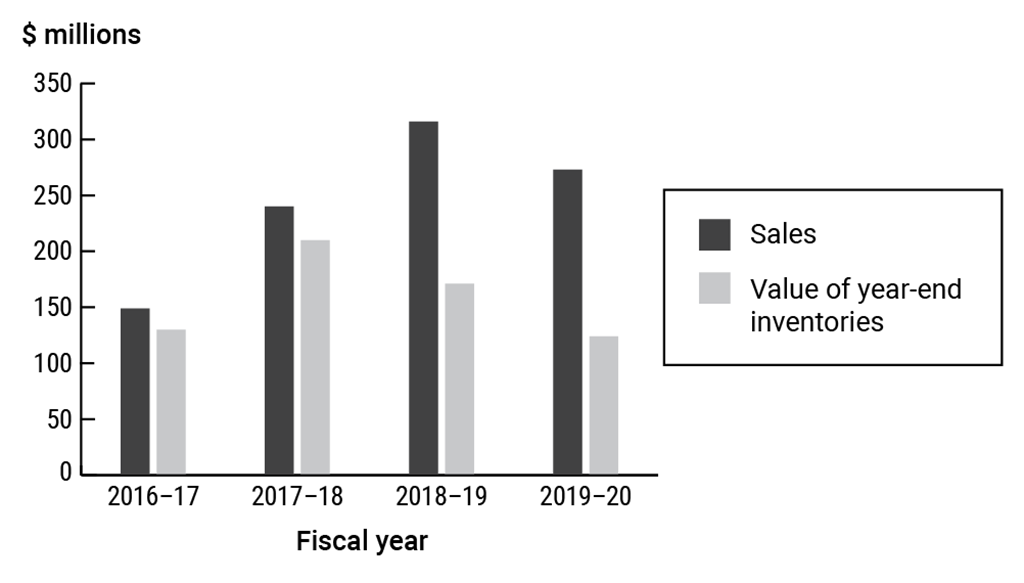

40. Furthermore, the corporation carries out domestic seasonality programs, which in recent years have involved mostly purchases and sales of butter (Exhibit 5). When milk production outstrips demand, processors turn the excess into butter. Under domestic seasonality programs, the corporation buys the butter from participating processors, stores it, and then sells it back when demand exceeds production. Loans from the federal government to the corporation enable these purchases. At the start of the 2019–20 fiscal year, the corporation was allowed to borrow up to $300 million from the government. Late in the fiscal year, the borrowing limit was increased to $500 million; this indicated the government’s commitment to helping the industry deal with the coronavirus disease (COVID-19) pandemic. As of 31 July 2020, actual loans from the government to the corporation amounted to $95 million.

Exhibit 5—The corporation’s programs for managing seasonal fluctuations in domestic supply and demand had substantial annual sales and fiscal year-end inventories of butter

Source: Canadian Dairy Commission

Exhibit 5—text version

This bar graph shows, in millions of dollars, the sales and the value of year-end inventories of butter for the Canadian Dairy Commission’s domestic seasonality programs, which manage seasonal fluctuations in domestic supply and demand, from the 2016–17 fiscal year to the 2019–20 fiscal year.

The value of year-end inventories was slightly less than the sales in the 2016–17 and 2017–18 fiscal years, and about half of the sales in the 2018–19 and 2019–20 fiscal years.

The following table lists the sales and the value of year-end inventories of butter for the Canadian Dairy Commission’s domestic seasonality programs for the 2016–17 to 2019–20 fiscal years.

| Fiscal year | Sales (in millions of dollars) |

Value of year-end inventories (in millions of dollars) |

|---|---|---|

| 2016–17 | 149 | 130 |

| 2017–18 | 240 | 210 |

| 2018–19 | 316 | 171 |

| 2019–20 | 273 | 124 |

41. The price that producers receive for their milk is regulated and varies according to the end use of the milk. For example, milk sold to make cheese is priced differently than milk sold to make butter. One of the key inputs for setting some prices is the average national cost of producing 1 hectolitre (100 litres) of milk. The corporation calculates the cost annually and uses it to set the price of butter for its domestic seasonality programs.

