2016–17 Report on Plans and Priorities

2016–17 Report on Plans and Priorities

ISSN 2292-5457

A Message from the Auditor General of Canada

I am pleased to present the Office of the Auditor General of Canada’s Report on Plans and Priorities for the 2016–17 fiscal year.

As the legislative auditor of the federal government and the three territories, we support Parliament and the territorial legislatures by providing independent and objective assurance, advice, and information regarding government expenditures and the management of government programs. This year, we expect to complete more than 85 financial audits, 24 performance audits, and 6 special examinations.

While ensuring the quality and timeliness of our audits is always our most important task, we also establish annual strategic priorities, aimed at making us a better and more effective office. Our priorities are based on our assessment of the risks that we need to manage as well as on the objectives outlined in our strategic plan.

We have identified three priorities for the 2016–17 fiscal year.

Our first priority is to ensure effective, efficient, and accountable governance and management of the Office. In 2014, we reviewed the structure of our executive committee and the roles and responsibilities of our senior managers in audit operations. Our objective was to make the Office as efficient as possible and to empower our employees to make decisions at the most appropriate level in the organization. In the 2016–17 fiscal year, we will fully implement the new roles and responsibilities and will closely monitor their impact. We will also complete our governance review and implement any improvements we may identify to make us more effective.

Our second priority is to develop and maintain a skilled, engaged, and bilingual workforce. In the 2016–17 fiscal year, we will implement our updated Policy on Learning and Professional Development and its related directives, monitor employee participation in the required professional development curricula, monitor the implementation of our current detailed plans for second language training, and complete the development and funding of the next round of these plans. We will also complete the development and delivery of empowerment and leadership workshops for our employees.

Our third priority is to ensure the selection and continuance of audit products likely to have significant impact and value. Consistent with the government’s position of ensuring that all officers of Parliament are properly funded, we want to ensure that we are investing our resources in a manner that provides the maximum benefit to Parliament and to our other clients and stakeholders. In the 2016–17 fiscal year, we will complete a review of our financial audit portfolio to ensure that we are conducting the audits of greatest importance. We will also review our forensic audit capacity to ensure that it is aligned with current and future needs, and we will study other opportunities to enhance the value and impact of our work.

We have made many changes to the Office in the last year, and we will continue to do so in the coming year and beyond. I would like to thank all of our employees for their ongoing commitment to making the Office the best it can be in the service of Parliament.

[Original signed by]

Michael Ferguson, CPA, CA,

FCA (New Brunswick)

Auditor General of Canada

4 February 2016

Section I—Office Overview

Organizational profile

Year established: 1878

Auditor General: Michael Ferguson, CPA, CA, FCA (New Brunswick)

Main legislative authorities:

Auditor General Act, R.S.C. 1985, c. A-17

Financial Administration Act, R.S.C. 1985, c. F-11

Minister: The Honourable William F. Morneau, P.C., M.P., Minister of Finance*

*The Auditor General acts independently in the execution of his audit responsibilities, but reports to Parliament on expenditures through the Minister of Finance.

Organizational context

Raison d’être

The Office of the Auditor General of Canada is the legislative audit office of the federal government. We are also the legislative auditor of the three territories (Nunavut, Yukon, and the Northwest Territories). We conduct independent audits and studies that provide objective information, advice, and assurance to Parliament, territorial legislatures, governments, and Canadians. All of our audits are conducted according to professional auditing standards and Office policies. With our reports and testimony at parliamentary hearings, we assist Parliament in its work on the authorization and oversight of government spending and operations. Our strategic outcome is to contribute to better-managed government programs and better accountability to Parliament through legislative auditing.

Responsibilities

The Auditor General is an Officer of Parliament who is independent of the government in the execution of his work and responsibilities, and who reports directly to Parliament. His duties are set out in the Auditor General Act, the Financial Administration Act (FAA), and other acts and orders-in-council. The Commissioner of the Environment and Sustainable Development carries out the portion of the Auditor General’s mandate related to the environment and sustainable development.

The Office of the Auditor General’s main legislative auditing duties are

- financial audits,

- performance audits,

- special examinations, and

- sustainable development monitoring activities.

Financial audits

A financial audit provides assurance that financial statements are presented fairly, in accordance with the applicable financial reporting framework. When required, we provide assurance that the organizations we audit comply, in all significant respects, with the legislative authorities that are relevant to a financial audit. We conduct financial audits of federal Crown corporations, territorial corporations, and other organizations. We also audit the summary financial statements of the Government of Canada and of the three territories (Nunavut, Yukon, and the Northwest Territories).

