2022 Reports 1 to 4 of the Auditor General of Canada to the Parliament of CanadaReport of the Auditor General of Canada to the Board of Directors of the Federal Bridge Corporation—Special Examination—2022

Independent Auditor’s Report

Table of Contents

- Audit Summary

- Introduction

- Findings, Recommendations, and Responses

- Conclusion

- About the Audit

- List of Recommendations

- Exhibits:

- 1—The 4 international bridges in the corporation’s portfolio

- 2—Responsibilities of the corporation for the 4 bridges

- 3—Traffic at the corporation’s bridge crossings before and during the COVID‑19 pandemic

- 4—The corporation’s revenues, expenses, and government funding before and during the COVID‑19 pandemic

- 5—Corporate governance—Key findings and assessment

- 6—Strategic planning—Key findings and assessment

- 7—Corporate risk management—Key findings and assessment

- 8—Management of bridge assets—Key findings and assessment

- 9—Management of bridge operations—Key findings and assessment

Audit Summary

We found no significant deficiencies in the corporate management practices and management of bridge assets and operations of the Federal Bridge Corporation during the period covered by the audit. The corporation managed its bridge assets and bridge operations well. However, we found several areas for improvement, including board oversight, performance measurement and monitoring, risk management, and bridge asset management. Despite these weaknesses, the corporation reasonably maintained the systems and practices needed to carry out its mandate.

Introduction

Background

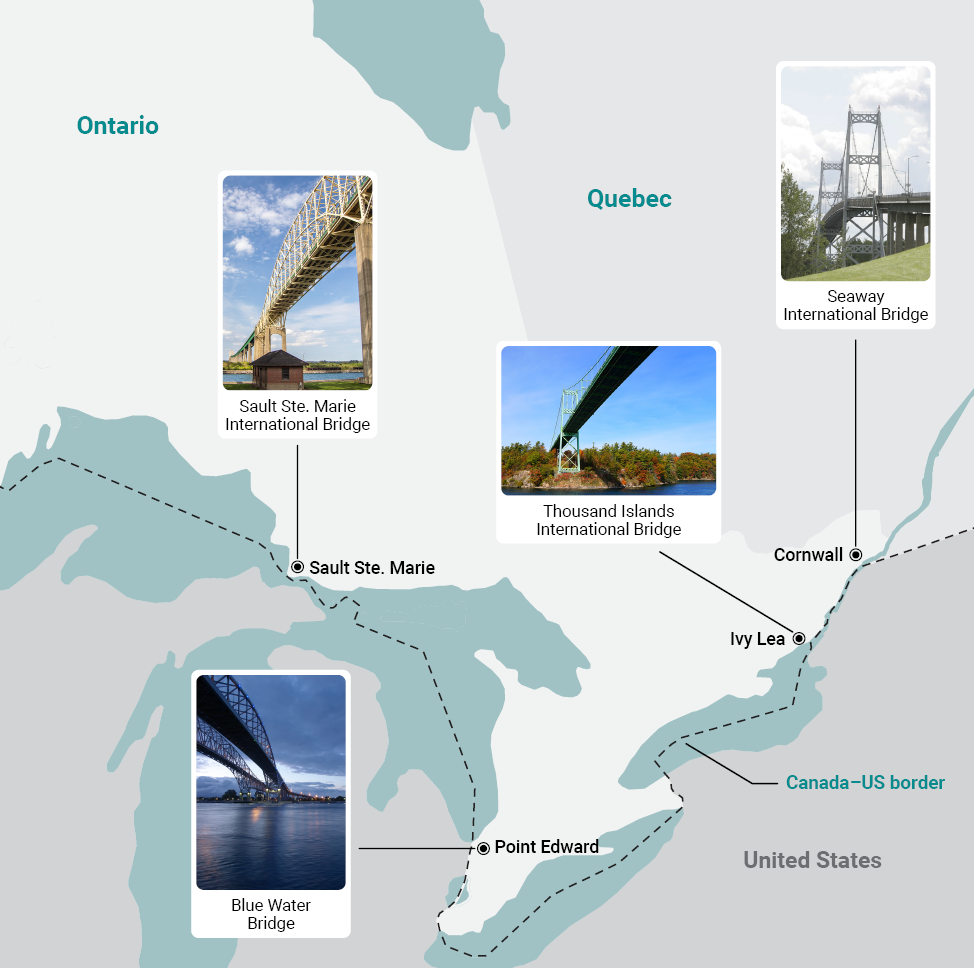

1. The Federal Bridge Corporation is a federal Crown corporation headquartered in Ottawa, Ontario. The corporation is responsible for the Canadian federal interests in 4 international bridges that connect Ontario to Michigan and New York in the United States (Exhibit 1):

- the Sault sainteSte. Marie International Bridge (Sault Ste. Marie)

- the Blue Water Bridge (Point Edward)

- the Thousand Islands International Bridge (Ivy Lea)

- the Seaway International Bridge (Cornwall)

Exhibit 1—The 4 international bridges in the corporation’s portfolio

Source: Based on information from the Federal Bridge Corporation

Photos: Federal Bridge Corporation and Shutterstock

Exhibit 1—text version

This map of southern Ontario shows the locations and photos of the 4 international bridges in the corporation’s portfolio:

- The Sault SainteSte. Marie International Bridge is located in Sault Ste. Marie, Ontario.

- The Blue Water Bridge is located in Point Edward, Ontario.

- The Thousand Islands International Bridge is located in Ivy Lea, Ontario.

- The Seaway International Bridge is located in Cornwall, Ontario.

2. The corporation’s business is the design, construction, acquisition, financing, maintenance, operation, management, development, repair, demolition, or reconstruction of bridges or other related structures, facilities, works, or properties that link the province of Ontario to the states of New York and Michigan in the United States. The corporation reports to Parliament through the Minister of Transport.

3. Unlike many federal Crown corporations, the corporation’s mandate is not defined in an act of Parliament. Its mandate, according to its government-approved corporate plan, is to provide the highest level of stewardship so that its international bridges and associated structures are safe and efficient for users.

4. The Federal Bridge Corporation was created under the Canada Business Corporations Act by amalgamating the legacy corporation (established in 1998) of the same name with 2 other bridge corporations, per the Economic Action Plan 2013 Act, numberNo. 2:

- the St. Mary’s River Bridge Company, on 27 January 2015, then a wholly owned subsidiary of the corporation that owned the Canadian interests in the Sault Ste. Marie International Bridge

- the Blue Water Bridge Authority, on 1 February 2015, another Crown corporation that owned the Canadian interests of the Blue Water Bridge

5. A planned amalgamation with the corporation’s remaining wholly owned subsidiary, The Seaway International Bridge Corporation, limitedLtd., awaits agreement by its United StatesUS partner, the Great Lakes SaintSt. Lawrence Seaway Development Corporation. The Thousand Islands International Bridge has been part of the original Federal Bridge Corporation’s portfolio since 1998.

