2021 Reports of the Auditor General of Canada to the Parliament of CanadaReport of the Joint Auditors to the Board of Directors of the Public Sector Pension Investment Board—Special Examination Report—2021

Independent Auditors’ Report

Table of Contents

- Audit Summary

- Introduction

- Findings, Recommendations, and Responses

- Conclusion

- Subsequent Event

- About the Audit

- List of Recommendations

- Exhibits:

- 1—Asset classes under management, as of 31 March 2020 ($ billions)

- 2—Public Sector Pension Investment Board growth since 2010–11

- 3—The corporation has a risk management framework

- 4—The corporation has both investment and non-investment risks

- 5—Corporate governance—Key findings and assessment

- 6—Strategic planning—Key findings and assessment

- 7—Corporate risk management—Key findings and assessment

- 8—Investments and operations management—Key findings and assessment

Audit Summary

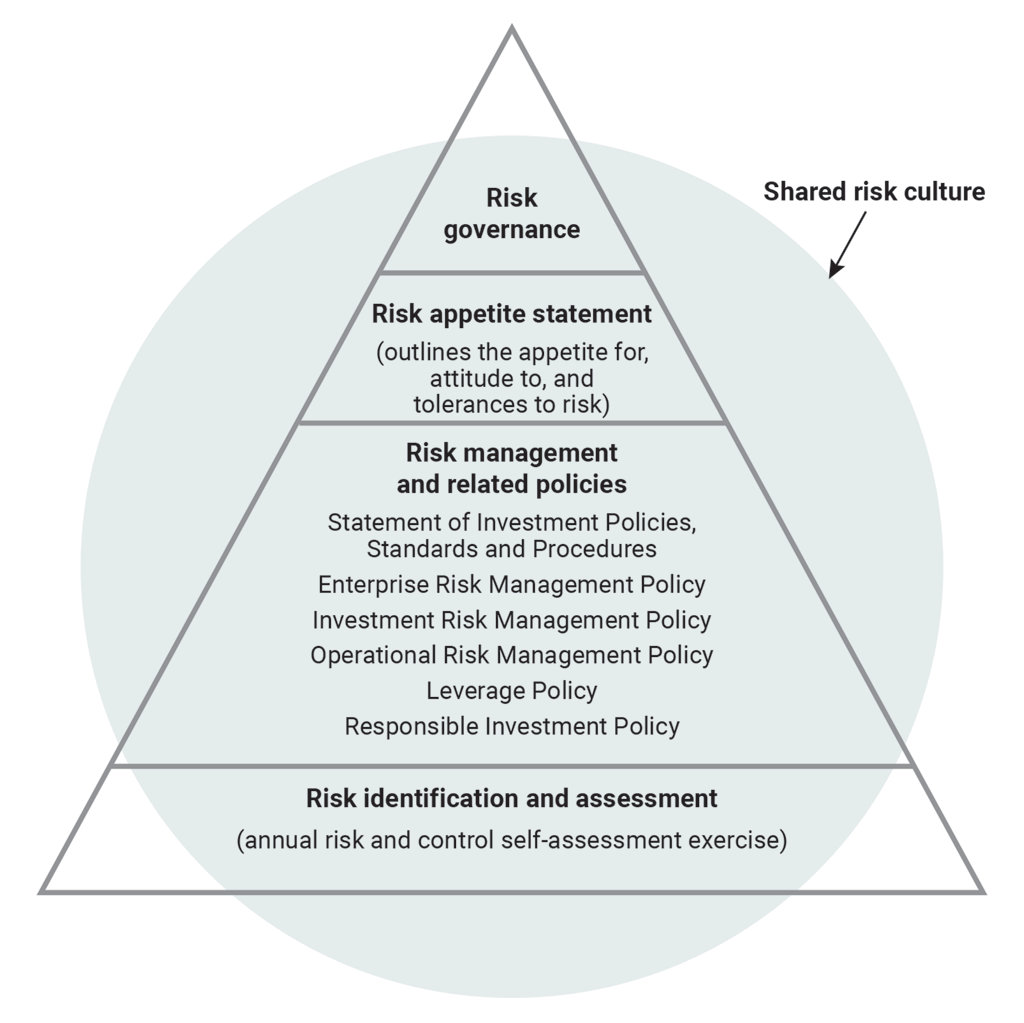

We found no significant deficiencies in the corporate management practices or management of investments and operations of the Public Sector Pension Investment Board during the period covered by the audit. Though we identified areas for improvement, the corporation generally maintained reasonable systems and practices for accomplishing its mandate.