If issues or opportunities for improvement in areas such as financial reporting and internal controls come to our attention during our financial audit work, we make recommendations to management. We also provide information and advice to support audit committees in meeting their responsibilities for the oversight of financial reporting and internal control.

Performance audits

A performance audit is an independent, objective, and systematic assessment of how well the government is managing its activities, responsibilities, and resources. Performance audits contribute to an effective public service and to a government that is accountable to Parliament and Canadians. The Auditor General Act gives the Office the discretion to determine which areas of government it will examine in its performance audits. We also consider requests for audits from parliamentary committees. The Auditor General is responsible for deciding what to audit.

Our reports contain recommendations for addressing any serious deficiencies identified. In a performance audit, the Office may comment on how the government is implementing a policy, but it does not comment on the merits of the policy itself.

Special examinations

A special examination assesses the systems and practices that a Crown corporation maintains to safeguard its assets; manage its human, physical, and financial resources economically and efficiently; and carry out its operations effectively. A special examination provides an opinion to a Crown corporation’s board of directors on whether there is reasonable assurance that there are no significant deficiencies in the systems and practices examined. In addition to reporting on significant deficiencies, our special examinations highlight the systems and practices that contribute to a Crown corporation’s success, and they provide information and recommendations to boards of directors about opportunities for improvement.

All parent Crown corporations are subject to a special examination by the Office, except the Bank of Canada, which is exempt from this requirement, and the Canada Pension Plan Investment Board, which, under its Act, is subject to a special examination by an auditor chosen by its board of directors. Under the FAA, special examinations are required at least once every 10 years.

Sustainable development monitoring activities and environmental petitions

The Commissioner of the Environment and Sustainable Development assists the Auditor General in performing his duties related to the environment and sustainable development. The Commissioner conducts performance audits to monitor the government’s management of environmental and sustainable development issues and, on behalf of the Auditor General, reports to Parliament on issues that should be brought to its attention. The Commissioner also administers the environmental petitions process.

Public Servants Disclosure Protection Act investigations

Under the Public Servants Disclosure Protection Act, the Auditor General has the mandate to investigate disclosures by public servants of alleged wrongdoing within the Office of the Public Sector Integrity Commissioner of Canada. If we determine that allegations of wrongdoing are well founded, we must submit a case report to Parliament.

Professional practices

In order to support the reliability and consistency of our audit work, the Office makes an ongoing investment in methodology and training. This investment supports

- the development and maintenance of up-to-date audit methodology;

- advice to auditors on the interpretation and application of professional standards and our audit methodology;

- quality assurance activities related to our ongoing audit engagements;

- monitoring of the Office’s System of Quality Control; and

- the development, maintenance, and deployment of curricula and learning tools related to accounting, auditing, and other skills for all Office employees.

The Office works with other legislative audit offices and professional associations, such as the Chartered Professional Accountants of Canada, to advance legislative audit methodology, accounting and auditing standards, and best practices.

In addition, the Office’s Professional Practices Group acts as the National Professional Practices Group, serving members of the Canadian Council of Legislative Auditors by offering methodology, training, and advice upon request.

International activities

Our 2012–2017 International Strategy guides our international activities. The strategy has the following four goals:

- contributing to the development and adoption of appropriate and effective professional standards,

- sharing knowledge among audit offices,

- building capabilities and professional capacities of audit offices, and

- promoting better-managed and accountable international institutions.

Our international activities focus on

- projects funded by Global Affairs Canada;

- International Organization of Supreme Audit Institutions (INTOSAI) working groups;

- INTOSAI Development Initiative projects; and

- other stated federal government priorities (for example, audits of United Nations entities).

Strategic plan and organizational priorities

The Office’s strategic plan identifies a number of client, operational, and people management objectives to help direct its work (Exhibit 1). We use this plan, together with our annual risk assessment, to establish priorities.