6. The corporation owns the Canadian share of the 4 international bridges in its portfolio, including bridge plazas and related facilities. The corporation operates the Canadian side of the Blue Water Bridge (the US owner operates the US side), but it does not directly operate the other bridges.

7. For the other 3 international bridges in its portfolio, the corporation has entered into binational agreements with the US owners. These agreements date as far back as 1954. Under these agreements, the bridges are operated as single ventures, where neither the corporation nor the US owner has unilateral control. Each of the single ventures has a governance structure with representation from the Canadian and US interests. The corporation’s Chief Executive Officer is currently a representative on all 3 binational partnership governance structures.

8. The bridge operators of these 3 single ventures are as follows (Exhibit 2):

- The Seaway International Bridge Corporation, Ltd., a wholly owned subsidiary of the corporation, operates the Seaway International Bridge.

- The International Bridge Administration, a unit of the American partner, operates the Sault Ste. Marie International Bridge.

- The Thousand Islands Bridge Authority, the American partner, operates the Thousand Islands International Bridge.

Exhibit 2—Responsibilities of the corporation for the 4 bridges

| Corporation’s overall responsibility | Responsible for the Canadian federal interests of 4 international bridges, including operating 1 and overseeing the operations of 3, subject to binational agreements | |||

|---|---|---|---|---|

| International Bridge | Blue Water Bridge | Thousand Islands International Bridge |

Sault Ste. Marie International Bridge |

Seaway International Bridge |

|

Federal Bridge Corporation’s ownership |

50% of each of the twin bridges (the first opened in 1938, the second in 1997) and 100% of the Truck Ramp Bridge (opened in 2007) |

100% of the Canadian Bridge and 50% of the Rift Bridge (opened in 1938) |

50% of the bridge (opened in 1962) |

100% of the North Channel Bridge and Canal Bridge (opened in 2014), and 32% of the South Channel Bridge (opened in 1958) |

|

100% of the Canadian bridge plaza and port of entry |

100% of the Canadian toll plaza and International Road |

|||

|

Owner of US interest |

Michigan Department of Transportation |

Thousand Islands Bridge Authority |

Michigan Department of Transportation |

Great Lakes St. Lawrence Seaway Development Corporation |

|

Operating model |

Canadian and US portions operated separately |

Canadian and US portions operated by bridge operator as a single venture per binational agreements |

||

|

Bridge operator |

Canadian portion: Federal Bridge Corporation US portion: Michigan Department of Transportation |

Thousand Islands Bridge Authority |

International Bridge Administration, a unit of the Michigan Department of Transportation |

The Seaway International Bridge Corporation, LimitedLtd., a wholly owned subsidiary of the Federal Bridge Corporation |

|

Bridge activities |

Bridge operations, security, and maintenance Bridge asset management and inspections Leases and licences, including duty-free shops, in some locations |

|||

|

Tolling |

Tolling, with free passage for the Indigenous community |

|||

|

Canada Border Services Agency facility and certain maintenance provided to the agency at no cost, per the Customs Act |

No requirement to maintain the Canada Border Services Agency facility, as it is not on the corporation’s land |

|||

|

Canadian Food Inspection Agency facility and certain maintenance provided to the agency at no cost, per the Plant Protection Act and the Health of Animals Act |

||||

|

Governance structure |

Canadian portion: Federal Bridge Corporation US portion: Michigan Department of Transportation |

US Chair and 6 directors appointed by Jefferson County, New York: 3 Americans and 3 Canadians recommended by the Federal Bridge Corporation |

8 directors: 4 Americans appointed by the Governor of Michigan and 4 Canadians appointed by the Federal Bridge Corporation |

8 directors appointed by the Federal Bridge Corporation: 4 Americans recommended by the Great Lakes St. Lawrence Seaway Development Corporation and 4 Canadians recommended by the Federal Bridge Corporation |

9. The corporation is normally expected to generate enough revenue to cover its expenses, including repairs and most major capital projects. It receives federal funding occasionally—for example, for specific activities or for acquisitions of property and equipment.

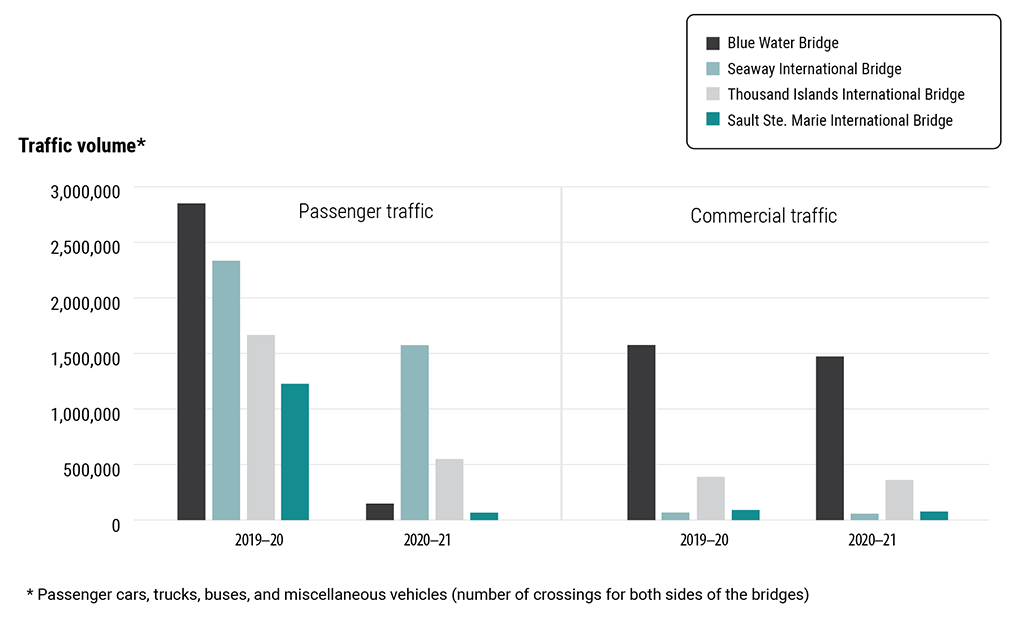

10. With the onset of the coronavirus disease (COVID‑19) pandemic, the Canada–US border was closed on 21 March 2020 to non‑essential traffic. Consequently, all of the corporation’s international bridge crossings saw major traffic decreases (Exhibit 3). On 9 August 2021, Canada started easing border restrictions.