Introduction

Background

1. The Public Sector Pension Investment Board is a Crown corporation created in 1999 under the Public Sector Pension Investment Board Act. It invests and manages contributions from the pension plans of the public service, the Canadian Armed Forces, the Royal Canadian Mounted Police (RCMP), and the Reserve Force. As outlined in the Public Sector Pension Investment Board Act, the corporation is responsible for

- managing the contributions that are transferred to it from the pension plans in the best interests of the contributors and beneficiaries

- investing its assets with a view to achieving a maximum rate of return, without undue risk of loss, considering the funding, policies, and requirements of the pension plans and the ability of those plans to meet their financial obligations

2. The Treasury Board of Canada Secretariat oversees the government’s relationship with the corporation. In the 2018–19 fiscal year, the secretariat worked with the corporation and other pension plan stakeholders to implement a funding policy that aligned with the government’s funding risk tolerance. The secretariat also created the Asset Liability Committee, which included departmental officials representing each of the plans, and other significant stakeholders, including officials of the corporation. This committee provides a forum for the review and discussion of the funding risks, and supports the secretariat’s role in ensuring that these risks remain within the established funding levels. During our audit, the secretariat communicated the government’s funding risk tolerance and long-term real rate-of-return objective for the pension assets that the corporation managed.

3. To develop its investment portfolio and investment management strategies, the corporation uses the government’s funding risk tolerance level, long-term real rate-of-return objective, and inflation expectations. In the 2019–20 fiscal year, the government’s real rate-of-return objective was 3.6% for the following 10 years and 4.0% thereafter. The corporation’s objective is to establish a long-term investment strategy that achieves an expected real rate of return that is at least equal to the government’s rate-of-return objective, without assuming undue risk of loss. The corporation developed an actively managed investment portfolio aimed at outperforming, at a lower or equal level of pension funding risk, a passively managed portfolio over a 10‑year period.

4. As of 31 March 2020, the total fund 1‑year net portfolio returnDefinition 1 was −0.6%. This rate of return was affected by the market conditions brought about by the coronavirus disease (COVID‑19) pandemic. The 5‑year and 10‑year net annualized returnsDefinition 2 were 5.8% and 8.5% respectively.

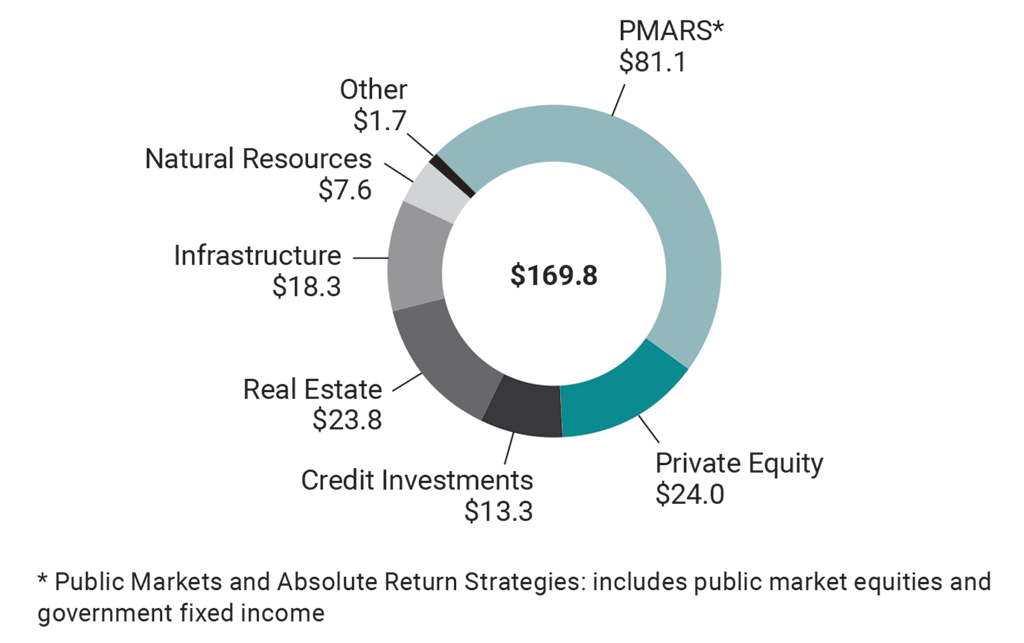

5. The corporation is one of Canada’s largest pension investment managers. As of 31 March 2020, it was managing $169.8 billion in assets. These assets were invested in 6 asset classes (Exhibit 1), in more than 100 sectors and industries across 85 countries. The corporation also held investments in 147 subsidiaries around the world, including 6 wholly owned operating subsidiaries. The subsidiaries are companies the corporation controls as part of its investment portfolio.

Exhibit 1—Asset classes under management, as of 31 March 2020 ($ billions)

Source: Adapted from the Public Sector Pension Investment Board’s website

Exhibit 1—text version

This pie chart shows, in billions of dollars, the asset classes of the corporation’s investments, which totalled $169.8 billion as of 31 March 2020.

The largest of these asset classes is Public Markets and Absolute Return Strategies, which includes public market equities and government fixed income, and amounted to $81.1 billion.

From largest to smallest, the asset classes in order of the amounts invested were as follows: Private Equity, amounting to $24.0 billion; Real Estate, amounting to $23.8 billion; Infrastructure, amounting to $18.3 billion; Credit Investments, amounting to $13.3 billion; and Natural Resources, amounting to $7.6 billion. All other asset classes amounted to $1.7 billion.