42. The corporation undertakes compliance audits to ensure that industry stakeholders adhere to dairy system rules. Audited stakeholders include provincial boards and private sector participants in various programs. For example, provincial milk marketing boards are audited to verify whether revenues are appropriately shared with producers in all 10 provinces. Audits of private sector participants, such as processors, include verifying their reporting of milk usage, which is important for ensuring that producers are fairly compensated. Other audits verify whether program participants that have access to competitively priced dairy products for further processing adhere to program requirements.

43. The corporation chairs the Canadian Milk Supply Management Committee and 2 regional committees. The corporation also administers 3 federal–provincial agreements for the sharing of revenues and markets among Canadian milk producers.

44. We made no recommendations in this area of examination.

45. Analysis. We found that the corporation had good practices in operational planning and performance monitoring and reporting (Exhibit 6).

Exhibit 6—Operational planning and performance monitoring and reporting—Key findings and assessment

46. Analysis. We found that the corporation had good practices for managing operations (Exhibit 7).

Exhibit 7—Operations—Key findings and assessment

Conclusion

47. In our opinion, on the basis of the criteria established, there was a significant deficiency in corporate governance, but there was reasonable assurance that there were no significant deficiencies in the other systems and practices we examined. We concluded that except for this significant deficiency, the Canadian Dairy Commission maintained its systems and practices during the period covered by the audit in a manner that provided the reasonable assurance required under section 138 of the Financial Administration Act.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on the Canadian Dairy Commission. Our responsibility was to express

- an opinion on whether there was reasonable assurance that during the period covered by the audit, there were no significant deficiencies in the corporation’s systems and practices we selected for examination

- a conclusion about whether the corporation complied in all significant respects with the applicable criteria

Under section 131 of the Financial Administration Act, the corporation is required to maintain financial and management control and information systems and management practices that provide reasonable assurance of the following:

- Its assets are safeguarded and controlled.

- Its financial, human, and physical resources are managed economically and efficiently.

- Its operations are carried out effectively.

In addition, section 138 of the act requires the corporation to have a special examination of these systems and practices carried out at least once every 10 years.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard on Assurance Engagements (CSAE) 3001—Direct Engagements, set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office of the Auditor General of Canada applies the Canadian Standard on Quality Control 1 and, accordingly, maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from the corporation:

- confirmation of management’s responsibility for the subject under audit

- acknowledgement of the suitability of the criteria used in the audit

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided

- confirmation that the audit report is factually accurate

Audit objective

The objective of this audit was to determine whether the systems and practices we selected for examination at the Canadian Dairy Commission were providing the corporation with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

Scope and approach

Our audit work examined the Canadian Dairy Commission. The scope of the special examination was based on our assessment of the risks the corporation faced that could affect its ability to meet the requirements set out by the Financial Administration Act.

In performing our work, we interviewed members of the board of directors, senior management, and other employees of the corporation to gain insights into its systems and practices. We reviewed key documents related to the systems and practices selected for examination. We selected and tested samples of items, such as management performance objectives, compliance audits, external warehouse contracts, and economic model approvals that occurred during the period covered by the audit.

We did not re-perform the cost of production study or the models used to inform national quotas to provide any assurance on the results reported by the corporation. We also did not examine systems and practices of any other government organizations participating in the milk supply management system.

The systems and practices selected for examination for each area of the audit are found in the exhibits throughout the report.

In carrying out the special examination, we did not rely on any internal audits.

Sources of criteria

The criteria used to assess the systems and practices selected for examination are found in the exhibits throughout the report.