Exhibit 3—Traffic at the corporation’s bridge crossings before and during the COVID‑19 pandemic

Source: Bridge and Tunnel Operators Association

Exhibit 3—text version

This chart shows the traffic at the corporation’s 4 bridge crossings from 2019–20 to 2020–21 for both passenger traffic and commercial traffic. The traffic volume includes passenger cars, trucks, buses, and miscellaneous vehicles, and the number of crossings is for both sides of the bridge.

Passenger traffic volume decreased significantly from the 2019–20 fiscal year to the 2020–21 fiscal year. In contrast, commercial traffic volume decreased slightly in the same period of time.

In 2019–20, the Blue Water Bridge had 2,850,792 passenger crossings, which decreased significantly to 147,451 in 2020–21. This bridge had 1,575,911 commercial crossings in 2019–20, which decreased to 1,472,751 in 2020–21.

In 2019–20, the Seaway International Bridge had 2,333,490 passenger crossings, which decreased significantly to 1,573,956 in 2020–21. This bridge had 67,949 commercial crossings 2019–20, which decreased to 57,477 in 2020–21.

In 2019–20, the Thousand Islands International Bridge had 1,665,430 passenger crossings, which decreased significantly to 549,227 in 2020–21. This bridge had 388,656 commercial crossings in 2019–20, which decreased to 361,132 in 2020–21.

In 2019–20, the Sault Ste. Marie International Bridge had 1,226,044 passenger crossings, which decreased significantly to 65,963 in 2020–21. This bridge had 90,143 commercial crossings 2019–20, which decreased to 76,765 in 2020–21.

11. As a result of the border closing, the corporation’s revenues from tolls and leasing, which are largely based on sales from duty-free shops, decreased sharply during the pandemic and put the corporation’s financial self-sustainability at risk (Exhibit 4). In the 2020–21 fiscal year, the corporation obtained Canadian federal government funding totalling $5,729,000 in emergency COVID‑19 relief. It used $2,381,000 of this amount to cover the revenue shortfalls of the Seaway International Bridge and $3,348,000 to cover its portion of costs for the other 3 bridges in its portfolio.

Exhibit 4—The corporation’s revenues, expenses, and government funding before and during the COVID‑19 pandemic

| Key financial information (in thousands of dollars) |

2018–19 fiscal year | 2019–20 fiscal year | 2020–21 fiscal year |

|---|---|---|---|

| Tolls and services revenue | 31,020 | 31,334 | 20,542 |

| Leases and permits and other revenue | 11,763 | 11,772 | 6,698 |

| Total revenue before government funding | 42,783 | 43,106 | 27,240 |

| Total expenses | 47,758 | 48,625 | 48,934 |

| Total consolidated net loss before government funding | -4,975 | -5,519 | -21,694 |

| Total government fundingNote 1 | 3,395 | 3,535 | 7,400 |

| Total consolidated net loss | -1,580 | -1,984 | -14,294 |

| Total consolidated equity | 236,046 | 235,076 | 219,521 |

| Consolidated property and equipment and investment properties | 395,330 | 383,485 | 378,299 |

|

Source: Federal Bridge Corporation’s annual reports |

|||

12. The corporation has secured access of up to $18,497,000 in emergency COVID‑19 funding from the Canadian federal government for the 2021–22 fiscal year to support the continued operation of all 4 international bridge crossings. It has also entered into a new loan agreement, which will allow it to borrow up to $10 million to help meet its future cash-flow needs, if required. The corporation was able to maintain its Standard and Poor’sS&P Global credit rating at A+ (with a revised negative contextual outlook) as of the end of our examination period.

13. The corporation also continues to work with the federal government to address its concern over the financial sustainability of its subsidiary, The Seaway International Bridge Corporation, Ltd. This concern preceded the COVID‑19 pandemic. In its 2019–24 corporate plan, the corporation alerted the government that the ongoing issue related to the financial sustainability of the subsidiary had become high risk, given the significant increase in crossings for which the government had imposed toll exemptions. This increase threatened the subsidiary’s ability to generate enough revenue to cover its costs over the long term. The corporation has been working with the government to develop a mechanism to address these funding challenges.

14. The Financial Administration Act requires each parent Crown corporation to have a special examination carried out, for itself and its wholly owned subsidiaries, at least once every 10 years. The statutory deadline for completing and reporting this examination is 1 February 2025, 10 years after the creation of the newly amalgamated Federal Bridge Corporation.

15. The Jacques Cartier and Champlain Bridges Incorporated became a parent Crown corporation in 2014. Previously, it was a subsidiary of the corporation. Therefore, The Jacques Cartier and Champlain Bridges Incorporated is subject to its own special examination and is not included in the scope of this special examination.

Focus of the audit

16. Our objective for this audit was to determine whether the systems and practices we selected for examination at the Federal Bridge Corporation were providing it with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

17. In addition, section 139 of the Financial Administration Act requires that we state an opinion, with respect to the criteria established, on whether there was reasonable assurance that there were no significant deficiencies in the systems and practices we examined. We define and report significant deficiencies when, in our opinion, the corporation could be prevented from having reasonable assurance that its assets are safeguarded and controlled, its resources are managed economically and efficiently, and its operations are carried out effectively.

18. On the basis of our risk assessment, we selected systems and practices in the following areas:

- Corporate management practices

- Management of bridge assets and bridge operations

The selected systems and practices, and the criteria used to assess them, are found in the exhibits throughout the report.

19. More details about the audit objective, scope, approach, and criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Corporate management practices

The corporation had good corporate management practices, but improvements were needed in board oversight, performance measurement, and corporate risk management

20. We found that the corporation had good corporate management practices, but improvements were needed in several areas. Specifically, we found that gaps in reporting lessened board oversight, and we found that some of the targets and indicators needed for strong performance measurement were lacking. The corporation also had not incorporated environmental and sustainable development risks into its risk assessments and lacked some documentation in its risk register.

21. The analysis supporting this finding discusses the following topics:

22. The corporation is governed by the Board of Directors consisting of 7 members, including the Chairperson and the Chief Executive Officer.

23. The Chief Executive Officer and the Chairperson are appointed by the Governor in CouncilDefinition 1 for a term that the Governor in Council considers appropriate. Each board member is appointed by the Minister of Transport with the approval of the Governor in Council, for a term not exceeding 4 years. All board members are eligible for reappointment at the expiration of their terms. There was 1 expired term for a director on the board as of the end of our examination period. However, there were no vacancies, because this director would continue to serve as a member until a successor is appointed, as permitted under the Financial Administration Act.

24. The board is supported by a Finance and Audit Committee and a Governance, Policy and Human Resources Committee.

25. The corporation is subject to Part X of the Financial Administration Act, which includes requirements for it to submit an annual corporate plan, including an annual operating budget and an annual capital budget, for government approval.

