Report of the Auditor General of Canada to the Board of Directors of The Jacques-Cartier and Champlain Bridges IncorporatedInc.—Special Examination—2022

Table of Contents

- Audit Summary

- Introduction

- Findings, Recommendations, and Responses

- Conclusion

- About the Audit

- List of Recommendations

- Exhibits:

- 1—Location of the corporation’s infrastructures in Greater Montréal

- 2—The corporation’s expenses (millions of dollars)

- 3—Corporate governance—Key findings and assessment

- 4—Strategic planning—Key findings and assessment

- 5—Corporate risk management—Key findings and assessment

- 6—Asset management—Key findings and assessment

- 7—Project management—Key findings and assessment

- 8—Management of environmental and sustainable development matters—Key findings and assessment

Audit Summary

We found no significant deficiencies in the corporate management practices or in the management of operations of The Jacques‑Cartier and Champlain Bridges IncorporatedInc. during the period covered by the audit. However, we found that improvement was needed in a number of areas, including the functioning of the Board of Directors, strategic planning, corporate risk management, project management, and environmental and sustainable development performance measurement. Despite these weaknesses, the corporation maintained reasonable systems and practices for accomplishing its mandate.

Introduction

Background

1. The Jacques‑Cartier and Champlain Bridges IncorporatedInc. is responsible for managing, maintaining, and repairing important infrastructures in the Greater Montréal area. The Corporation reports to Parliament through the Minister of Intergovernmental Affairs, Infrastructure and Communities.

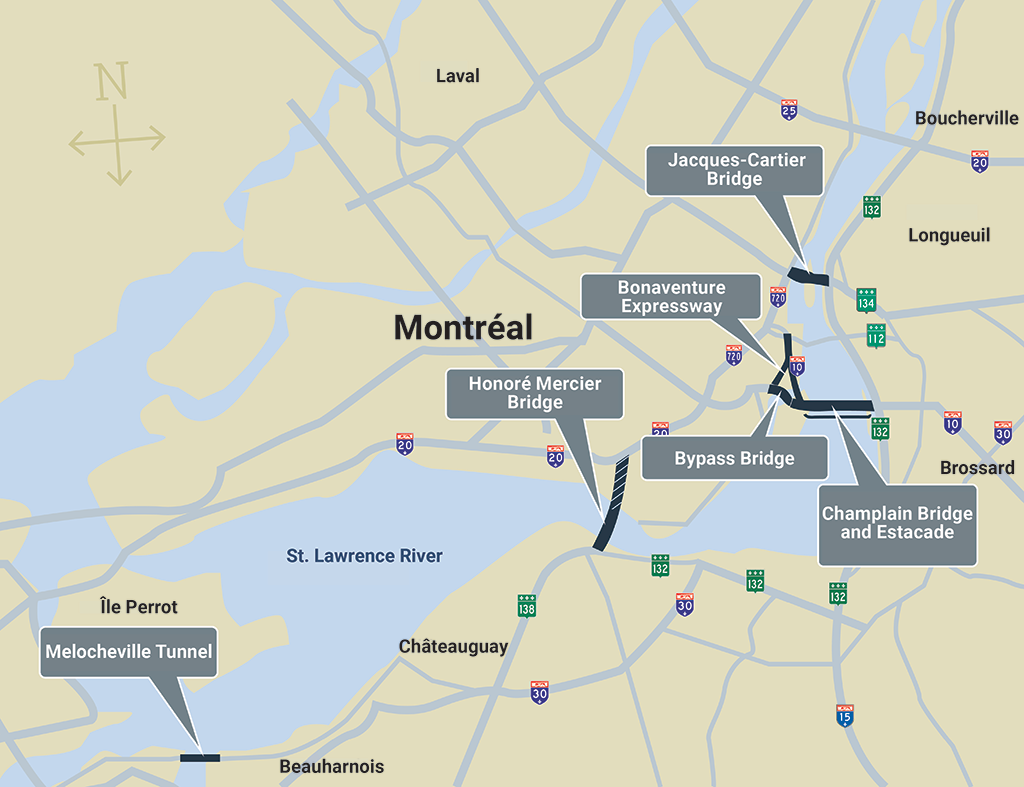

2. The corporation is responsible for the following structures (Exhibit 1):

- the original Champlain Bridge

- the Jacques Cartier Bridge and its approaches

- the Île des Sœurs Bypass Bridge and its approaches

- the federal section of the Honoré Mercier Bridge and its approaches

- the Melocheville Tunnel

- the federal section of the Bonaventure Expressway

- the Champlain Bridge Estacade (Ice Control Structure)

Exhibit 1—Location of the corporation’s infrastructures in Greater Montréal

Source: The Jacques‑Cartier and Champlain Bridges Inc.

Exhibit 1—text version

This map shows the locations of the corporation’s 7 infrastructures in the Greater Montréal area along the St. Lawrence River. From southwest to northeast, the infrastructures are

- Melocheville Tunnel

- Honoré Mercier Bridge

- Champlain Bridge

- Estacade

- Bypass Bridge

- Bonaventure Expressway

- Jacques-Cartier Bridge

3. The corporation has been listed in Part I of Schedule III of the Financial Administration Act since 2014. It was previously a subsidiary of the Federal Bridge Corporation.