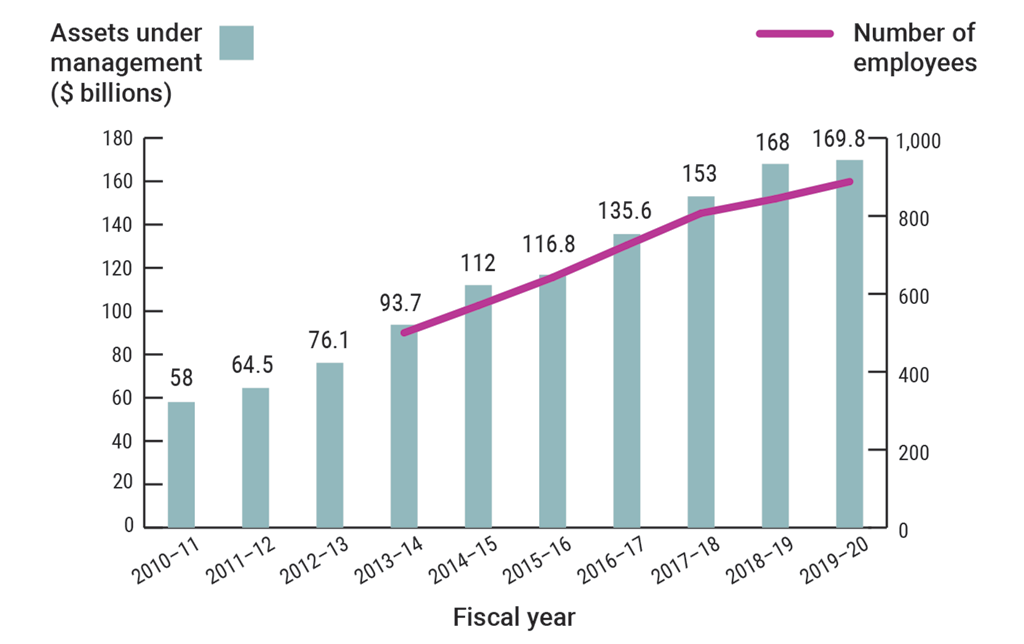

6. The corporation has 888 employees in 5 offices around the world. Its head office is in Ottawa, while its main business offices are in Montréal, New York, London, and Hong Kong. The offices in New York, London, and Hong Kong opened in the past 5 years. The corporation has grown significantly since our last special examination in 2011, particularly over the past 5 years (Exhibit 2).

Exhibit 2—Public Sector Pension Investment Board growth since 2010–11

Source: Adapted from the Public Sector Pension Investment Board’s website

Exhibit 2—text version

This combined bar chart and line graph shows the growth in the corporation’s assets under management since the 2010–11 fiscal year and the number of employees for the 6 fiscal years leading up to the 2019–20 fiscal year.

The corporation’s assets under management grew steadily, with increases every fiscal year, from $58 billion in 2010–11 to $169.8 billion in 2019–20.

The number of employees grew steadily too, with increases every fiscal year, from 500 in 2013–14 to 888 in 2019–20.

The following table lists for each fiscal year the value of the corporation’s assets under management and its number of employees.

| Fiscal year | Assets under management (in billions of dollars) |

Number of employees |

|---|---|---|

| 2010–11 | 58 | not recorded |

| 2011–12 | 64.5 | not recorded |

| 2012–13 | 76.1 | not recorded |

| 2013–14 | 93.7 | 500 |

| 2014–15 | 112 | 570 |

| 2015–16 | 116.8 | 642 |

| 2016–17 | 135.6 | 725 |

| 2017–18 | 153 | 807 |

| 2018–19 | 168 | 844 |

| 2019–20 | 169.8 | 888 |

7. In the 2020–21 fiscal year, after the implementation of the Funding Policy for the Public Sector Pension Plans, the Treasury Board of Canada Secretariat communicated to the corporation the government’s funding risk tolerance by providing a portfolio breakdown of investment types (equity and fixed income) in line with this funding risk tolerance level. This practice replaced the communication of a long-term real rate-of-return objective.

Focus of the audit

8. Our objective for this audit was to determine whether the systems and practices we selected for examination at the Public Sector Pension Investment Board were providing the corporation with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

9. In addition, section 139 of the Financial Administration Act requires that we state an opinion, with respect to the criteria established, on whether there was reasonable assurance that there were no significant deficiencies in the systems and practices we examined. We define and report significant deficiencies when, in our opinion, the corporation could be prevented from having reasonable assurance that its assets are safeguarded and controlled, its resources are managed economically and efficiently, and its operations are carried out effectively.

10. On the basis of our risk assessment, we selected systems and practices in the following areas:

The selected systems and practices, and the criteria used to assess them, are found in the exhibits throughout the report.

11. More details about the audit objective, scope, approach, and sources of criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Corporate management practices

The corporation had good corporate management practices in some areas and opportunities for improvement in others

12. We found that the corporation had good corporate management practices. However, improvements were needed in performance measurement, performance monitoring and reporting, risk mitigation, and risk monitoring and reporting.