26. Although the corporation had submitted its 2021–26 corporate plan on time, the plan had not yet been approved by the Treasury Board or tabled in Parliament by the end of our examination period.

27. Our recommendations in this area of examination appear at paragraphs 34, 38, 48, 49, 55, and 59.

28. Analysis. We found that the corporation had good corporate governance practices, but improvements were needed in board oversight. The board did not receive complete reporting on compliance with legislative authorities or on the results of conflict‑of‑interest processes. Also, the corporation had not formalized its information-sharing practices with all bridge operators in its portfolio (Exhibit 5).

Exhibit 5—Corporate governance—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Board independence |

The board functioned independently. |

All board members, excluding the Chief Executive Officer, were independent from management. The corporation had a code of conduct for board members. Board members completed annual conflict‑of‑interest declarations. Board members were asked to declare conflicts of interest at board and committee meetings. Independent board members held sessions without the Chief Executive Officer in attendance. |

Check mark in a green circle |

|

Providing strategic direction |

The board provided strategic direction. |

The board provided strategic direction through its annual strategic planning session and its approval of the strategic direction in the corporate plan. The board was active in setting the Chief Executive Officer’s annual objectives, which aligned with the corporation’s strategic direction. The independent board members conducted an annual assessment of the Chief Executive Officer’s performance. |

Check mark in a green circle |

|

Board appointments and competencies |

The board collectively had capacity and competencies to fulfill its responsibilities. |

The board communicated with the Minister of Transport about board appointments, renewals, and vacancies. The board determined the skills and expertise it needed to be effective and carry out its responsibilities. Board members performed self-evaluations of their skills and expertise. Board members were provided orientation sessions and ongoing training. |

Check mark in a green circle |

|

Board oversight |

The board carried out its oversight role over the corporation. |

The board regularly discussed the corporation’s financial status and the progress of major projects. The board assessed its performance annually. The corporation conducted regular internal audits. Weaknesses The board did not receive complete reporting on compliance with legislative authorities or on the results of conflict‑of‑interest processes. While the corporation received information from the bridge operators in its 3 binational partnerships, some of its information needs had not been formally documented. |

Exclamation point in a yellow circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

29. Weaknesses—Board oversight. The corporation is subject to many federal and provincial laws and regulations, and the bridge operators in its portfolio may be subject to both Canadian and US federal and state laws and regulations. Furthermore, the binational agreements stipulate that bridge operators must comply with applicable laws and regulations. The board did receive reporting on the corporation’s compliance with some of these laws and regulations (including financial legislation and regulations under the International Bridges and Tunnels Act). However, it did not receive reporting on others, such as compliance with applicable environmental laws. Nor did it receive any information from the corporation about the bridge operators’ compliance with Canadian or US laws. Therefore, the board did not receive complete information to allow it to fully carry out its oversight.

30. As there have been high-profile instances of unethical behaviour in the infrastructure industry in recent years, disclosure of wrongdoing has become a focus for many public and private organizations connected to the industry, as a way of encouraging public trust. The board received an annual report from the corporation’s Senior Disclosure Officer on fraud and other wrongdoing, including a copy of the annual report filed with the Treasury Board Secretariat under the Public Servants Disclosure Protection Act.

31. However, the board did not receive information on the results of the corporation’s annual process for employee declarations on conflicts of interest. It also did not receive information from the corporation about the conflict‑of‑interest policies and processes put in place by the bridge operators.

32. The board needs complete reporting on the corporation’s compliance with applicable laws and regulations, and information on the results of conflict‑of‑interest processes. This would allow the board to address the risk that non‑compliance with legislative authorities could pose to the corporation’s ability to meet its mandate. It would also allow the corporation to address any risks posed by those influenced by outside interests.

33. This weakness matters because without complete reporting on compliance with legislative authorities and results of conflict‑of‑interest processes, the board cannot be sure that it is receiving the information it needs to oversee the corporation effectively. This could expose the corporation to regulatory and reputational risks.

34. Recommendation. The corporation should ensure that the board receives complete reporting on compliance with legislative authorities and results of conflict‑of‑interest processes, to support effective board oversight and decision making.

The corporation’s response. Agreed. The corporation’s Board of Directors currently receives compliance reporting on key authorities. The corporation has contractual relationships with bi‑national entities and bridge operators for the operation of specific international bridges that govern the nature of the relationship and the obligations of each party per applicable laws, diplomacy and governance considerations. These agreements are subject by the corporation to independent third-party audits per negotiated bi‑national agreements. Subject to these agreements, the corporation commits to conducting a review of the reporting to the Board of Directors on applicable legislation relevant to the corporation within the 2022–23 to 2026–27 planning period. In its oversight of conflict of interest, the corporation has formal policies, internal controls and targeted activities in place to protect its interests. The corporation has established a reporting by exception framework through the Chief Executive Officer to the Board of Directors. The corporation commits to reviewing its conflict of interest reporting practices within the 2022–23 fiscal year, with an aim to continuous improvement.

35. We also found that the corporation received information from the 3 bridge operators in its binational partnerships about the administration and management of the binational agreements informally through professional working relationships. Furthermore, we found that the corporation formally documented, in its corporate policies, some but not all of the information it needed from the bridge operators. For example, it documented the need for financial information, as well as for bridge inspection and maintenance reporting. However, it had not documented some of the other information it needed from bridge operators, nor had it formally communicated its information needs to bridge operators.

36. In 2021, the corporation and the Michigan Department of Transportation exchanged letters to document their commitment to continue sharing key information with each other (such as master plans, inspection reports, and advance communication of toll‑rate changes) for the Blue Water Bridge. However, there was no similar exchange of information with the other 3 bridge operators to elaborate and formalize their information-sharing practices beyond what was stipulated in the binational agreements.

37. This weakness matters because the corporation, including its board of directors, requires large amounts of information from bridge operators to fulfill its oversight role over its bridges and associated structures so that they are safe and efficient for users. A formal communication of information needs from bridge operators would facilitate the coordination of complete, timely, and regular information sharing.

38. Recommendation. The corporation should formalize its information requirements with the bridge operators in its 3 binational bridge partnerships.

The corporation’s response. Agreed. The corporation agrees that there is benefit to an increased formalization of detailed information requirements that support the agreements in place at its crossings. The corporation will review all information exchanges linked to each agreement in place for enhanced documentation by the end of the 2023–24 fiscal year.

39. Analysis. We found weaknesses in performance measurement, monitoring, and reporting. In particular, the corporation had not established performance indicators that directly addressed its mandate that its international bridges and associated structures be safe and efficient for users. It also did not define targets for the performance indicators related to its strategic objectives (Exhibit 6).