Exhibit 1—Strategic Plan of the Office of the Auditor General of Canada

Vision

An independent legislative audit office serving Parliament and territorial legislatures, widely respected for the quality and impact of our work

Mission

Contribute to well-managed and accountable government for Canadians by providing information, advice, and assurance reports; working with legislative auditors, and federal and territorial governments; and being a leader in the legislative auditing profession

Strategic Objectives

Customer Perspective

Be independent, objective, and non-partisan

Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, and fair, and adds value

Contribute to the development and adoption of professional standards and best practices

Build and maintain relationships with parliamentarians and key stakeholders

Financial Perspective

Be a financially well-managed organization accountable for the use of resources entrusted to it

Internal Perspective

Ensure the selection and continuance of audit products likely to have significant impact and value

Ensure that audit products comply with professional standards and Office policies in an economical manner

Ensure effective and efficient support services

Ensure effective, efficient, and accountable Office governance and management

Learning and Growth Perspective

Ensure a culture of empowerment

Develop and maintain a skilled, engaged, and bilingual workforce

The Office identified the following three strategic objectives as priority areas for improvement for the 2016–17 fiscal year:

- ensuring effective, efficient, and accountable Office governance and management (Exhibit 2);

- developing and maintaining a skilled, engaged, and bilingual workforce (Exhibit 3); and

- ensuring the selection and continuance of audit products likely to have significant impact and value (Exhibit 4).

Exhibit 2—Priorities for the 2016–17 fiscal year—Office governance and management

Strategic objective: Ensuring effective, efficient, and accountable Office governance and management

Description

In 2014, the Office reviewed the roles and responsibilities of our senior managers. Our goal was to make decision making in the Office as efficient and effective as possible, and to empower our employees to make decisions about their work at the most appropriate level in the organization. The year 2015 was one of transition as we worked to implement the new roles and responsibilities. We have made the required changes to our audit methodology and other procedures to reflect our revised roles. In addition, we reviewed and adjusted the executive committee structure, and we are moving to a smaller committee. We have enhanced several other elements of the governance framework, including our system of internal controls. The revised governance framework provides clarity with respect to roles and responsibilities, as well as the flexibility to be responsive to change. The new roles and responsibilities took effect on 1 January 2016.

Initiatives

- Monitor the implementation of the new senior management roles and responsibilities.

- Monitor the revised governance framework and review policies for key areas.

- Implement improvements to our risk management procedures.

Exhibit 3—Priorities for the 2016–17 fiscal year—workforce

Strategic objective: Developing and maintaining a skilled, engaged, and bilingual workforce

Description

We have updated our Policy on Learning and Professional Development and the related directives to support the development of our employees’ skills. We have also approved an empowerment action plan, designed to improve the extent to which the Office’s employees feel empowered to make decisions about their work. In addition, we have updated our Bilingualism in the Workplace Strategy to support our staff in meeting the language requirements of their positions. Detailed second language learning plans have been prepared, and the necessary funding has been allocated to support implementation of the plans to 31 March 2016.

Initiatives

- Monitor employee participation in the required professional development curricula.

- Develop and deliver empowerment workshops.

- Finalize second-language learning plans for the 2016–17 fiscal year and beyond.

Exhibit 4—Priorities for the 2016–17 fiscal year—audit products

Strategic objective: Ensuring the selection and continuance of audit products likely to have significant impact and value.

Description

We want to invest our resources in audits that maximize the impact and value of our work for Canadians, Parliament, and other clients and stakeholders.

Initiatives

- Complete a tri-annual continuance review of our financial audit portfolio to ensure that we are conducting the audits of greatest importance.

- Undertake a review of our forensic audit capacity to ensure that it is aligned with current and future needs.

- Study other opportunities to enhance the impact of our work.

Risk analysis

As a result of our annual risk assessment, we have identified risks that could significantly affect the Office (Exhibit 5). These risks are in addition to those associated with the previously described priorities.

Exhibit 5—Additional risks identified for the 2016–17 fiscal year

| Risk | Risk response strategy |

|---|---|

| The need to continually renew our information technology (IT) infrastructure, and to prepare for additional requirements arising from Government of Canada initiatives and IT security policies, will place a significant demand on Office resources in the coming years. | An IT investment plan is being developed. |

| Paying for increasing audit and service costs from a funding base that is not increasing will require reductions in products or services, or both, in the near future. | We are reviewing our resource allocations to ensure that we can produce all required audits as efficiently as possible in the near term, and we are considering potential options for the longer term. |

| The impact of labour negotiations with federal government employees has the potential to affect how we conduct our work in the coming months. | We are monitoring ongoing developments. |

Planned expenditures

Exhibits 6 and 7 provide the Office’s planned financial and human resources for the next three years. Planned spending in the 2016–17 fiscal year reflects cost pressures that will reduce the carry-forward funding available for future years. Planned spending for the 2017–18 and 2018–19 fiscal years is based on softer estimates, which are subject to change.