13. The analysis supporting this finding discusses the following topics:

14. For additional information, see Subsequent Event at the end of the report.

15. The corporation is governed by a Board of Directors composed of 11 members, including the Chair, who are appointed by the Governor in CouncilDefinition 3 upon recommendation from the President of the Treasury Board.

16. The board oversees the corporation and is accountable to Parliament for the fulfillment of its duties. It reports through the President of the Treasury Board, as well as the ministers of National Defence and of Public Safety and Emergency Preparedness, in fulfilling its duties as pension investment manager.

17. The board is supported by an Investment and Risk Committee, Audit Committee, Governance Committee, and Human Resources and Compensation Committee.

18. The corporation is exempt from certain sections of Part X of the Financial Administration Act. As a result, it does not have to submit an annual corporate plan or an operating and capital budget for government approval.

19. To achieve its mandate, the corporation sets out strategic objectives in its strategic plan. It also develops performance indicators to measure its progress toward these objectives. Performance indicators are a means of measuring an output or outcome, to gauge the performance of a program, policy, or initiative. Along with the indicators, the corporation uses targets to specify the success levels or goals it must reach to achieve strategic objectives. For the 2016–21 period, the corporation identified 5 strategic objectives:

- Cultivate One public sector pensionPSP (encourage a total fund view across the corporation)

- improve its brand both locally and internationally

- increase its global footprint

- increase scalability and efficiency

- develop its people

At the time of our audit, the corporation was developing its 2021–26 strategic plan.

20. The corporation uses a risk management framework (Exhibit 3) that includes risk governance, a risk appetite statement, risk management and related policies, and risk identification and assessment:

- Risk governance refers to processes by which decisions about risks are made and implemented.

- A risk appetite statement specifies the level and types of risk that a corporation is willing to take to meet its strategic objectives. It sets the basic goals, parameters, and limits for the risks an organization is assuming. At the corporation, the board reviews and approves the risk appetite statement annually.

- Risk management policies outline the guiding principles governing a corporation’s overall values and approach to managing risk. The corporation uses risk management policies to mitigate investment and non-investment risks (Exhibit 4).

- Risk identification and assessment refers to the process in which risks are identified, categorized, and assessed, on the basis of their potential impact and likelihood of occurrence. The corporation conducts an annual, enterprise-wide risk and control self-assessment exercise to identify and evaluate significant risks, and assess the effectiveness of its risk mitigation activities. This exercise supports the corporation’s business planning process and ensures that risks are factored into its overall strategy. The board participates in this process through an annual risk-identification survey.

Exhibit 3—The corporation has a risk management framework

Source: Public Sector Pension Investment Board 2020 annual report

Exhibit 3—text version

This pyramid-shaped chart shows the 4 levels of the corporation’s risk management framework and the shared risk culture, which includes all 4 levels.

The top level is risk governance.

The second-highest level is the risk appetite statement, which outlines the appetite for, attitude to, and tolerances for risk.

The third-highest level is risk management and related policies. These include 6 subcategories: the Statement of Investment Policies, Standards and Procedures; the Enterprise Risk Management Policy; the Investment Risk Management Policy; the Operational Risk Management Policy; the Leverage Policy; and the Responsible Investment Policy.

The base level of the pyramid is risk identification and assessment, which includes an annual risk and control self-assessment exercise.

Exhibit 4—The corporation has both investment and non-investment risks

| Investment risks | Non-investment risks |

|---|---|

|

|

Source: Public Sector Pension Investment Board 2020 annual report

21. Our recommendations in this area of examination appear at paragraphs 26, 32, 33, 34, and 37.

22. Analysis. We found that the corporation had good systems and practices for corporate governance (Exhibit 5).

Exhibit 5—Corporate governance—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Board independence |

The board functioned independently. |

The board functioned independently from management when making decisions. The corporation established processes for board members to declare real, potential, or apparent conflicts of interest. |

|

|

Providing strategic direction |

The board provided strategic direction. |

The board provided strategic direction to management that aligned with the corporation’s mandate and strategic plan. The direction also aligned with the government’s funding risk tolerance level and long-term rate-of-return objective. The board set objectives for the President and Chief Executive Officer and assessed his performance. This activity aligned with the corporation’s strategic direction. The corporation had regular communication with its stakeholders and shareholders, which helped the board provide strategic direction to the corporation. |

|

|

Board appointments and competencies |

The board collectively had the capacity and competencies to fulfill its responsibilities. |

The board determined the skills and expertise it needed to be effective. The board communicated its needs for member appointments to the responsible minister. The corporation provided new board members with orientation sessions and training material. The board was composed of 11 members with staggered terms. Four of them had expired terms; however, they planned to remain on the board until they were replaced. For additional information, see Subsequent Event at the end of the report. |

|

|

Board oversight |

The board carried out its oversight role over the corporation. |

The board’s governance structure reflected the nature and complexity of the corporation’s business and responsibilities. The board made decisions, requested and challenged information, offered direction, and followed up on management actions. The board annually evaluated its performance and the performance of its committees. The corporation’s internal audit department provided an independent, objective view on risk and internal controls. This activity supported the board’s oversight. The board reviewed information related to the governance of the corporation’s subsidiaries and their performance. Internal audits on the governance of the subsidiaries were performed at an appropriate frequency. |

|

|

Legend—Assessment against the criteria

Met the criteria

Met the criteria, with improvement needed

Did not meet the criteria |

|||

23. Analysis. We found that the corporation had good systems and practices for strategic planning. However, improvements were needed in performance measurement and in performance monitoring and reporting (Exhibit 6).