Exhibit 6—Strategic planning—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Strategic planning |

The corporation established a strategic plan and strategic objectives that were aligned with its mandate. |

The corporation had a board-approved corporate planning and reporting policy. The corporation defined strategic objectives that aligned with its mandate. The corporation had a strategic planning process in place, which included analyzing its strengths, weaknesses, opportunities, and key risks and threats. The corporation considered its internal and external environments when preparing its corporate plan. |

Check mark in a green circle |

|

Performance measurement, monitoring, and reporting |

The corporation established performance indicators in support of achieving strategic objectives, monitored them, and reported on progress in achieving its strategic objectives. |

The corporation established performance indicators for its strategic objectives. The corporation regularly reported to senior management and the board on qualitative progress toward its strategic objectives. It formally assessed financial performance each quarter. Weaknesses The corporation did not articulate clear targets for the performance indicators related to its strategic objectives. The corporation did not establish performance indicators that directly addressed its mandate that its international bridges and associated structures be safe and efficient for users. |

Exclamation point in a yellow circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

40. Weaknesses—Performance measurement and reporting. The corporation publicly reported on key achievements related to its strategic objectives in its 2020–21 annual report. However, we found that it did not establish any clear targets for the performance indicators related to those objectives. So, the corporation could not objectively measure progress against its strategic objectives.

41. Some strategic objectives had performance indicators that were based on the implementation or completion of the objective itself but lacked targets such as milestones or timelines. Here are two examples:

- The strategic objective of “real-time predictive traffic analysis” had an indicator of “deployment of consolidated data aggregation and analysis solution.”

- The strategic objective of “technology master plan” had an indicator of “plan completed and execution progress.”

42. The status reported for each of these strategic objectives in the 2020–21 annual report was “progressing.” However, without specific targets, the corporation could not use the indicators to determine whether there were any performance shortfalls or performance improvements over time.

43. Other strategic objectives had performance indicators that were based on financial or other measures, but specific targets were not set. Here are two examples:

- The strategic objective of “toll rate strategies” had an indicator of “traffic trends and market shares.”

- The strategic objective of “maintain or increase customer amenities and service” had an indicator of “increase in lease and other diversified non‑toll revenues.”

44. The reported status for each of these strategic objectives in the 2020–21 annual report was “not achieved.” However, because the performance indicators did not include specific targets, there was no meaningful way to assess how far these strategic objectives were from being met.

45. We also found that while the corporation established performance indicators for its strategic objectives, it did not establish any that directly addressed its mandate that its international bridges and associated structures be safe and efficient for users. We recognize that many of the corporation’s strategic objectives, as well as its day‑to‑day operations, support its mandate. However, establishing and tracking key performance indicators and targets for safety and efficiency is important so that a signal can be sent to management or the board when an organizational response may be needed.

46. Although the corporation is best equipped to identify these performance indicators and targets, we have provided an example. A performance indicator related to safety could be the number of urgent items identified through bridge inspections and the length of time to address them. If the corporation established a target for this indicator, any increase in the number of items or the length of time outstanding would prompt management to consider whether additional actions and monitoring were needed.

47. These weaknesses matter because without measurable, specific, and time-bound targets for its performance indicators, the corporation cannot meaningfully assess or report on progress. Consequently, it might not consider in a timely manner whether additional actions and monitoring are needed for it to achieve its strategic objectives. Furthermore, establishing performance indicators directly related to safety and efficiency—which are public policy objectives and part of the corporation’s mandate—would better allow the corporation to demonstrate its performance in these areas and improve its accountability.

48. Recommendation. The corporation should define specific targets and time-bound milestones for the performance indicators related to its strategic objectives.

The corporation’s response. Agreed. The corporation resolves to review its performance targets and objectives methodology to enhance information for users and include these revisions in the corporate plan for 2023–24 to 2027–28 as well as in the 2023–24 annual report.

49. Recommendation. The corporation should establish performance indicators and targets that directly address its mandate that its international bridges and associated structures be safe and efficient for users.

The corporation’s response. Agreed. The corporation agrees that performance indicators and targets are important measurements of its achievement of the mandate and resolves to review its methodology to enhance information to users and include these revisions in the corporate plan for 2023–24 to 2027–28 as well as in the 2023–24 annual report.

50. Analysis. We found weaknesses in risk management. Specifically, the corporation did not integrate environmental and sustainable development risks into its corporate risk assessment processes. Nor did it document the mitigation measures for some of its risks (Exhibit 7).

Exhibit 7—Corporate risk management—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Risk identification and assessment |

The corporation identified and assessed risks to achieving strategic objectives. |

The corporation had a board-approved enterprise risk management policy. The corporation identified its strategic and operational risks and assigned residual risk ratings to them according to their likelihood of occurrence and potential impact. Weakness The corporation did not integrate environmental and sustainable development risks into its risk management processes. |

Exclamation point in a yellow circle |

|

Risk mitigation |

The corporation defined and implemented risk mitigation measures. |

The corporation identified owners, defined tolerance levels, and implemented risk mitigation measures for its strategic and operational risks. Weakness The corporation did not document in its risk register the mitigation measures for the risks it had assessed as having effective risk management in place. |

Exclamation point in a yellow circle |

|

Risk monitoring and reporting |

The corporation monitored and reported on the implementation of risk mitigation measures. |

The corporation regularly revised its risk register to address changes to assessments of residual risk. The corporation reported quarterly to the board on new and emerging issues and risk events, on residual ratings for its strategic and operational risks, and on its mitigation measures for risks it had assessed as being above its risk tolerance levels. |

Check mark in a green circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

51. Weakness—Risk identification and assessment. The corporation completed a study in March 2021 on the effects and risks of climate change on its infrastructure and on the organization as a whole. However, we found that it had not integrated these environmental and sustainable development risks into its risk management processes. For example, the climate study considered the long-term effects of extreme heat, high winds, and freezing rain accumulation. Over time, these factors could affect several corporate-risk areas: bridge safety (asset integrity), bridge safety (human element), workforce management, technological systems, and financial sustainability. Once the potential effects of these factors are understood, the corporation should adjust its risk management processes to integrate these risks.

52. The corporation has a mandate to provide safe and efficient infrastructure, which typically includes considering environmental sustainability. Moreover, recently, the prevalence of environmental, social, and governance-related risks, also referred to as sustainability risks, has increased rapidly. Accordingly, the government and the global community are placing increasing importance on environmental, social, and governance-related risks. For example, in 2015, Canada and other United Nations member states adopted the 2030 Agenda for Sustainable Development, a vision for partnership, peace, and prosperity for all people and the planet. The 2030 Agenda outlined 17 Sustainable Development Goals and corresponding targets that aimed to address current and future social, economic, and environmental challenges. At the national level, the government reiterated its commitment to implementing these goals.