Corporate governance

Meeting the Expectations of Canadians: Review of the Governance Framework for Canada’s Crown Corporations, Treasury Board of Canada Secretariat, 2005

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Corporate Governance in Crown Corporations and Other Public Enterprises—Guidelines, Department of Finance Canada and Treasury Board, 1996

20 Questions Directors Should Ask about Risk, Canadian Institute of Chartered Accountants, 2006

Performance Management Program for Chief Executive Officers of Crown Corporations—Guidelines, Privy Council Office, 2016

Practice Guide: Assessing Organizational Governance in the Public Sector, The Institute of Internal Auditors, 2014

Strategic planning

Meeting the Expectations of Canadians: Review of the Governance Framework for Canada’s Crown Corporations, Treasury Board of Canada Secretariat, 2005

Guidelines for the Preparation of Corporate Plans, Treasury Board of Canada Secretariat, 1996

Corporate Governance in Crown Corporations and Other Public Enterprises—Guidelines, Department of Finance Canada and Treasury Board, 1996

Recommended Practice Guideline 3, Reporting Service Performance Information, International Public Sector Accounting Standards Board, 2015

20 Questions Directors Should Ask about Risk, Canadian Institute of Chartered Accountants, 2006

Corporate risk management

20 Questions Directors Should Ask about Risk, Canadian Institute of Chartered Accountants, 2006

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Corporate Governance in Crown Corporations and Other Public Enterprises—Guidelines, Department of Finance Canada and Treasury Board, 1996

Operational planning and performance monitoring and reporting

Plan-Do-Check-Act management model adapted from the Deming Cycle

Guidelines for the Preparation of Corporate Plans, Treasury Board of Canada Secretariat, 1996

A Guide to the Project Management Body of Knowledge (PMBOK® Guide), fourth edition, Project Management Institute incorporatedInc., 2008

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Control Objectives for Information and related TechnologyCOBIT 5 Framework—EDM02 (Ensure Benefits Delivery), Information Systems Audit and Control AssociationISACA

Control Objectives for Information and related TechnologyCOBIT 5 Framework—APO05 (Manage Portfolio), BAI01 (Manage Programmes and Projects), Information Systems Audit and Control AssociationISACA

Operations

A Guide to the Project Management Body of Knowledge (PMBOK® Guide), fourth edition, Project Management Institute incorporatedInc., 2008

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Plan-Do-Check-Act management model adapted from the Deming Cycle

Canadian Dairy Commission Act

Period covered by the audit

The special examination covered the period from 1 September 2019 to 31 October 2020. This is the period to which the audit conclusion applies. However, to gain a more complete understanding of the significant systems and practices, we also examined certain matters that preceded the start date of this period.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 3 February 2021, in Ottawa, Canada.

Audit team

Principal: Dusan Duvnjak

Makeddah John

Amanda Lapierre

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report, and the numbers in parentheses indicate the location of the related discussion.

Corporate management practices

| Recommendation | Response |

|---|---|

|

26. Given the small size of the board, the corporation should continue engaging with the Minister of Agriculture and Agri-Food on a timely basis to help ensure that the board continuously has a full complement of its members. It should also update its profile of potential candidates more regularly and provide it to the minister. (21 to 25) |

The corporation’s response. Agreed. The corporation is already in communication with the office of the Minister of Agriculture and Agri-Food as well as the section of Agriculture and Agri-Food Canada that is responsible for appointments, especially as the term of 1 of the board members is almost over. The profile of potential candidates will be updated by July 2021 and provided to the minister. |

|

31. The corporation should set performance indicators for each of its strategic objectives. (28 to 30) |

The corporation’s response. Agreed. The corporation will develop performance indicators for each of its strategic objectives during the 2021–22 strategic planning exercise, which started in January 2021. |

|

36. To strengthen monitoring and reporting for risk mitigation strategies, the corporation should integrate risk appetites, tolerances, and timelines into its action plans, and it should update action plans regularly. (33 to 35) |

The corporation’s response. Agreed. The corporation will articulate its risk appetites and set appropriate tolerance levels, to help guide and monitor implementation of mitigation strategies. The corporation will also include timelines in all action plans and will update the plans regularly. |