Exhibit 6—Strategic planning—Key findings and assessment

24. Weaknesses—Performance measurement, monitoring, and reporting. In our 2011 special examination report, we noted that the corporation had reported on the execution of tasks, rather than on outcomes. In the current audit, we found that the corporation had improved in this area. It established performance indicators for its 2016–21 strategic objectives. It also monitored and reported on the completion of strategic initiatives, and on its performance indicators and targets related to investment management. However, we found that some of its non-investment performance indicators did not have specific targets. We also found that the corporation did not report on all of its non-investment performance indicators consistently to the board. For example:

- For the strategic objective related to branding itself as a global pension investment manager, the corporation had performance indicators, but no specific targets to measure whether the objective would be achieved.

- For the strategic objective related to talent and the prioritization of inclusion and diversity, the corporation had performance indicators, but no specific targets to measure whether the objective would be achieved.

25. This weakness matters because monitoring progress against performance indicators and targets would help the corporation assess its progress toward its strategic objectives. Without this information, it cannot take timely action if it is at risk of not achieving them. The weakness also matters because if the corporation does not consistently report on all its performance indicators and targets, the board cannot fully monitor its performance.

26. Recommendation. The corporation should ensure that its strategic objectives are supported by performance indicators with targets that are specific and measurable. It should also regularly and consistently monitor and report on its performance against these indicators.

The corporation’s response. Agreed. In support of its next 5‑year strategic plan, the corporation is developing performance indicators to monitor the achievement of its strategic objectives. In the course of the 2021–22 fiscal year, the corporation will set targets for the indicators and will regularly monitor and report on progress against these indicators. The corporation will complete these by the end of 2021–22.

27. Analysis. We found that while the corporation had good systems and practices for corporate risk management, improvements were needed in some areas (Exhibit 7).

Exhibit 7—Corporate risk management—Key findings and assessment

28. Weaknesses—Risk mitigation. In our 2011 special examination report, we found that the corporation had not defined its risk tolerance for non-investment risks. We found that during this audit period, the corporation had improved in this area. It established a board-approved risk appetite statement to set risk appetite for investment and non-investment risks. It also set risk appetite metrics, with thresholds or limits, for its investment risks. However, as also noted in a 2019 internal audit report, it did not set metrics and thresholds or limits, when applicable, for some of its significant non-investment risks. The thresholds or limits would set the degree of risk that the corporation is prepared to accept in pursuing its objectives. Because it did not set these parameters, management was left to make decisions without clear guidance on how much risk the corporation would accept before responding with mitigation measures.

29. We also found that the corporation had not fully implemented a risk-based compliance program. At the time of our audit, it was in the process of completing compliance risk assessments, using a risk-based approach that would evaluate how its business units were complying with the regulations relevant to its operations.

30. The corporation used models for valuing financial instruments and measuring risk. It adopted a model validation procedure that assessed models as critical or non-critical, and set requirements for model documentation, validation, and oversight. However, as also noted in a 2019 internal audit report, the model validation procedure did not outline a methodology for model risk assessment, or procedures for model development, ownership, maintenance, independent validation, monitoring, or reporting.

31. These weaknesses matter because without risk appetite thresholds and limits for significant non-investment risks, the corporation cannot ensure that its decision making aligns with the board-approved risk appetite statement. Furthermore, completing compliance risk assessments for laws and regulations relevant to its operations would ensure that the corporation does not inadvertently contravene a law or regulation, exposing it to financial and reputational risk. Finally, a complete model risk validation procedure would provide consistency in model governance and model risk management activities. This would also allow the corporation to communicate its expectations of model risk management throughout all its departments.

32. Recommendation. The corporation should set risk appetite metrics and thresholds or limits for significant non-investment risks.

The corporation’s response. Agreed. The corporation is establishing tolerances or thresholds for non-investment risks, as an initiative to provide additional assurance on its management and monitoring of key non-investment risks for management and the board, as appropriate. The corporation will identify the appropriate tolerances or thresholds for the significant non-investment risks, recognizing that these may in some cases be best expressed qualitatively. The corporation will complete these matters by the end of the 2021–22 fiscal year.

33. Recommendation. The corporation should complete compliance risk assessments, using a risk-based approach, to evaluate its adherence to the regulations relevant to its operations.

The corporation’s response. Agreed. The corporation intends to continue to complete compliance risk assessments of its business units in accordance with its internal schedule and before the end of the 2021–22 fiscal year.