Source: United Nations

53. Of particular importance to the corporation’s operations is Target 9.1, to “develop quality, reliable, sustainable and resilient infrastructure, including regional and transborder infrastructure, to support economic development and human well-being, with a focus on affordable and equitable access for all.” Sustainable infrastructure systems are those that are planned, designed, constructed, operated, and decommissioned in a way that ensures economic and financial, social, environmental, and institutional sustainability over the infrastructure lifecycle.

54. This weakness matters because the federal government recently established formal expectations for federal departments and agencies to integrate the Sustainable Development Goals into their operations. We recognize that similar expectations were not established for Crown corporations. However, in our view, the Sustainable Development Goals offer a framework for organizations, including Crown corporations, to identify and contribute to social, economic, and environmental initiatives.

55. Recommendation. The corporation should integrate environmental and sustainable development risks into its risk management processes in order to identify, mitigate, monitor, and report on its environmental and sustainable development risks.

The corporation’s response. Agreed. The corporation has long‐established and responsible environmental and socially responsible practices and processes embedded into all of its bridge operations and major capital projects. The corporation’s Board of Directors began training on environment, social, and governance frameworks in 2018, and most recently in 2020–21, a comprehensive climate change study across its entire portfolio was performed. In October 2021, the corporation has initiated a strategic process to integrate all sources of current information and activities into a formal environmental, social, and governance framework. Once the modern framework is in place, the corporation will reassess its risks and mitigation measures as part of its enterprise risk management program. A target date of the end of fiscal 2023–24 is set for completion of all related documentation.

56. Weakness—Risk mitigation. We found that the corporation did not document risk mitigation measures in its risk register for risks that it had assessed as having effective risk management in place.

57. The corporation assessed several of its risk areas—for example, workforce management, competition, partnerships and stakeholders, public perception, and bridge safety (asset integrity)—as constituting low residual risk, meaning that these risks had effective risk management in place. However, it did not document in its risk register the mitigation measures that it had implemented to derive this low residual risk rating. For example, it was unclear from the risk register which actions the corporation took that reduced bridge safety risk from a higher inherent risk rating to a low residual risk rating. While the low residual risk rating was likely due in part to annual bridge inspections, the corporation could have implemented other mitigation measures to address this risk that were not documented in its risk register.

58. This weakness matters because documenting risk mitigation measures provides management with baseline information to identify changes in mitigation measures, including the need to make decisions about resource allocation. Documenting these measures also allows management to regularly assess the effectiveness of the measures to support residual risk ratings.

59. Recommendation. The corporation should document, in its risk register, mitigation measures for all risks, including those it has assessed as having effective risk management in place.

The corporation’s response. Agreed. The corporation agrees that the risk register should include mitigation measures for all risks, including those not currently reported to the board, and shall review the manner of documentation of such reporting by the end of the 2022–23 fiscal year.

Management of bridge assets and bridge operations

The corporation generally managed its bridge assets and bridge operations well but lacked a digitized asset inventory and database system for managing its bridge assets

60. We found that the corporation generally managed its bridge assets and bridge operations well. However, the corporation had not digitized its asset inventory and database system for its bridge locations.

61. The analysis supporting this finding discusses the following topics:

62. In 2007, Parliament enacted the International Bridges and Tunnels Act to ensure effective oversight of international vehicular and railway bridges and tunnels. In 2009, the International Bridges and Tunnels Regulations were introduced to establish a consistent approach for reporting on the maintenance and operation of these structures. These regulations apply to 25 international vehicular structures, but no railway bridges and tunnels are prescribed in these regulations. The act and regulations require the corporation to submit to Transport Canada reports on detailed visual inspections of each international bridge at least every 2 years and on underwater inspections every 5 years. The regulations also allow Transport Canada to conduct additional inspections. The act and regulations define an international bridge as one that connects any place in Canada to any place outside of Canada. Transport Canada has directed the corporation to not submit inspection reports for the following 4 domestic spans of its international bridges, because they connect 2 places in Canada:

- the Truck Ramp Bridge of the Blue Water Bridge

- the Canadian Bridge of the Thousand Islands International Bridge

- the North Channel Bridge and Canal Bridge of the Seaway International Bridge

63. The corporation also submits inspection reports annually to Public Services and Procurement Canada of all spans of 3 of its international bridges, according to long-standing orders in council. Moreover, while there is no equivalent order in council for the Seaway International Bridge, the corporation submits annual inspection reports of all spans of this bridge to Public Services and Procurement Canada. Accordingly, the corporation annually completes inspections of all of its bridge spans, whether domestic or international.

64. Transport Canada oversees the security of international bridges through memorandums of understanding with bridge owners and operators. The memorandums require the establishment of bridge security management systems for the Canadian‑owned components, to prevent and mitigate security incidents. A security incident is defined as an event that could result in death, injury, significant property damage, or serious disruptions to operations, works, or equipment. Examples include toll and port runners, protests, and car accidents.

65. The Economic Action Plan 2013 Act, numberNo. 2 allows the corporation to set and charge tolls, fees, or other charges for the use of a bridge or tunnel it owns or operates or to authorize another body to do so. While the Sault Ste. Marie International Bridge, the Thousand Islands International Bridge, and the US side of the Blue Water Bridge are subject to US regulations related to toll-rate setting, their toll rates are not constrained by a regulator. The Canadian side of the Blue Water Bridge and the Seaway International Bridge are not subject to any toll-rate setting regulations.

66. Our recommendation in this area of examination appears at paragraph 71.

67. Analysis. We found that the corporation could improve its bridge asset management systems and practices by developing a digitized asset inventory and database system to track and analyze bridge and related structure data (Exhibit 8).

Exhibit 8—Management of bridge assets—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Bridge asset management planning and implementation |

The corporation managed bridge asset life cycles and maintenance work to provide international bridges and associated structures that are safe for users. |

The corporation had board-approved policies related to asset management for all of the bridges in its portfolio. The corporation used bridge inspection reports to assess the general condition of bridge assets and determine maintenance priorities. Weakness The corporation did not have a digitized asset inventory and database system to track and analyze bridge and related structure data. |

Exclamation point in a yellow circle |

|

Bridge inspections |

The corporation carried out inspections at its international bridges that met regulatory requirements. |

The corporation had a board-approved policy on bridge inspections for all of the bridges in its portfolio. The corporation submitted bridge inspection reports to Transport Canada in accordance with the International Bridges and Tunnels Regulations. The corporation addressed Transport Canada’s queries on bridge inspection findings to the department’s satisfaction. The corporation annually submitted inspection reports to Public Services and Procurement Canada for all its bridges. The department confirmed receipt of the reports, and no follow‑up actions were required of the corporation. |

Check mark in a green circle |

|

Performance monitoring and reporting |

The corporation monitored and reported on its bridge asset management and inspection results. |

The corporation provided regular updates to the board on asset management mitigation strategies and major capital projects. The corporation annually informed the board of inspection results, including maintenance recommendations and 10‑year capital plans. The corporation reported publicly on major capital projects and related asset management initiatives in its corporate plan and annual report. |

Check mark in a green circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

68. Weakness—Bridge asset management planning and implementation. The corporation received asset management plans for all of its bridges, which contained data from inspections on current asset conditions and on maintenance and repair priorities. However, we found that the corporation lacked a digitized system to track and analyze this data.