4. The corporation was mandated by the Government of Canada to carry out the deconstruction of the original Champlain Bridge. The government undertook the Samuel De Champlain Bridge Corridor project—including the construction, financing, and maintenance of the new bridge—through a public-private partnership with the Signature on the Saint Lawrence Group.

5. The corporation’s mission is to ensure user mobility, safety, and infrastructure longevity using a systemic management approach based on sustainable development. As part of its operations, the corporation plans and carries out construction, rehabilitation, and reinforcement projects of the infrastructures under its responsibility, and oversees the operation and maintenance of these structures.

6. During the period covered by the audit, the corporation employed nearly 200 people. Its expenses were primarily financed through parliamentary appropriations (Exhibit 2).

Exhibit 2—The corporation’s expenses (millions of dollars)

| 2020–21 | 2019–20 | 2018–19 | |

|---|---|---|---|

| Expenses—Deconstruction of original Champlain Bridge | 73.3 | 7.8 | 0 |

| Expenses—Regular and major maintenance | 47.3 | 57.3 | 74.4 |

| Expenses—Salaries and employee benefits | 24.3 | 22.5 | 20.7 |

| Expenses—Other | 54.9 | 61.2 | 61.4 |

| Acquisition of tangible capital assets | 63.6 | 49.4 | 50.3 |

Source: The Jacques‑Cartier and Champlain Bridges Inc. annual reports

7. The original Champlain Bridge was decommissioned in June 2019. In June 2020, the corporation signed a contract for the deconstruction of the bridge with Nouvel Horizon SainteSt‑Laurent G.P. Deconstruction work began in July 2020 and is expected to be completed in January 2024. The estimated budget for the entire project is $400 million. The work involves a number of components, including deconstruction, environmental protection measures, research projects, and redevelopment work following the deconstruction of the bridge. The entire project is expected to be completed in April 2025.

8. Under the Financial Administration Act, each parent Crown corporation must undergo a special examination of itself and its wholly owned subsidiaries at least once every 10 years. A special examination report on the Federal Bridge Corporation was issued in September 2008, when The Jacques‑Cartier and Champlain Bridges Inc. was one of its subsidiaries.

9. Given that The Jacques‑Cartier and Champlain Bridges Inc. became a parent Crown corporation in February 2014, the statutory deadline for carrying out the examination and submitting the resulting report is February 2024. This is therefore the corporation’s first special examination as a parent Crown corporation.

Focus of the audit

10. Our objective for this audit was to determine whether the systems and practices we selected for examination at The Jacques‑Cartier and Champlain Bridges Inc. were providing the corporation with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

11. In addition, section 139 of the Financial Administration Act requires that we state an opinion, with respect to the criteria established, on whether there was reasonable assurance that there were no significant deficiencies in the systems and practices we examined. We define and report significant deficiencies when, in our opinion, the corporation could be prevented from having reasonable assurance that its assets are safeguarded and controlled, its resources are managed economically and efficiently, and its operations are carried out effectively.

12. On the basis of our risk assessment, we selected systems and practices in the following areas:

- corporate management practices

- management of operations

The selected systems and practices, and the criteria used to assess them, are found in the exhibits throughout the report.

13. More details about the audit objective, scope, approach, and sources of criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Corporate management practices

The corporation had good corporate management practices in some areas but needed improvement in others

14. We found that the corporation had some good corporate management practices in place. However, we found areas for improvement in practices related to board independence and oversight, strategic planning, and risk mitigation.

15. The analysis supporting this finding discusses the following topics:

16. The corporation’s Board of Directors is made up of six external members and the Chief Executive Officer. The board members, other than the Chair and the Chief Executive Officer, are appointed for a term not exceeding four years, which can be renewed. With the exception of the Chair and the Chief Executive Officer, a board member whose term has expired may continue to serve until a successor has been appointed.

17. At the time of our audit, the terms of two of the seven board members had expired, in one case by more than a year. However, since the two members were still serving, quorum was not at risk.

18. The board is supported by the following committees: Audit Committee, Governance and Ethics Committee, Human Resources Committee, Corporate Risk Committee, and Risk Committee—Infrastructures.

19. The corporation is subject to Part X of the Financial Administration Act, which requires the preparation of an annual corporate plan. The corporate plan sets out a Crown corporation’s objectives, strategies, and operational and financial performance indicators and targets. It also includes operating and capital budgets. The plan is submitted to the responsible minister for approval by the Government of Canada.

20. Our recommendations in this area of examination appear at paragraphs 25, 26, 29, 34, 35, 38, and 42.

21. Analysis. We found that the corporation had good systems and practices for providing strategic direction and for board appointments and competencies. However, certain areas of board independence and oversight needed improvement (Exhibit 3).