34. Recommendation. The corporation should develop and apply, enterprise-wide, a model risk management framework comprising model governance, a model risk assessment methodology, a model validation methodology, and model risk management activities. The corporation could leverage and expand its current model validation procedure to develop this framework.

The corporation’s response. Agreed. During the 2020–21 fiscal year, the corporation reviewed and enhanced its model governance framework with an emphasis on the framework ownership, roles and responsibilities, and scope of the framework—including model definition, model inventory and materiality assessment linked to the review cycle, model documentation, and validation requirements. In 2021–22, the corporation will determine priority areas to expand the application of the framework, based on materiality.

35. Weakness—Risk monitoring and reporting. The corporation provided risk monitoring information to senior management and the board through its Enterprise Risk Management Quarterly Report and the Risk and Control Self-Assessment Report. The latter report described the corporation’s significant investment and non-investment risks, and identified mitigation measures for each of them. However, the corporation provided this report only once a year and did not include timelines and deliverables for every mitigation measure. The report also did not consistently include updates of the corporation’s progress toward implementing those measures.

36. This weakness matters because without timelines and deliverables for each mitigation measure, the corporation cannot effectively track its progress toward implementing them. Also, without regular reporting to the board on risk mitigation measures, the board cannot effectively monitor the corporation’s progress in implementing these measures.

37. Recommendation. The corporation should continue to enhance its reporting to the board on implementation of mitigation measures, to identify clear timelines and deliverables, and provide a periodic update on progress and completion as part of its risk and control self-assessment process.

The corporation’s response. Agreed. The corporation prioritizes the continued enhancement of its reporting to the board, to ensure that the information is effective, streamlined, and appropriate. The corporation will consider augmenting its periodic board updates with regard to progress and completion of key mitigation measures, where relevant. The corporation will complete these matters by the end of the 2021–22 fiscal year.

Investments and operations management

The corporation had good practices for investments and operations management

38. We found that the corporation had good systems and practices for managing its investments and operations.

39. The analysis supporting this finding discusses the following topic:

40. The corporation’s business units and departments manage its assets to achieve its mandate. The corporation also has a team of investment professionals that designs investment strategies aligned with its investment objectives and Statement of Investment Policies, Standards and Procedures. This team also manages risks and investment performance.

41. As a global pension investment manager with a long-term view, the corporation integrates environmental, social, and governance factors within its investment decision making.

42. We made no recommendations in this area of examination.

43. Analysis. We found that the corporation had good systems and practices for investments and operations management (Exhibit 8).

Exhibit 8—Investments and operations management—Key findings and assessment

Commentary on the United Nations’ Sustainable Development Goals

44. In 2015, Canada and other United Nations member states adopted the 2030 Agenda for Sustainable Development, a vision for partnership, peace, and prosperity for all people and the planet. The 2030 Agenda outlined 17 Sustainable Development Goals that aimed to address current and future social, economic, and environmental challenges. At the national level, the Government of Canada reiterated its commitment to implementing these goals.

45. The federal government recently established formal expectations for the integration of the Sustainable Development Goals by federal departments and agencies. Similar expectations were not established for Crown corporations.

46. As part of its Sustainable Development Strategy, the Office of the Auditor General of Canada has committed to reporting on progress toward these goals as part of its audit work. As a result, we asked the corporation’s senior management about whether the corporation had integrated these goals into its investment operations.

47. Senior management told us that the corporation was aware of the Sustainable Development Goals and was monitoring how its peers were integrating and reporting against them. It had not systematically integrated these goals into its investment operations. However, its investment operations and the activities of its Responsible Investment group, as reported in its 2019 Responsible Investment Report, indirectly addressed 3 of the goals:

- gender equality (Goal 5)

- affordable and clean energy (Goal 7)

- responsible consumption and production (Goal 12)

48. The 2019 Responsible Investment Report did not explicitly link the corporation’s activities to the Sustainable Development Goals. Because its investment operations and the activities of the Responsible Investment group contributed to aspects of the Sustainable Development Goals, there is an opportunity for the corporation to enhance its reporting on the sustainability impact of its investment activities. It could also consider reporting on its contributions to support the government’s commitment to the Sustainable Development Goals.

49. In our view, the Sustainable Development Goals offer a framework for organizations, including Crown corporations, to identify and contribute to social, economic, and environmental impacts through their activities and to report on results. We encourage Crown corporations, including the Public Sector Pension Investment Board, to consider and integrate these goals as a means of embedding sustainability considerations into their operations, while supporting the government in this important initiative.

Conclusion

50. In our opinion, on the basis of the criteria established, there was reasonable assurance that there were no significant deficiencies in the corporation’s systems and practices we examined. We concluded that the Public Sector Pension Investment Board maintained its systems and practices during the period covered by the audit in a manner that provided the reasonable assurance required under section 138 of the Financial Administration Act.

