Office of the Auditor General of Canada Quarterly Financial Report for the quarter ended 30 June 2024

Statement outlining results, risks, and significant changes in operations, personnel, and program

Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board, and it should be read in conjunction with the Main Estimates. This quarterly report has not been subject to an external audit or review.

The Office of the Auditor General of Canada (OAG) has 1 program activity: legislative auditing. The OAG conducts independent audits and studies that provide objective information, advice, and assurance to Parliament, government, and Canadians.

Mandate

The Auditor General of Canada is an Officer of Parliament, who is independent from the government and reports directly to Parliament. The duties are set out in the Auditor General Act, the Financial Administration Act, and other acts and orders-in-council. These duties relate to legislative auditing and, in certain cases, to monitoring of federal departments and agencies, Crown corporations, territorial governments, and other entities.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the OAG’s spending authorities granted by Parliament and those used by the OAG, consistent with the Main Estimates for the 2024–25 fiscal year. This quarterly report provides financial information on the use of spending authorities. The OAG uses the full accrual method of accounting to prepare and present its annual financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of quarterly and year-to-date results

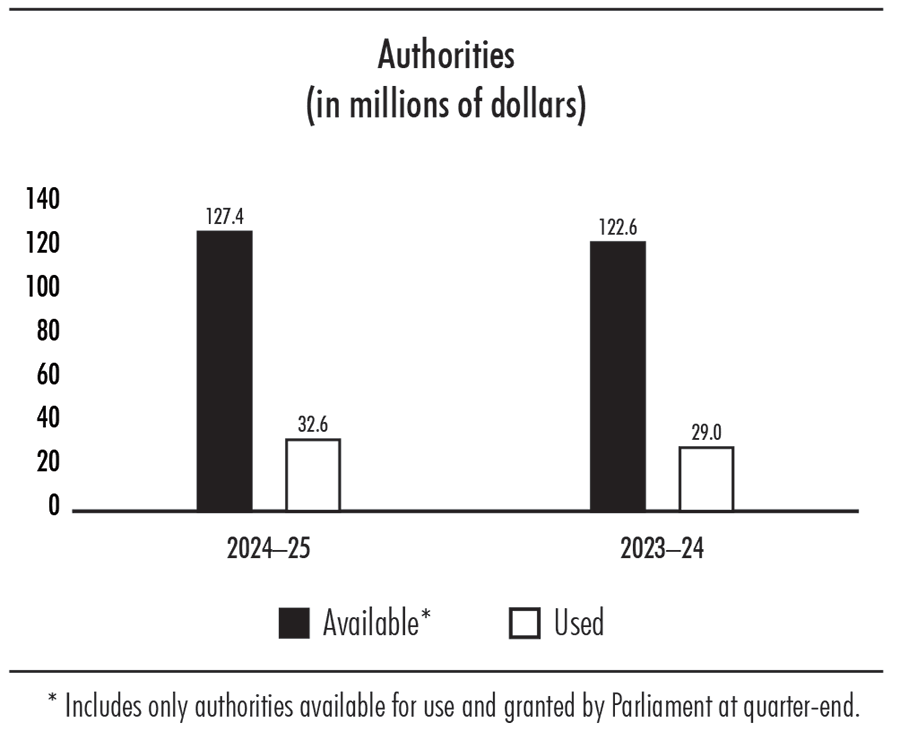

The authorities available for use increased as a result of additional funding received for approved economic salary increases announced in the quarter ended 31 December 2023.

The authorities used increased primarily as a result of the payment of economic increases and a larger workforce than the previous year.

Figure 1—text version

Authorities (in millions of dollars)

| AvailableNote * | Used | |

|---|---|---|

| 2024–25 | 127.4 | 32.6 |

| 2023–24 | 122.6 | 29.0 |

Risks and uncertainties

There are no significant risks and uncertainties to report.

Significant changes in operations, personnel, and program

On 17 June 2024, the OAG signed a collective agreement with the Public Service Alliance of Canada for its members in the Audit Services Group. The agreement includes economic increases for the period from 1 October 2023 to 30 September 2025.

Approved by:

[Original signed by]

Karen Hogan, Fellow Chartered Professional AccountantFCPA

Auditor General of Canada

[Original signed by]

Jean-René Drapeau, Chartered Professional AccountantCPA

Assistant Auditor General

and Chief Financial Officer

Ottawa, Canada

29 August 2024

Statement of authorities (unaudited)

(in thousands of dollars)

| Fiscal year 2024–25 | Fiscal year 2023–24 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending 31 March 2025Footnote * |

Used during the quarter ended 30 June 2024 |

Year to date used at quarter-end | Total available for use for the year ended 31 March 2024Footnote * |

Used during the quarter ended 30 June 2023 |

Year to date used at quarter-end | |

| Vote 1—Program expenditures | 117,350 | 29,498 | 29,498 | 111,792 | 26,348 | 26,348 |

| Less revenues netted against program expenditures | (2,660) | (108) | (108) | (2,660) | (737) | (737) |

| Net Vote 1—Program expenditures | 114,690 | 29,390 | 29,390 | 109,132 | 25,611 | 25,611 |

| Budgetary statutory authorities | 12,726 | 3,182 | 3,182 | 13,418 | 3,355 | 3,355 |

| Total budgetary authorities | 127,416 | 32,572 | 32,572 | 122,550 | 28,966 | 28,966 |

| Non-budgetary authorities | – | – | – | – | – | – |

| Total authorities | 127,416 | 32,572 | 32,572 | 122,550 | 28,966 | 28,966 |

Departmental budgetary expenditures by standard object (unaudited)

(in thousands of dollars)

| Fiscal year 2024–25 | Fiscal year 2023–24 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending 31 March 2025 |

Expended during the quarter ended 30 June 2024 |

Year to date expended at quarter-end | Planned expenditures for the year ended 31 March 2024 |

Expended during the quarter ended 30 June 2023 |

Year to date expended at quarter-end | |

| Expenditures: | ||||||

|

Personnel

|

104,946 | 28,553 | 28,553 | 101,695 | 26,280 | 26,280 |

|

Transportation and communications

|

2,700 | 662 | 662 | 2,700 | 856 | 856 |

|

Information

|

1,400 | 340 | 340 | 1,250 | 211 | 211 |

|

Professional and special services

|

13,940 | 1,722 | 1,722 | 15,115 | 990 | 990 |

|

Rentals

|

3,169 | 1,322 | 1,322 | 2,600 | 1,223 | 1,223 |

|

Repair and maintenance

|

120 | 22 | 22 | 200 | 12 | 12 |

|

Utilities, materials, and supplies

|

347 | 15 | 15 | 100 | 13 | 13 |

|

Acquisition of machinery and equipment

|

3,354 | 43 | 43 | 1,500 | 116 | 116 |

|

Other subsidies and payments

|

100 | 1 | 1 | 50 | 2 | 2 |

|

Total gross budgetary expenditures

|

130,076 | 32,680 | 32,680 | 125,210 | 29,703 | 29,703 |

| Less revenues netted against expenditures: | ||||||

|

Costs recovered

|

||||||

|

Members of the Canadian Council of Legislative Auditors (CCOLA)

|

(660) | (20) | (20) | (660) | (25) | (25) |

|

International audits

|

(2,000) | (88) | (88) | (2,000) | (712) | (712) |

|

Total cost recovered

|

(2,660) | (108) | (108) | (2,660) | (737) | (737) |

| Total net budgetary expenditures | 127,416 | 32,572 | 32,572 | 122,550 | 28,966 | 28,966 |