69. We noted that the corporation had initiated a project to modernize its asset management program by implementing a digitized inventory and database of assets by bridge location. The implementation of an asset management system to collect, analyze, and report on asset data has been included as a strategic objective in the corporation’s corporate plans since 2016. By the end of our examination period, the corporation had not clarified a target implementation date.

70. This weakness matters because without a digitized asset inventory and database to track bridge and related structure data, the corporation cannot perform data-driven analyses of its assets to enhance its maintenance practices. For example, the digitization of bridge condition data from past inspections could allow the corporation to identify trends or commonalities, which could allow for more timely identification of deterioration issues. By digitizing the collection and analysis of data, the corporation would be able to make predictive maintenance decisions that could increase reliability, reduce accidents and failures, and lower costs.

71. Recommendation. The corporation should complete its development of a digitized asset inventory and database system to track and analyze bridge and related structure data.

The corporation’s response. Agreed. The corporation is proud of the quality of its asset management practices as demonstrated through the results of its annual independent inspections of its bridges and facilities. The corporation supports the view that the completion of the digitization of its asset inventory will be a valuable tool that will supplement existing quality asset management practices, and will allow continuity in the effective delivery of its mandate. Since 2015, the corporation has been actively engaged in the modernization of its asset maintenance planning and workflows to best inform and execute on future works. An asset management program was designed and implementation initiated. Most recently (in September 2021), the conversion of asset information to electronic documentation of its assets through a geographic information system was initiated and has provided immediate results. Further investments are subject to the critical financial impact of the reduced traffic due to the ongoing COVID‑19 border restrictions. The ultimate strength and timing of the recovery of cross-border traffic will guide when this comprehensive program can be fully realized.

72. Analysis. We found that the corporation had good systems and practices to manage its bridge operations (Exhibit 9).

Exhibit 9—Management of bridge operations—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Bridge operations planning and implementation |

The corporation defined and implemented bridge operation plans to provide efficient international bridge passage to users. |

The corporation had board-approved bridge operation policies for the portion of the Blue Water Bridge that it operated. The operations for the Sault Ste. Marie, Thousand Islands, and Seaway international bridges were governed by binational agreements with US partners. |

Check mark in a green circle |

|

Toll-rate setting |

The corporation considered its financial requirements and traffic data trends in setting toll rates to optimize revenue at its international bridge crossings. |

The corporation had a board-approved tolling policy for the portion of the Blue Water Bridge that it operated. The setting of toll rates for the Sault Ste. Marie, Thousand Islands, and Seaway international bridges were governed by binational agreements with US partners. The corporation considered financial requirements and traffic data trends in setting toll rates for its bridge crossings. |

Check mark in a green circle |

|

Bridge safety and security |

The corporation established safety and security management systems at its international bridges that met regulatory requirements. |

The corporation had board-approved bridge policies related to bridge safety and security for all bridges in its portfolio. The corporation established and maintained security management systems for the Canadian side of each international bridge in its portfolio, in accordance with the security memorandums of understanding with Transport Canada. These systems addressed security plans, security exercises, reports of security incidents, and communication protocols with local law enforcement and government agencies on the US and Canadian sides of the bridges. For each bridge in its portfolio, the corporation had completed threat and risk assessments, which were considered in the security plans reviewed by Transport Canada. In its reviews, Transport Canada did not identify any deficiencies in the security plans for any of the corporation’s international bridges. |

Check mark in a green circle |

|

Performance monitoring and reporting |

The corporation monitored and reported on its bridge operations, toll-rate setting, and bridge safety and security results. |

The corporation provided regular updates to the board on bridge operation management, toll-rate setting, and safety and security. The corporation reported publicly on operational results, toll-rate setting, and bridge safety and security initiatives in its corporate plan and annual report. |

Check mark in a green circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

Conclusion

73. In our opinion, on the basis of the criteria established, there was reasonable assurance that there were no significant deficiencies in the corporation’s systems and practices we examined. We concluded that the Federal Bridge Corporation maintained its systems and practices during the period covered by the audit in a manner that provided the reasonable assurance required under section 138 of the Financial Administration Act.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on the Federal Bridge Corporation. Our responsibility was to express

- an opinion on whether there was reasonable assurance that during the period covered by the audit, there were no significant deficiencies in the corporation’s systems and practices we selected for examination

- a conclusion about whether the corporation complied in all significant respects with the applicable criteria

Under section 131 of the Financial Administration Act, the corporation is required to maintain financial and management control and information systems and management practices that provide reasonable assurance of the following:

- Its assets are safeguarded and controlled.

- Its financial, human, and physical resources are managed economically and efficiently.

- Its operations are carried out effectively.

In addition, section 138 of the act requires the corporation to have a special examination of these systems and practices carried out at least once every 10 years.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard on Assurance Engagements (CSAE) 3001—Direct Engagements, set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office of the Auditor General of Canada applies the Canadian Standard on Quality Control 1 and, accordingly, maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from the corporation:

- confirmation of management’s responsibility for the subject under audit

- acknowledgement of the suitability of the criteria used in the audit

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided

- confirmation that the audit report is factually accurate

Audit objective

The objective of this audit was to determine whether the systems and practices we selected for examination at the Federal Bridge Corporation were providing it with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

Scope and approach

Our audit work examined the Federal Bridge Corporation. The scope of the special examination was based on our assessment of the risks the corporation faced that could affect its ability to meet the requirements set out by the Financial Administration Act.

In carrying out the special examination, we reviewed key documents related to the systems and practices selected for examination. We interviewed members of the Board of Directors, senior management, employees of the corporation, and Transport Canada officials. We tested the systems and practices in place to obtain the required level of audit assurance.

The systems and practices selected for examination for each area of the audit are found in the exhibits throughout the report.

In carrying out the special examination, we did not rely on any internal audits.

Sources of criteria

The criteria used to assess the systems and practices selected for examination are found in the exhibits throughout the report.