Subsequent Event

51. The corporate governance section of this report discusses the board appointments for the Public Sector Pension Investment Board. At the end of our examination, 4 of the 11 board members’ terms had expired. As of 1 February 2021, 3 positions were filled and 1 position was vacant.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada (the Office) and Deloitte Limited Liability PartnershipLLPFootnote 1 on the Public Sector Pension Investment Board. Our responsibility was to express

- an opinion on whether there was reasonable assurance that during the period covered by the audit, there were no significant deficiencies in the corporation’s systems and practices we selected for examination

- a conclusion about whether the corporation complied in all significant respects with the applicable criteria

Under section 131 of the Financial Administration Act, the corporation is required to maintain financial and management control and information systems and management practices that provide reasonable assurance of the following:

- Its assets are safeguarded and controlled.

- Its financial, human, and physical resources are managed economically and efficiently.

- Its operations are carried out effectively.

In addition, section 138 of the act requires the corporation to have a special examination of these systems and practices carried out at least once every 10 years.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard on Assurance Engagements (CSAE) 3001—Direct Engagements, set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office and Deloitte LLP apply the Canadian Standard on Quality Control 1 and, accordingly, maintain comprehensive systems of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from the corporation:

- confirmation of management’s responsibility for the subject under audit

- acknowledgement of the suitability of the criteria used in the audit

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided

- confirmation that the audit report is factually accurate

Audit objective

The objective of this audit was to determine whether the systems and practices we selected for examination at the Public Sector Pension Investment Board were providing the corporation with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

Scope and approach

Our audit work examined the Public Sector Pension Investment Board. The scope of the special examination was based on our assessment of the risks the corporation faced that could affect its ability to meet the requirements set out by the Financial Administration Act.

The systems and practices selected for examination for each area of the audit are found in the exhibits throughout the report.

As part of our examination, we interviewed members of the Board of Directors, senior management, and employees of the corporation to gain insight into its systems and practices. We reviewed documents related to the systems and practices selected for examination. We tested the systems and practices to obtain the required level of audit assurance. Our testing sometimes included detailed sampling. For example, we selected samples based on auditors’ judgment in corporate governance, strategic planning, corporate risk management, and investments and operations management.

In carrying out the special examination, we relied on the internal audits of wholly owned operating subsidiaries’ governance, business continuity management, global private investment acquisition and disposal processes, and natural resources and real estate acquisition and disposal processes.

We did not examine the systems and practices of the Public Sector Pension Investment Board’s subsidiaries, including those that are wholly owned. We did examine the systems and practices that the Public Sector Pension Investment Board had in place to exercise oversight over its subsidiaries.

Sources of criteria

The criteria used to assess the systems and practices selected for examination are found in the exhibits throughout the report.

Corporate governance

Meeting the Expectations of Canadians: Review of the Governance Framework for Canada’s Crown Corporations, Treasury Board of Canada Secretariat, 2005

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Enterprise Risk ManagementERM—Integrating with Strategy and Performance, Committee of Sponsoring Organizations of the Treadway Commission, 2017

Corporate Governance in Crown Corporations and Other Public Enterprises—Guidelines, Department of Finance and Treasury Board, 1996

20 Questions Directors Should Ask about Risk, Canadian Institute of Chartered Accountants, 2006

Performance Management Program for Chief Executive Officers of Crown Corporations—Guidelines, Privy Council Office, 2016

Practice Guide: Assessing Organizational Governance in the Public Sector, The Institute of Internal Auditors, 2014

Strategic planning

Meeting the Expectations of Canadians: Review of the Governance Framework for Canada’s Crown Corporations, Treasury Board of Canada Secretariat, 2005

Guidelines for the Preparation of Corporate Plans, Treasury Board of Canada Secretariat, 1996

Corporate Governance in Crown Corporations and Other Public Enterprises—Guidelines, Treasury Board of Canada Secretariat, 1996

Recommended Practice Guideline 3, Reporting Service Performance Information, International Public Sector Accounting Standards Board, 2015

20 Questions Directors Should Ask about Risk, Canadian Institute of Chartered Accountants, 2006

ERM—Integrating with Strategy and Performance, Committee of Sponsoring Organizations of the Treadway Commission, 2017

Corporate risk management

20 Questions Directors Should Ask about Risk, Canadian Institute of Chartered Accountants, 2006

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

ERM—Integrating with Strategy and Performance, Committee of Sponsoring Organizations of the Treadway Commission, 2017

Corporate Governance in Crown Corporations and Other Public Enterprises—Guidelines, Treasury Board of Canada Secretariat, 1996

Control Objectives for Information and related TechnologyCOBIT 4.1 Framework—DS5 (Ensure Systems Security) and ME3 (Ensure Compliance with External Requirements), information technologyIT Governance Institute and Information Systems Audit and Control AssociatioISACA

COBIT 5 Framework, ISACA

Global Technology Audit Guide: Assessing Cybersecurity Risk—Roles of the Three Lines of Defense, Institute of Internal Auditors, 2016

Cyber Security Self-Assessment Guidance, Office of the Superintendent of Financial Institutions, 2013