Exhibit 3—Corporate governance—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Board independence |

The board functioned independently. |

Board members, other than the Chief Executive Officer, were independent of management. Independent board members held sessions without the Chief Executive Officer in attendance. Obligations of board members in relation to conflicts of interest were clearly defined. Weaknesses The corporation had no systematic process in place for enabling board members to regularly declare any conflicts of interest or for documenting measures taken in that regard. The corporation did not have a code of conduct for its board members. |

Exclamation point in a yellow circle |

|

Providing strategic direction |

The board provided strategic direction. |

The board participated in setting the corporation’s strategic direction. The board set annual performance objectives for the Chief Executive Officer, which aligned with the corporation’s strategic direction. The board assessed the performance of the Chief Executive Officer against set objectives. |

Check mark in a green circle |

|

Board appointments and competencies |

The board collectively had capacity and competencies to fulfill its responsibilities. |

The board defined the competencies and expertise it needed to be effective and fulfill its responsibilities. The board informed the responsible minister of terms that were expiring. Board members had the opportunity to take part in orientation and training sessions. The board solicited independent advice to help it fulfill its responsibilities. |

Check mark in a green circle |

|

Board oversight |

The board carried out its oversight role over the corporation. |

The roles and responsibilities of the board and its committees were clearly defined. The board and its committees received information on financial performance, the corporation’s compliance with applicable laws and regulations, operational activities, implementation of strategic objectives, and risks. The internal audit service regularly performed audits, and the results were reported to the Audit Committee. The board evaluated its performance and the performance of its committees annually. Weakness The board did not receive complete information on the corporation’s ethical performance or on infrastructure risks. |

Exclamation point in a yellow circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

22. Weaknesses—Board independence. Obligations of board members in relation to conflicts of interest were clearly defined, and the members annually disclosed the names of any companies with which they or their close family had employment or business ties if those companies were likely to have a business relationship with the corporation. However, we found that those disclosures did not address all types of conflicts of interest, and that the board and its committees did not systematically ask their members to declare any conflicts of interest at the start of meetings. In addition, the corporation did not have a systematic process in place to document the measures taken regarding disclosed conflicts of interest.

23. We also found that the corporation had informed board members of the legislative requirements and guidelines to which they were subject concerning values, ethics, behaviour, and conflicts of interest. However, the corporation did not have a code of conduct for board members, supported by a process for ensuring compliance. A code of conduct sets out the values and behaviours expected in the performance of professional duties.

24. These weaknesses matter because regular reporting of potential conflicts of interest and the documentation of safeguard measures to address such conflicts are important for establishing the corporation’s credibility and fostering sound governance and accountability. In addition, establishing a process to ensure compliance with a code of conduct for board members would help the members fulfill their duties as expected.

25. Recommendation. The corporation should establish a regular disclosure process for board members that covers all types of conflicts of interest, and should document any measures taken, if necessary.

The corporation’s response. Agreed. Since late August 2021, an item has been systematically added to the board’s meeting agenda so that members can declare, at the start of the meetings, any types of conflicts of interest relating to the agenda items. In addition, by the end of the 2022–23 fiscal year, the corporation will modify the process to disclose conflicts of interest to cover all types of conflicts of interest, and it will document measures taken to address disclosed conflicts of interest.

26. Recommendation. The corporation should establish a code of conduct for board members and ensure that it is followed.

The corporation’s response. Agreed. The corporation will establish a code of conduct for board members and will implement an annual process for members to declare their compliance with the code. The corporation will put in place the code and the declaration process by the end of the 2022–23 fiscal year.

27. Weakness—Board oversight. We also found that the corporation had not provided the board with the following information that would enable it to exercise comprehensive oversight:

- Ethical performance. The corporation had a values and ethics code, as well as a policy on conflicts of interest for its employees. In addition, an annual process was in place that required employees to declare their compliance with the code and policy, and to disclose any conflicts of interest. However, we found that the board was not provided with the results of this process, including information on how management addressed any disclosed conflicts of interest.

- Infrastructure risk management. We found that the board received some information about infrastructure risks. However, the board was not provided with complete information enabling it to ensure that measures were in place to mitigate the risks, in accordance with its mandate.

28. This weakness matters because the board must ensure that the corporation is properly managing its operations. Without complete information on ethical performance and infrastructure risks, the board was unable to fully perform its oversight role.

29. Recommendation. The corporation should provide the board with complete information about its ethical performance and its management of infrastructure risks.

The corporation’s response. Agreed. The corporation will modify its policies in the 2022–23 fiscal year to provide for annual reporting to the board that includes employees’ declarations of compliance with the values and ethics code and the policy on conflicts of interest, as well as employees’ disclosures and any actions by management to address the conflicts of interest disclosed. In addition, as of the start of the 2022–23 fiscal year, the corporation will provide the board with complete information on the management of infrastructure risks so that the board can fulfill its mandate.