Corporate governance

Articles of amalgamation under the Canada Business Corporations Act

Economic Action Plan 2013 Act, numberNo. 2

Federal Bridge Corporation Bylaw No. 1, 2020

Federal Bridge Corporation Board Governance Manual, 2020

Federal Bridge Corporation Board profile

Practice Guide: Assessing Organizational Governance in the Public Sector, The Institute of Internal Auditors, 2014

Strategic planning

Financial Administration Act

Articles of amalgamation under the Canada Business Corporations Act

Economic Action Plan 2013 Act, No. 2

Federal Bridge Corporation Corporate and Planning Reporting Policy, 2018

Federal Bridge Corporation Board Governance Manual, 2020

Guidance for Crown Corporations on Preparing Corporate Plans and Budgets, Treasury Board of Canada Secretariat, 2019

Recommended Practice Guideline 3, Reporting Service Performance Information, International Public Sector Accounting Standards Board, 2015

Corporate risk management

Enterprise Risk Management—Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2017

Federal Bridge Corporation Enterprise Risk Management Policy, 2019

Federal Bridge Corporation Board Governance Manual, 2020

Management of bridge assets

Financial Administration Act

International Bridges and Tunnels Act and regulations

International agreements with US bridge partners

Federal Bridge Corporation Asset Management Framework Policy, 2020

Guidance for Crown Corporations on Preparing Corporate Plans and Budgets, Treasury Board of Canada Secretariat, 2019

Management of bridge operations

Financial Administration Act

International Bridges and Tunnels Act and regulations

International agreements with US bridge partners

Memorandums of understanding between Transport Canada and the corporation on the enhancement of security at each bridge

Federal Bridge Corporation Operations Management Framework Policy, 2020

Federal Bridge Corporation Bridge Use and Tolling Policy, 2021

Federal Bridge Corporation Security Policy Framework, 2018

Federal Bridge Corporation Strategic Emergency Management Policy, 2018

Guidance for Crown Corporations on Preparing Corporate Plans and Budgets, Treasury Board of Canada Secretariat, 2019

Period covered by the audit

The special examination covered the period from 2 November 2020 to 31 August 2021. This is the period to which the audit conclusion applies. However, to gain a more complete understanding of the significant systems and practices, we also examined certain matters that preceded the start date of this period.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 19 January 2022, in Ottawa, Canada.

Audit team

Principal: Firyal (Fera) Awada

Directors: Ewa (Eva) Jarzyna and Ian Theaker

Nathalie Coletta

Emily Duval

Michaela McConnell

Bismarck Ocon

Daniel Spagnolo

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report, and the numbers in parentheses indicate the location of the related discussion.

Corporate management practices

| Recommendation | Response |

|---|---|

|

34. The corporation should ensure that the board receives complete reporting on compliance with legislative authorities and results of conflict‑of‑interest processes, to support effective board oversight and decision making. (29 to 33) |

The corporation’s response. Agreed. The corporation’s Board of Directors currently receives compliance reporting on key authorities. The corporation has contractual relationships with bi‑national entities and bridge operators for the operation of specific international bridges that govern the nature of the relationship and the obligations of each party per applicable laws, diplomacy and governance considerations. These agreements are subject by the corporation to independent third-party audits per negotiated bi‑national agreements. Subject to these agreements, the corporation commits to conducting a review of the reporting to the Board of Directors on applicable legislation relevant to the corporation within the 2022–23 to 2026–27 planning period. In its oversight of conflict of interest, the corporation has formal policies, internal controls and targeted activities in place to protect its interests. The corporation has established a reporting by exception framework through the Chief Executive Officer to the Board of Directors. The corporation commits to reviewing its conflict of interest reporting practices within the 2022–23 fiscal year, with an aim to continuous improvement |

|

38. The corporation should formalize its information requirements with the bridge operators in its 3 binational bridge partnerships.(35 to 37) |

The corporation’s response. Agreed. The corporation agrees that there is benefit to an increased formalization of detailed information requirements that support the agreements in place at its crossings. The corporation will review all information exchanges linked to each agreement in place for enhanced documentation by the end of the 2023–24 fiscal year. |

|

48. The corporation should define specific targets and time-bound milestones for the performance indicators related to its strategic objectives. (40 to 47) |

The corporation’s response. Agreed. The corporation resolves to review its performance targets and objectives methodology to enhance information for users and include these revisions in the corporate plan for 2023–24 to 2027–28 as well as in the 2023–24 annual report. |

|

49. The corporation should establish performance indicators and targets that directly address its mandate that its international bridges and associated structures be safe and efficient for users. (40 to 47) |

The corporation’s response. Agreed. The corporation agrees that performance indicators and targets are important measurements of its achievement of the mandate and resolves to review its methodology to enhance information to users and include these revisions in the corporate plan for 2023 to 2028 as well as in the 2023 annual report. |

|

55. The corporation should integrate environmental and sustainable development risks into its risk management processes in order to identify, mitigate, monitor, and report on its environmental and sustainable development risks. (51 to 54) |

The corporation’s response. Agreed. The corporation has long-established and responsible environmental and socially responsible practices and processes embedded into all of its bridge operations and major capital projects. The corporation’s Board of Directors began training on environment, social, and governance frameworks in 2018, and most recently in 2020–21, a comprehensive climate change study across its entire portfolio was performed. In October 2021, the corporation has initiated a strategic process to integrate all sources of current information and activities into a formal environmental, social, and governance framework. Once the modern framework is in place, the corporation will reassess its risks and mitigation measures as part of its enterprise risk management program. A target date of the end of fiscal 2023–24 is set for completion of all related documentation. |

|

59. The corporation should document, in its risk register, mitigation measures for all risks, including those it has assessed as having effective risk management in place. (56 to 58) |

The corporation’s response. Agreed. The corporation agrees that the risk register should include mitigation measures for all risks, including those not currently reported to the board, and shall review the manner of documentation of such reporting by the end of the 2023 fiscal year. |

Management of bridge assets and bridge operations

| Recommendation | Response |

|---|---|

|

71. The corporation should complete its development of a digitized asset inventory and database system to track and analyze bridge and related structure data. (68 to 70) |

The corporation’s response. Agreed. The corporation is proud of the quality of its asset management practices as demonstrated through the results of its annual independent inspections of its bridges and facilities. The corporation supports the view that the completion of the digitization of its asset inventory will be a valuable tool that will supplement existing quality asset management practices, and will allow continuity in the effective delivery of its mandate. Since 2015, the corporation has been actively engaged in the modernization of its asset maintenance planning and workflows to best inform and execute on future works. An asset management program was designed and implementation initiated. Most recently (in September 2021), the conversion of asset information to electronic documentation of its assets through a geographic information system was initiated and has provided immediate results. Further investments are subject to the critical financial impact of the reduced traffic due to the ongoing COVID‑19 border restrictions. The ultimate strength and timing of the recovery of cross-border traffic will guide when this comprehensive program can be fully realized. |