Investments and operations management

20 Questions Directors Should Ask about Risk, Canadian Institute of Chartered Accountants, 2006

Guidelines for the Preparation of Corporate Plans, Treasury Board of Canada Secretariat, 1996

Pension Plan Prudent Investment Practices Guideline and Self-Assessment Questionnaire, Canadian Association of Pension Supervisory AuthoritiesCAPSA, 2011

The Global Investment Performance Standards, Chartered Financial AnalystCFA Institute, 2020

Investment Industry Standards, CFA Institute

ERM—Integrating with Strategy and Performance, Committee of Sponsoring Organizations of the Treadway Commission, 2017

A Guide to the Project Management Body of Knowledge (PMBOK® Guide), fourth edition, Project Management Institute incorporatedInc., 2008

COBIT 5 Framework—APO05 (Manage Portfolio), BAI01 (Manage Programmes and Projects), ISACA

COBIT 5 Framework—EDM02 (Ensure Benefits Delivery), ISACA

Plan-Do-Check-Act management model adapted from the Deming Cycle

Internal Control—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Risk Principles for Asset Managers, The Global Association of Risk ProfessionalsGARP Buy Side Risk Managers Forum, 2015

Liquidity Risk Principles for Asset Managers, The GARP Buy Side Risk Managers Forum, 2017

Funding Policy for the Public Sector Pension Plans, Treasury Board of Canada Secretariat, 2018

Public Sector Pension Investment Board Act

Principles of Responsible Investment, United Nations, 2006

Transforming Our World: The 2030 Agenda for Sustainable Development, United Nations, 2015

Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures, Financial Stability Board, 2017

Final Report of the Expert Panel on Sustainable Finance, Environment and Climate Change Canada, 2019

Period covered by the audit

The special examination covered the period from 1 September 2019 to 23 October 2020. This is the period to which the audit conclusion applies. However, to gain a more complete understanding of the significant systems and practices, we also examined certain matters that preceded the start date of this period. We also noted a subsequent event on 18 December 2020.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 1 February 2021, in Montréal, Canada.

Audit team

Office of the Auditor General of Canada:

Principal: Mélanie Cabana

Director: Josée Maltais

Anastasiya Abmiotka

Sophie Bernard

John Ebsary

Josée Surprenant

Alexandre Tremblay

Deloitte LLP:

Partners: Chantal Leclerc and Victoria Loutsiv

Managers: Ali Shah and Usha Sthankiya

May Lim

Nicolas Panaritis

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report, and the numbers in parentheses indicate the location of the related discussion.

Corporate management practices

| Recommendation | Response |

|---|---|

|

26. The corporation should ensure that its strategic objectives are supported by performance indicators with targets that are specific and measurable. It should also regularly and consistently monitor and report on its performance against these indicators. (24 to 25) |

The corporation’s response. Agreed. In support of its next 5‑year strategic plan, the corporation is developing performance indicators to monitor the achievement of its strategic objectives. In the course of the 2021–22 fiscal year, the corporation will set targets for the indicators and will regularly monitor and report on progress against these indicators. The corporation will complete these by the end of 2021–22. |

|

32. The corporation should set risk appetite metrics and thresholds or limits for significant non-investment risks. (28 to 31) |

The corporation’s response. Agreed. The corporation is establishing tolerances or thresholds for non-investment risks, as an initiative to provide additional assurance on its management and monitoring of key non-investment risks for management and the board, as appropriate. The corporation will identify the appropriate tolerances or thresholds for the significant non-investment risks, recognizing that these may in some cases be best expressed qualitatively. The corporation will complete these matters by the end of the 2021–22 fiscal year. |

|

33. The corporation should complete compliance risk assessments, using a risk-based approach, to evaluate its adherence to the regulations relevant to its operations. (28 to 31) |

The corporation’s response. Agreed. The corporation intends to continue to complete compliance risk assessments of its business units in accordance with its internal schedule and before the end of the 2021–22 fiscal year. |

|

34. The corporation should develop and apply, enterprise-wide, a model risk management framework comprising model governance, a model risk assessment methodology, a model validation methodology, and model risk management activities. The corporation could leverage and expand its current model validation procedure to develop this framework. (28 to 31) |

The corporation’s response. Agreed. During the 2020–21 fiscal year, the corporation reviewed and enhanced its model governance framework with an emphasis on the framework ownership, roles and responsibilities, and scope of the framework—including model definition, model inventory and materiality assessment linked to the review cycle, model documentation, and validation requirements. In 2021–22, the corporation will determine priority areas to expand the application of the framework, based on materiality. |

|

37. The corporation should continue to enhance its reporting to the board on implementation of mitigation measures, to identify clear timelines and deliverables, and provide a periodic update on progress and completion as part of its risk and control self-assessment process. (35 to 36) |

The corporation’s response. Agreed. The corporation prioritizes the continued enhancement of its reporting to the board, to ensure that the information is effective, streamlined, and appropriate. The corporation will consider augmenting its periodic board updates with regard to progress and completion of key mitigation measures, where relevant. The corporation will complete these matters by the end of the 2021–22 fiscal year. |