Exhibit 6—Financial resources (planned spending—$ dollars)

Exhibit 7—Human resources (full-time equivalents)

| 2016–17 | 2017–18 | 2018–19 |

|---|---|---|

| 570 | 550 | 550 |

Exhibit 8 provides the Office’s budgetary spending summary and planned spending for the 2013–14 to 2018–19 fiscal years. Exhibit 9 shows the departmental spending trend for the same period.

Exhibit 8—Budgetary spending summary ($ dollars)

| Legislative auditing activityNote 1 | Actual spending 2013–14 | Actual spending 2014–15 | Forecast spending 2015–16 | Planned spending | ||

|---|---|---|---|---|---|---|

| 2016–17 | 2017–18 | 2018–19 | ||||

| Financial audits of Crown corporations, territorial governments, and other organizations, and of the summary financial statements of the Government of Canada | 41,700,000 | 37,300,000 | 43,200,000 | 43,100,000 | 40,800,000 | 40,900,000 |

| Performance audits and studiesNote 2 | 41,200,000 | 43,600,000 | 37,500,000 | 37,000,000 | 36,600,000 | 36,700,000 |

| Special examinations of Crown corporations | 3,300,000 | 3,100,000 | 3,500,000 | 6,100,000 | 6,800,000 | 6,100,000 |

| Sustainable development monitoring activities and environmental petitions | 1,600,000 | 1,600,000 | 2,000,000 | 2,000,000 | 1,500,000 | 1,500,000 |

| Professional practices | 9,500,000 | 8,000,000 | 8,900,000 | 8,800,000 | 8,400,000 | 8,400,000 |

| Total cost of operations | 97,300,000 | 93,600,000 | 95,100,000 | 97,000,000 | 94,100,000 | 93,600,000 |

| Less: costs recoveredNote 3 | (1,100,000) | (1,200,000) | (1,400,000) | (700,000) | (300,000) | (300,000) |

| Net cost of operations | 96,200,000 | 92,400,000 | 93,700,000 | 96,300,000 | 93,800,000 | 93,300,000 |

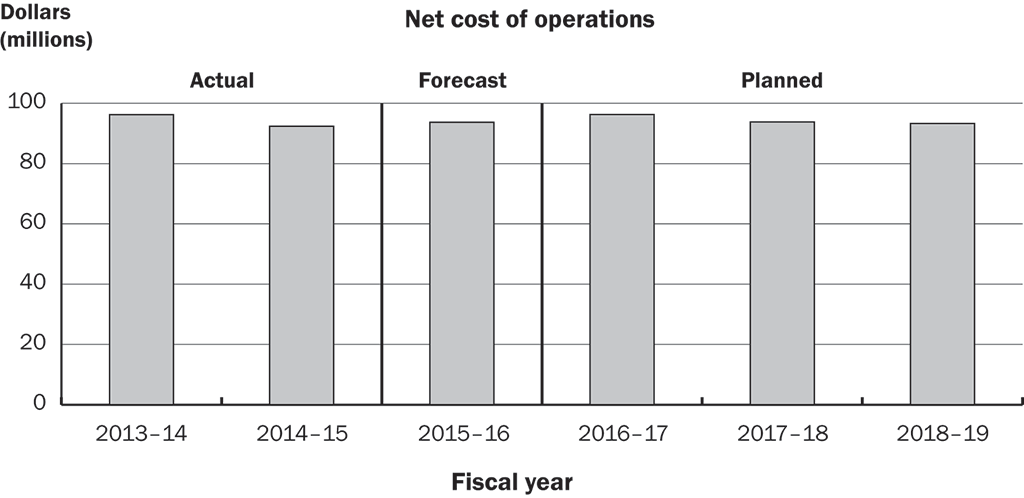

Exhibit 9—Departmental spending trend

Exhibit 9—text version

This bar graph shows the actual, forecast, and planned spending by the Office of the Auditor General of Canada from the 2013–14 fiscal year to the 2018–19 fiscal year. The following amounts represent the net cost of operations, in millions of dollars, for the fiscal year listed.

| Actual spending | Forecast spending | Planned spending | |||

|---|---|---|---|---|---|

| 2013–14 | 2014–15 | 2015–16 | 2016–17 | 2017–18 | 2018–19 |

| 96.2 | 92.4 | 93.7 | 96.3 | 93.8 | 93.3 |

Spending decreased from 96.2 million in the 2013–14 fiscal year to 92.4 million in the 2014–15 fiscal year. The graph shows a decline from forecast spending of 93.7 million in the 2015–16 fiscal year to 93.3 million in the 2018–19 fiscal year.