30. Analysis. We found that the systems and practices for strategic planning needed improvement (Exhibit 4).

Exhibit 4—Strategic planning—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Strategic planning |

The corporation established a strategic plan and strategic objectives that were aligned with its mandate. |

The corporation had a strategic planning process that included employee consultation, an internal environmental scan, and the development of strategic objectives. The set strategic objectives were aligned with the corporation’s mandate. The strategic plan was communicated throughout the organization. Weaknesses The strategic planning process did not take into account the external environment. The corporation did not submit the final version of its last three corporate plans within the required time frame, nor did it obtain the Government of Canada’s approval of its plans in a timely manner. (The corporation had no control over the government’s approval process for corporate plans.) |

Exclamation point in a yellow circle |

|

Performance measurement, monitoring and reporting |

The corporation established performance indicators in support of achieving its strategic objectives, and monitored and reported on its progress against these indicators. |

The corporation established performance indicators, some of them with targets, in support of its strategic objectives. The corporation identified activities in support of its strategic objectives, monitored progress made, and reported on results to the board. Weakness The corporation did not set targets for some performance indicators, and did not monitor progress for all set targets. |

Exclamation point in a yellow circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

31. Weaknesses—Strategic planning. A strategic planning process was in place. However, we found that it did not include stakeholder consultations or a systematic and explicit analysis of risks, opportunities, and threats in the external environment, such as the social and economic context as well as technological advances.

32. Eight weeks before the start of each fiscal year, the corporation was required to submit to the responsible minister the final version of its five‑year corporate plan, including an operating and capital budget. Although drafts of the last three corporate plans were approved by the board and submitted to Infrastructure Canada before the start of the fiscal year, we found that the corporation did not submit the final versions before the 8‑week deadline. Furthermore, the corporation did not obtain the Government of Canada’s approval of the plans in a timely manner. For example, the final version of the 2020–21 to 2024–25 corporate plan was submitted in October 2020, nearly seven months after the start of the fiscal year, and the government’s approval of the plan was obtained approximately one month before the end of the fiscal year. Moreover, the final version of the 2021–22 to 2025–26 corporate plan had not yet been submitted by the end of the audit period, that is, by the end of July 2021.

33. These weaknesses matter because an external environmental scan helps the corporation identify opportunities and threats in order to determine its future direction. In addition, a key element of the accountability framework for any Crown corporation to the Government of Canada is the submission of an annual corporate plan to the responsible minister for government approval.

34. Recommendation. The corporation should take into account external environment considerations, including stakeholders, in its strategic planning process.

The corporation’s response. Agreed. The corporation takes into account its external environment, including stakeholders, in all its projects and operations. The corporation will explicitly include these considerations in its 2022–23 annual action plan, which supports its 2020–24 strategic plan, as well as when preparing its next strategic plan in 2023–24, to be implemented starting in 2024–25.

35. Recommendation. The corporation should ensure that it submits the final version of its corporate plan to the responsible minister at least eight weeks before the start of each fiscal year, in compliance with the provisions of the Crown Corporation Corporate Plan, Budget and Summaries Regulations, and should continue to work with the Government of Canada to ensure that its corporate plans are approved in a timely manner.

The corporation’s response. Agreed. The corporation submitted the final version of its 2022–23 to 2026–27 corporate plan to the responsible minister within the specified time frame, and will continue to do so with future plans. The corporation will continue to follow up on the approval of its corporate plan by the government, notably during monthly meetings with Infrastructure Canada.

36. Weakness—Performance measurement, monitoring and reporting. The corporation established performance indicators to support the achievement of its strategic objectives. However, we found that some of the indicators lacked targets. For example, targets were not set for the indicators relating to the availability of active mobility lanes and the ratio of professional fees to construction work value for a given contract. In addition, the corporation had not yet monitored the progress made on all the targets it had set.

37. This weakness matters because without targets and without the monitoring of those targets, the corporation cannot fully assess the achievement of its strategic objectives or determine whether corrective action is needed.

38. Recommendation. The corporation should complete setting targets for performance indicators so that it can assess the achievement of its strategic objectives. The corporation should also regularly monitor and report on the progress made.

The corporation’s response. Agreed. The corporation is now completing the process of setting targets for performance indicators to support the achievement of its strategic objectives. It will complete the work by 31 December 2022. In addition, starting from January 2023, the corporation will regularly monitor the progress made on all the targets it has set, and from April 2023 it will begin reporting on that progress.

39. Analysis. We found that the corporation had good systems and practices for identifying, assessing, monitoring, and reporting on risks. However, an improvement was needed in risk mitigation (Exhibit 5).

Exhibit 5—Corporate risk management—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Risk identification and assessment |

The corporation identified and assessed the risks to achieving its strategic objectives. |

The corporation developed a risk management process, as well as a related policy and implementation guide. The corporation identified its corporate and operational risks, as well as the risks associated with each of the infrastructures under its responsibility. The corporation then assessed the risks based on their likelihood and potential impact. The corporation assessed the residual risks for its highest corporate and operational risks. |

Check mark in a green circle |

|

Risk mitigation |

The corporation defined and implemented risk mitigation measures. |

The corporation defined risk mitigation measures for its highest risks. In the case of risks considered to be priorities, the corporation identified actions and timelines for mitigation measures that had not yet been implemented. Weakness The corporation did not set its risk appetite and tolerance levels to guide its decision making. |

Exclamation point in a yellow circle |

|

Risk monitoring and reporting |

The corporation monitored and reported on the implementation of risk mitigation measures. |

In the case of risks considered to be priorities, the corporation monitored the status of mitigation measures that had not yet been implemented. The results were shared with senior management and with the Corporate Risk Committee. |

Check mark in a green circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

40. Weakness—Risk mitigation. The corporation had a register in which it documented corporate and operational risks, along with the inherent risk for each. It also assessed the residual risk for its highest inherent risks, and identified related mitigation measures. The corporation then selected priority risks for which it monitored mitigation measures that remained to be put in place. However, we found that the corporation did not set its risk appetite and risk tolerance levels. The risk appetite level is the degree of risk that the corporation is prepared to accept in pursuing its objectives. The risk tolerance level, which represents the extent to which the corporation is willing to assume a particular risk in relation to its risk appetite, enables the corporation to determine whether additional measures are required.

41. This weakness matters because the risk appetite and risk tolerance levels guide decision making and help an organization select the priority risks that require additional mitigation measures and monitoring.

42. Recommendation. The corporation should set its risk appetite and risk tolerance levels.

The corporation’s response. Agreed. The corporation will set its risk appetite and risk tolerance levels by 31 March 2023.

Management of operations

The corporation had good practices for managing its operations, but some practices for managing projects and for managing environmental and sustainable development matters needed improvement

43. We found that the corporation had good practices for managing its operations. However, in the area of project management, we found that the corporation did not put in place all planned activities for quality control and continuous improvement, and did not define performance indicators to measure certain elements. In addition, in the area of environment and sustainable development, we found that the corporation did not define all the targets for measuring the achievement of its objectives, and did not assess the progress made on existing targets.

The analysis supporting this finding discusses the following topics:

45. The corporation’s mission is to ensure user mobility, safety, and the longevity of the infrastructures under its responsibility.

46. Among the corporation’s activities are:

- asset management, which includes knowledge of the infrastructure condition and developing work plans

- project management, which involves project planning and implementation, as well as contract management

- management of environmental and sustainable development matters, which are integral parts of asset management and project management

47. The corporation acquires knowledge about the condition of the infrastructures through an asset supervision program, which involves inspections and surveillance of the network under the corporation’s responsibility. The corporation then assesses the condition of the infrastructures so that it can decide on which work to prioritize.

48. Project management includes developing practices for project planning, implementation, and performance monitoring. The corporation awards contracts to carry out major infrastructure work. The corporation also uses the professional services of consulting engineering firms for the inspection, planning, engineering, and monitoring of the work carried out by contractors.

49. In December 2020, the corporation became one of two Crown corporations subject to the Federal Sustainable Development Act. Under the act, the corporation is required to prepare its own sustainable development strategy and report on the progress achieved. In fall 2020, before becoming subject to the act, the corporation voluntarily submitted its strategy for 2020–23. The strategy, tabled in Parliament in June 2021, describes how the corporation is contributing to the achievement of certain objectives of the 2019–22 Federal Sustainable Development Strategy and some of the United Nations’ Sustainable Development Goals.

50. Our recommendations in this area of examination appear at paragraphs 56, 59, and 64.

51. Analysis. We found that the corporation had good systems and practices for managing its assets (Exhibit 6).

Exhibit 6—Asset management—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Asset information |

The corporation had policies and procedures in place to monitor, inspect, and document the condition of its assets. |

The corporation developed policies and procedures to monitor, inspect, and document the condition of its assets. The corporation established asset monitoring and inspection plans. The corporation consolidated the results of infrastructure inspections in a database. |

Check mark in a green circle |

|

Planning of maintenance and major works |

The corporation developed plans for maintenance and major works for its assets on the basis of set priorities. |

The corporation had a process for prioritizing work, including diagnostics and infrastructure risk assessment. The corporation developed infrastructure work plans in accordance with set priorities. |

Check mark in a green circle |

|

Performance monitoring and reporting |

The corporation monitored and reported on the implementation of its asset management activities. |

The corporation periodically monitored the implementation of its asset management activities, including progress made on the inspection program, completion of diagnostics on structures, and investments made in relation to the plan for major works. The corporation also shared the results with senior management. Management informed the board about the condition of its assets and reported on the status of its asset monitoring and inspection program activities. |

Check mark in a green circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

52. Analysis. We found that the corporation had good systems and practices for project management. However, improvements were needed in the implementation of project management practices and in project performance monitoring (Exhibit 7).

Exhibit 7—Asset management—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Project management practices |

The corporation’s project management practices enabled it to plan, organize, and control allocated resources in order to achieve objectives and expected results. |

The corporation had tools and practices, including a policy, process maps, and models to guide project management. The corporation had a team that participated in the development and implementation of project management practices. |

Check mark in a green circle |

|

Implementation of project management practices |

The corporation implemented its project management practices in order to achieve set objectives and produce expected results. |

The corporation implemented its project management practices. The corporation developed quality control and continuous improvement activities for the management of its projects. Weakness The corporation did not implement all planned quality control and continuous improvement activities. |

Exclamation point in a yellow circle |

|

Monitoring of contract execution |

The corporation monitored contract execution to ensure compliance with terms and conditions. |

To monitor compliance with contract terms and conditions, the corporation put in place systems and practices, such as a guide for consultants hired to supervise the work and a process for providing contract progress updates. |

Check mark in a green circle |

|

Performance monitoring and reporting |

The corporation monitored and reported on the implementation of its projects. |

The corporation monitored the implementation of projects and important issues, and reported on the results to senior management and the board. The corporation discussed current and future projects with external stakeholders. Weakness The corporation did not define performance indicators, with targets, to measure compliance with set timelines and the execution of projects in accordance with specifications and quality requirements. |

Exclamation point in a yellow circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

53. Weakness—Implementation of project management practices. In fall 2020, the corporation developed a quality control process requiring each project management team to conduct a self‑assessment in order to confirm that the project management steps deemed essential by the corporation had been followed and documented properly. This process also called for an independent team to conduct random checks in order to validate the results of the self‑assessments. However, we found that no random checks had been carried out as of July 2021.