Estimates by vote

For information on the Office of the Auditor General of Canada’s organizational appropriations, please consult the 2016–17 Main Estimates.

Section II—Planning Highlights by Product Line

Strategic outcome and expected results

The long-term strategic outcome of the Office of the Auditor General of Canada is to contribute to better-managed government programs and better accountability to Parliament through legislative auditing.

We have identified a number of results that we expect to achieve with our audits in the short, medium, and long terms.

In the short term, we want to

- engage Parliament, territorial legislatures, and federal and territorial organizations in the audit process;

- ensure that Parliament, territorial legislatures, and federal and territorial organizations are well informed about our work; and

- maintain support for our role and work.

In the medium term, we want to

- assist Parliament and territorial legislatures in holding governments to account;

- ensure that our work is relevant to federal and territorial organizations, departments, agencies, and Crown corporations; and

- ensure that the public is well informed about our work.

In the long term, we want our work to lead to more effective, efficient, and economical government programs and operations; programs that foster sustainable development; and better results for Canadians.

Legislative auditing activities

Financial audits of Crown corporations, territorial governments, and other organizations

Financial audits answer the following questions:

- Are the annual financial statements of Crown corporations, territorial governments, and other organizations presented fairly?

- Are federal and territorial governments presenting their overall financial situation fairly?

- Are these entities complying with their legislative authorities?

Planning highlights. The Office has statutory responsibilities for the audit of the summary financial statements of the Government of Canada and each of the three territorial governments, the financial statements of federal Crown corporations and territorial corporations, and other entities. These other entities include INTERPOL, for which the Office has been appointed auditor for the 2016, 2017, and 2018 fiscal years.

In the 2016–17 fiscal year, we will conduct more than 85 financial audits and related assurance engagements.

Performance audits of federal and territorial organizations

Performance audits answer questions such as the following:

- Are programs being run with due regard for economy, efficiency, and environmental impact?

- Does the government have the means to measure the effectiveness of its programs?

Planning highlights. In the 2016–17 fiscal year, we plan to report the findings of 24 federal and territorial performance audits. Our audit schedule for the coming year is in Section III—Supplementary Information.

Special examinations

A special examination of a Crown corporation answers the following question: Do the systems and practices of the Crown corporation that we examined provide reasonable assurance that assets are safeguarded, that resources are managed economically and efficiently, and that operations are carried out effectively?

Planning highlights. During a 10-year period, the Office performs special examinations of more than 40 federal Crown corporations. In the 2016–17 fiscal year, we plan to complete examinations of six corporations: Pacific Pilotage Authority, Atlantic Pilotage Authority, Freshwater Fish Marketing Corporation, Canadian Museum of Nature, International Development Research Centre, and Defence Construction (1951) Limited.

Exhibit 10 includes the expected results, strategic objectives, indicators, and targets for our legislative auditing activities.

Exhibit 10—Legislative auditing activities—strategic objectives, indicators, and targets

Expected results:

- Parliament and territorial legislatures are well informed.

- Parliament, territorial legislatures, and federal and territorial organizations are engaged in the audit process.

- Parliament and territorial legislatures hold government to account.

- Our work is relevant to federal and territorial organizations, departments, agencies, and Crown corporations.

- The media and public are well informed.