54. The corporation also developed a continuous improvement process requiring project management teams to document lessons learned during the execution of projects. However, we found that the corporation did not identify priority matters to be addressed, did not address a significant number of lessons learned, and did not assign responsibility for addressing many of these lessons.

55. This weakness matters because quality control activities provide the corporation with assurance that its project management practices are being followed, in a consistent manner. In addition, continuous improvement activities enable the corporation to make adjustments to the practices in place.

56. Recommendation. The corporation should conduct the random checks required by its quality control process and should follow up on the lessons learned that project management teams have identified.

The corporation’s response. Agreed. The corporation will clarify expectations regarding the frequency and the role of the independent team to ensure effective random checks of the self‑assessments. In addition, roles and responsibilities for managing lessons learned will be defined to ensure systematic follow‑up. These measures will be implemented by the end of the 2022–23 fiscal year.

57. Weakness—Performance monitoring and reporting. The corporation monitored the progress of projects, including budgetary aspects. However, we found that the corporation did not define organizational performance indicators, with targets, to measure compliance with set timelines and the completion of projects in accordance with specifications and quality requirements.

58. This weakness matters because compliance with timelines, specifications, and quality requirements is crucial in the execution of projects. By regularly monitoring these elements, the corporation can assess project performance more comprehensively.

59. Recommendation. The corporation should define organizational performance indicators, with targets, to measure compliance with project timelines and the execution of projects in accordance with specifications and quality requirements. The corporation should also regularly measure and report on performance.

The corporation’s response. Agreed. In fall 2021, the corporation developed organizational performance indicators to measure compliance with project timelines. The Board of Directors began receiving information about performance against these indicators in the third quarter of the 2021–22 fiscal year, and the related targets will be set by 31 December 2022. Organizational performance indicators with targets will be developed by 31 December 2022 to measure project execution in accordance with specifications and quality requirements. The corporation will conduct quarterly monitoring of progress made against set targets beginning in the 2023–24 fiscal year.

60. Analysis. We found that the corporation had good practices for managing environmental and sustainable development matters. However, improvements were needed in monitoring the implementation of those practices (Exhibit 8).

Exhibit 8—Management of environmental and sustainable development matters—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Environmental and sustainable development management practices |

The corporation had environmental and sustainable development management practices. |

The corporation developed environmental and sustainable development objectives, together with performance indicators and some targets. The corporation had practices for managing its environmental and sustainable development activities. Environmental and sustainable development considerations were integrated into project planning. |

Check mark in a green circle |

|

Monitoring and reporting on environmental and sustainable development management practices |

The corporation monitored and reported on the implementation of environmental and sustainable development management practices. |

The corporation monitored the progress of its environmental and sustainable development activities, and reported on the results to senior management. The corporation’s annual report contained information on environmental and sustainable development achievements. Weakness The corporation did not define all the targets needed to measure the achievement of its environmental and sustainable development objectives, and it did not regularly measure its progress against the targets it had set. |

Exclamation point in a yellow circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

61. Weakness—Monitoring and reporting on environmental and sustainable development management practices. The corporation developed environmental and sustainable development objectives, as well as performance indicators to monitor their achievement. However, we found that targets were lacking for some of the indicators. As a result, the corporation was unable to fully measure its performance against all the objectives it had set.

62. In September 2020, the corporation set certain performance targets for its sustainable development strategy (see paragraph 49). However, we found that the corporation did not regularly measure its progress against those targets. For example, for the objective of pristine lakes and rivers, one of the corporation’s targets was for 100% of projects carried out in naturalized ecosystems to undergo a biodiversity analysis. As of July 2021, the corporation had not measured its progress in this area.

63. This weakness matters because setting and regularly monitoring performance targets ensures that objectives are met and that appropriate action is taken.

64. Recommendation. The corporation should define complete targets to measure the achievement of its environmental and sustainable development objectives, should regularly measure progress achieved, and should report on the results.

The corporation’s response. Agreed. By 31 March 2023, the corporation will define complete targets for its environmental and sustainable development objectives. The corporation will also regularly measure its performance against set targets, and will report on the results starting from the end of the third quarter of the 2023–24 fiscal year.

Conclusion

65. In our opinion, on the basis of the criteria established, there was reasonable assurance that there were no significant deficiencies in the corporation’s systems and practices we examined. We concluded that The Jacques‑Cartier and Champlain Bridges IncorporatedInc. maintained its systems and practices during the period covered by the audit in a manner that provided the reasonable assurance required under section 138 of the Financial Administration Act.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on The Jacques‑Cartier and Champlain Bridges IncorporatedInc. Our responsibility was to express

- an opinion on whether there was reasonable assurance that during the period covered by the audit, there were no significant deficiencies in the corporation’s systems and practices that we selected for examination

- a conclusion about whether the corporation complied in all significant respects with the applicable criteria

Under section 131 of the Financial Administration Act, the corporation is required to maintain financial and management control and information systems and management practices that provide reasonable assurance of the following:

- Its assets are safeguarded and controlled.

- Its financial, human, and physical resources are managed economically and efficiently.

- Its operations are carried out effectively.

In addition, section 138 of the act requires the corporation to have a special examination of these systems and practices carried out at least once every 10 years.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard on Assurance Engagements (CSAE) 3001—Direct Engagements, set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office of the Auditor General of Canada applies the Canadian Standard on Quality Control 1 and, accordingly, maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from the corporation:

- confirmation of management’s responsibility for the subject under audit

- acknowledgement of the suitability of the criteria used in the audit

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided

- confirmation that the audit report is factually accurate

Audit objective

The objective of this audit was to determine whether the systems and practices we selected for examination at The Jacques‑Cartier and Champlain Bridges Inc. were providing the corporation with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

Scope and approach

In this audit, we examined The Jacques‑Cartier and Champlain Bridges Inc. The scope of the special examination was based on our assessment of the risks the corporation faced that could affect its ability to meet the requirements set out by the Financial Administration Act.

In performing our work, we reviewed key documents related to the systems and practices selected for examination. We tested the systems and practices in place to obtain the required level of audit assurance. We also examined a selection of activities, such as inspections, projects, and contracts. The activities were selected on a risk assessment basis and professional judgment. We also interviewed members of the Board of Directors, senior management, and other employees of the corporation. In addition, we observed meetings of the board and its committees.

In our examination of asset management and project management, we made use of sampling approaches.

In our work on asset management, our sampling covered 179 planned inspections from the corporation’s 2020–21 annual program. We randomly sampled 24 planned inspections, to examine whether they were carried out at the frequency set out in the corporation’s policy, to verify whether the results were documented in the database, and to confirm that the results were integrated into the work plans.

In our work on project management, we carried out the following judgmental sampling:

- selection of 9 projects from a list of 21 for which an important phase of the work was carried out during the period covered by the audit, in order to examine whether the corporation had followed its project management systems and practices

- selection of 10 contracts from a list of 30 contracts being executed during the period covered by the audit, in order to examine whether the corporation had monitored the contracts to ensure that the terms and conditions had been met

The systems and practices selected for examination for each area of the audit are found in the exhibits throughout the report.

In carrying out the special examination, we did not rely on any internal audits. Furthermore, we did not examine the corporation’s procurement process.

Sources of criteria

The criteria used to assess the systems and practices selected for examination are found in the exhibits throughout the report.

Corporate governance

Practice Guide: Assessing Organizational Governance in the Public Sector, The Institute of Internal Auditors, 2014

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

By‑law 2014‑1, The Jacques‑Cartier and Champlain Bridges Inc., 2014

Charter of the Board of Directors, The Jacques‑Cartier and Champlain Bridges Inc., 2019

Charters of the different committees of the Board of Directors, The Jacques‑Cartier and Champlain Bridges Inc., 2019

Strategic planning

Guidance for Crown Corporations on Preparing Corporate Plans and Budgets, Treasury Board of Canada Secretariat, 2019

Recommended Practice Guideline 3, Reporting Service Performance Information, International Public Sector Accounting Standards Board, 2015

Financial Administration Act

Crown Corporation Corporate Plan, Budget and Summaries Regulations

Charter of the Board of Directors, The Jacques‑Cartier and Champlain Bridges Inc., 2019

Corporate risk management

Enterprise Risk Management—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2017

International Organization for StandardizationISO 31000, Risk Management—Principles and Guidelines, International Organization for Standardization, 2009

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Integrated risk management policy, The Jacques‑Cartier and Champlain Bridges Inc., 2019

Integrated risk management implementation guide, The Jacques‑Cartier and Champlain Bridges Inc., 2019

Asset management

Asset supervision policy, The Jacques‑Cartier and Champlain Bridges Inc., 2019

Asset management policy, The Jacques‑Cartier and Champlain Bridges Inc., 2020

ISO 55000—Asset management—Overview, principles and terminology, International Organization for Standardization, 2014

ISO 55001—Asset management—Management systems: Requirements, International Organization for Standardization, 2014

Project management

Project-based management policy, The Jacques‑Cartier and Champlain Bridges Inc., 2019

Administration of contracts and approval authority policy, The Jacques‑Cartier and Champlain Bridges Inc., 2019

A Guide to the Project Management Body of Knowledge (PMBOK® Guide), 6th edition, Project Management Institute Inc., 2017

Management of environmental and sustainable development issues

Environmental policy, The Jacques‑Cartier and Champlain Bridges Inc., 2020

Sustainable development policy, The Jacques‑Cartier and Champlain Bridges Inc., 2016

Federal Sustainable Development Act

ISO 14001—Environmental management systems, International Organization for Standardization, 2015

Transforming Our World: The 2030 Agenda for Sustainable Development, United Nations, 2015

Period covered by the audit

The special examination covered the period from 1 October 2020 to 31 July 2021. This is the period to which the audit conclusion applies. However, to gain a more complete understanding of the significant systems and practices, we also examined certain matters that preceded the start date of this period.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 21 February 2022, in Montréal, Canada.