- Support for our role and work is maintained.

| Strategic objectives | Indicators and targets |

|---|---|

|

Be independent, objective, and non-partisan. |

Percentage compliance with professional standards and Office policies for independence: 100% Number of founded complaints and allegations regarding failure to comply with professional standards, legal and regulatory requirements, or the Office’s system of quality control: None |

|

Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, and fair, and adds value. |

Percentage of users who find that our audits are understandable, are fair, and add value: 90% Percentage of senior managers who find that our audits are understandable, are fair, and add value: 80% Percentage of reports to Parliament that are reviewed by parliamentary committees: 65% Percentage of audits that meet statutory deadlines, where applicable, or our planned reporting dates:

|

|

Contribute to the development and adoption of professional standards and best practices. |

Percentage of commitments met to contribute to domestic and international professional standards bodies: 100% For financial audits, percentage of qualifications and “other matters” that are addressed from one report to the next: 100% For performance audits, percentage of issues examined in our follow-up audits for which progress is assessed as satisfactory: 75% For special examinations, percentage of significant deficiencies that are addressed from one examination to the next: 100% |

|

Build and maintain relationships with parliamentarians and key stakeholders. |

Indicators and targets to be set in 2016 |

Internal perspective

Seven of the objectives in our strategic framework focus on our internal processes and long-term learning and growth as an organization. Exhibit 11 summarizes the indicators for monitoring the achievement of these objectives.

Exhibit 11—Internal perspective—strategic objectives, indicators, and targets

| Strategic objectives | Indicators and targets |

|---|---|

|

Be a financially well-managed organization accountable for the use of resources entrusted to it. |

Percentage compliance with financial management and reporting requirements: 100% |

|

Ensure the selection and continuance of audit products likely to have significant impact and value. |

Complete the triannual review of our audit portfolio. |

|

Ensure that audit products comply with professional standards and Office policies in an economical manner. |

Percentage of internal practice reviews that find the opinions and conclusions expressed in our audit reports to be appropriate and supported by the evidence: 100% Percentage of internal and external reviews that find our practitioners complied with professional standards: 100% Percentage of internal and external reviews that find our System of Quality Control is suitably designed and operating effectively: 100% Percentage of audits that are completed on budget: 80% |

|

Ensure effective and efficient support services. |

Percentage of internal service standards met: 100% |

|

Ensure effective, efficient, and accountable Office governance and management. |

Indicators and targets to be finalized in 2016 |

|

Ensure a culture of empowerment. |

Percentage of “strongly agree” and “somewhat agree” responses to Public Service Employee Survey statements related to empowerment: 80% |

|

Develop and maintain a skilled, engaged, and bilingual workforce. |

Percentage of auditors who have completed required training within the allotted time frame: 100% Percentage of “strongly agree” and “somewhat agree” responses to Public Service Employee Survey statements related to engagement: 85% Percentage of staff who meet the language requirements of their positions: 100% Percentage of “strongly agree” and “somewhat agree” responses to Public Service Employee Survey statements related to official languages: 90% |

Section III—Supplementary Information

Planned reports for 2016–17

Reports to Parliament

Spring 2016: Reports of the Auditor General of Canada

- Drug Benefits—Veterans Affairs Canada

- Citizenship Program

- Follow-up Audit on Governor-in-Council Appointments

- Venture Capital Action Plan

- Canadian Armed Forces Military Reserve

- Special Examinations of Crown Corporations—2015

Spring 2016: Reports of the Commissioner of the Environment and Sustainable Development

- Safety of Consumer Products

- Federal Support for Sustainable Communities

- Federal Support to Mitigate the Effects of Severe Weather

Fall 2016: Reports of the Auditor General of Canada

- Income Tax Appeals

- Reintegration of Aboriginal Offenders

- Car Safety Oversight

- Professional Conduct of Border and International Staff

- Enabling Technology for Beyond the Border Action Plan

- Specific Claims Tribunal of Canada

- Canadian Armed Forces Recruitment and Retention

- In-Service Support Contracts for the Maintenance and Repair of Military Equipment

Fall 2016: Reports of the Commissioner of the Environment and Sustainable Development

- Oversight of the Nuclear Sector

- Enforcement of the Fisheries Act

- Departmental Progress in Implementing Sustainable Development Strategies

- Review of the 2016 Progress Report of the Federal Sustainable Development Strategy

- Environmental Petitions Annual Report

Reports to Northern Legislatures

Fall 2016: Reports of the Auditor General of Canada

- Capital Asset Management—Yukon

- Long-Term Leases—Yukon

- Support to Communities for Municipal Services—Northwest Territories

- Health Programs and Services—Nunavut

Supplementary table and information

The following supplementary table and information can be found on the Office of the Auditor General of Canada’s website:

- Green procurement

Internal audit plan

The Practice Review and Internal Audit team is currently developing its multi-year plan for the 2016–17 to 2018–19 fiscal years, which is expected to be finalized in April 2016.