Audit team

This special examination was completed by a multidisciplinary team from across the Office of the Auditor General of Canada led by Nathalie Chartrand, Principal. The principal has overall responsibility for audit quality, including conducting the audit in accordance with professional standards, applicable legal and regulatory requirements, and the office’s policies and system of quality management.

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report, and the numbers in parentheses indicate the location of the related discussion.

Corporate management practices

| Recommendation | The corporation’s response |

|---|---|

|

25. The corporation should establish a regular disclosure process for board members that covers all types of conflicts of interest, and should document any measures taken, if necessary. (22 to 24) |

Agreed. Since late August 2021, an item has been systematically added to the board’s meeting agenda so that members can declare, at the start of the meetings, any types of conflicts of interest relating to the agenda items. In addition, by the end of the 2022–23 fiscal year, the corporation will modify the process to disclose conflicts of interest to cover all types of conflicts of interest, and it will document measures taken to address disclosed conflicts of interest. |

|

26. The corporation should establish a code of conduct for board members and ensure that it is followed. (23 to 24) |

Agreed. The corporation will establish a code of conduct for board members and will implement an annual process for members to declare their compliance with the code. The corporation will put in place the code and the declaration process by the end of the 2022–23 fiscal year. |

|

29. The corporation should provide the board with complete information about its ethical performance and its management of infrastructure risks. (27 to 28) |

Agreed. The corporation will modify its policies in the 2022–23 fiscal year to provide for annual reporting to the board that includes employees’ declarations of compliance with the values and ethics code and the policy on conflicts of interest, as well as employees’ disclosures and any actions by management to address the conflicts of interest disclosed. In addition, as of the start of the 2022–23 fiscal year, the corporation will provide the board with complete information on the management of infrastructure risks so that the board can fulfill its mandate. |

|

34. The corporation should take into account external environment considerations, including stakeholders, in its strategic planning process. (31 to 33) |

Agreed. The corporation takes into account its external environment, including stakeholders, in all its projects and operations. The corporation will explicitly include these considerations in its 2022–23 annual action plan, which supports its 2020–24 strategic plan, as well as when preparing its next strategic plan in 2023–24, to be implemented starting in 2024–25. |

|

35. The corporation should ensure that it submits the final version of its corporate plan to the responsible minister at least 8 weeks before the start of each fiscal year, in compliance with the provisions of the Crown Corporation Corporate Plan, Budget and Summaries Regulations, and should continue to work with the Government of Canada to ensure that its corporate plans are approved in a timely manner. (32 to 33) |

Agreed. The corporation submitted the final version of its 2022–23 to 2026–27 corporate plan to the responsible minister within the specified time frame, and will continue to do so with future plans. The corporation will continue to follow up on the approval of its corporate plan by the government, notably during monthly meetings with Infrastructure Canada. |

|

38. The corporation should complete setting targets for performance indicators so that it can assess the achievement of its strategic objectives. The corporation should also regularly monitor and report on the progress made. (36 to 37) |

Agreed. The corporation is now completing the process of setting targets for performance indicators to support the achievement of its strategic objectives. It will complete the work by 31 December 2022. In addition, starting from January 2023, the corporation will regularly monitor the progress made on all the targets it has set, and from April 2023 it will begin reporting on that progress. |

|

42. The corporation should set its risk appetite and risk tolerance levels. (40 to 41) |

Agreed. The corporation will set its risk appetite and risk tolerance levels by 31 March 2023. |

Management of operations

| Recommendation | The corporation’s response |

|---|---|

|

56. The corporation should conduct the random checks required by its quality control process and should follow up on the lessons learned that project management teams have identified. (53 to 55) |

Agreed. The corporation will clarify expectations regarding the frequency and the role of the independent team to ensure effective random checks of the self‑assessments. In addition, roles and responsibilities for managing lessons learned will be defined to ensure systematic follow‑up. These measures will be implemented by the end of the 2022–23 fiscal year. |

|

59. The corporation should define organizational performance indicators, with targets, to measure compliance with project timelines and the execution of projects in accordance with specifications and quality requirements. The corporation should also regularly measure and report on performance. (57 to 58) |

Agreed. In fall 2021, the corporation developed organizational performance indicators to measure compliance with project timelines. The Board of Directors began receiving information about performance against these indicators in the third quarter of the 2021–22 fiscal year, and the related targets will be set by 31 December 2022. Organizational performance indicators with targets will be developed by 31 December 2022 to measure project execution in accordance with specifications and quality requirements. The corporation will conduct quarterly monitoring of progress made against set targets beginning in the 2023–24 fiscal year. |

|

64. The corporation should define complete targets to measure the achievement of its environmental and sustainable development objectives, should regularly measure progress achieved, and should report on the results. (61 to 63) |

Agreed. By 31 March 2023, the corporation will define complete targets for its environmental and sustainable development objectives. The corporation will also regularly measure its performance against set targets, and will report on the results starting from the end of the third quarter of the 2023–24 fiscal year. |