Results of the financial audits

Results of the financial audits

Results of the 2018–2019 financial audits

The Office of the Auditor General of Canada provided the Government of Canada with an unmodified audit opinion on its consolidated financial statements for the 21st consecutive year. This opinion is an important contribution to the ability of Canada to meet its commitments under the United Nations’ 2030 Agenda for Sustainable Development. In particular, the opinion helps Canada meet Sustainable Development Goal 16.6: “Develop effective, accountable and transparent institutions at all levels.”

Overall, we were satisfied with the timeliness and credibility of the financial statements prepared by 68 government organizations we audit, including the Government of Canada.

One opinion is still outstanding: the one on National Defence’s Reserve Force pension plan. For many years, we have not been able to issue an audit opinion on the plan’s financial statements. This has been because of significant and persistent problems with the department not retaining all the documents that support the data used to estimate pension obligations. Although National Defence has been actively developing ways to retain this information and gathering the supporting documents needed for us to complete our audit, much work remains to be done. On the basis of the progress made by National Defence and the audit work we performed to date on the 31 March 2018 financial statements, we expect to be able to complete the audit in early 2020.

The independent auditor’s report in the 2018–2019 Public Accounts of Canada and any other recently audited financial statements has a new format. This was required because of changes in auditing standards effective for periods ending on or after 15 December 2018. The enhanced auditor’s report offers more organization-specific information, which will better help users of financial statements make informed decisions.

Our independent auditor’s report on the consolidated financial statements of the Government of Canada is found in Section 2 of Volume I of the Public Accounts of Canada.

We noted 4 instances of non-compliance during 3 financial audits this year. A new instance came up during the audit of the National Arts Centre. The corporation used funds from one project to cover the cost overruns of another project, which, in our opinion, was not in accordance with approved authorities. For more details about the National Arts Centre, refer to our link to a portable document format (PDF) fileindependent auditor’s report in the organization’s 2017–2018 Annual Report.

The 3 other instances of non-compliance were the same ones we reported in our Commentary on the 2017–2018 Financial Audits and remained unresolved. Two of these instances related to appointments of officer-directors, which came up during the financial audits of Ridley Terminals IncorporatedInc. and the Canada Development Investment Corporation. The third instance related to the remuneration of the President and Chief Operating Officer of Ridley Terminals Inc.

For more details about the financial audit of Ridley Terminals Inc., refer to our link to a portable document format (PDF) fileindependent auditor’s report in the organization’s 2018 Annual Report. For more details about the audit of the Canada Development Investment Corporation, refer to our link to a portable document format (PDF) fileindependent auditor’s report in the corporation’s 2018 Annual Report.

This section provides information to show how the Trans Mountain pipeline was reflected in the government’s consolidated financial statements.

In August 2018, the federal government purchased the Trans Mountain pipeline through the Canada Development Investment Corporation, which is a government business enterprise. To finance the transaction, the Government of Canada made a loan to the corporation.

Users of the government’s consolidated financial statements might expect to see the Trans Mountain pipeline purchase among the government’s assets, but it was not. This was because of public sector accounting standards. As the corporation is a government business enterprise, its assets and liabilities must be presented in the government’s consolidated financial statements on a net basis as an investment. The Trans Mountain pipeline was, however, presented as an asset in the link to a portable document format (PDF) filecorporation’s own consolidated financial statements.

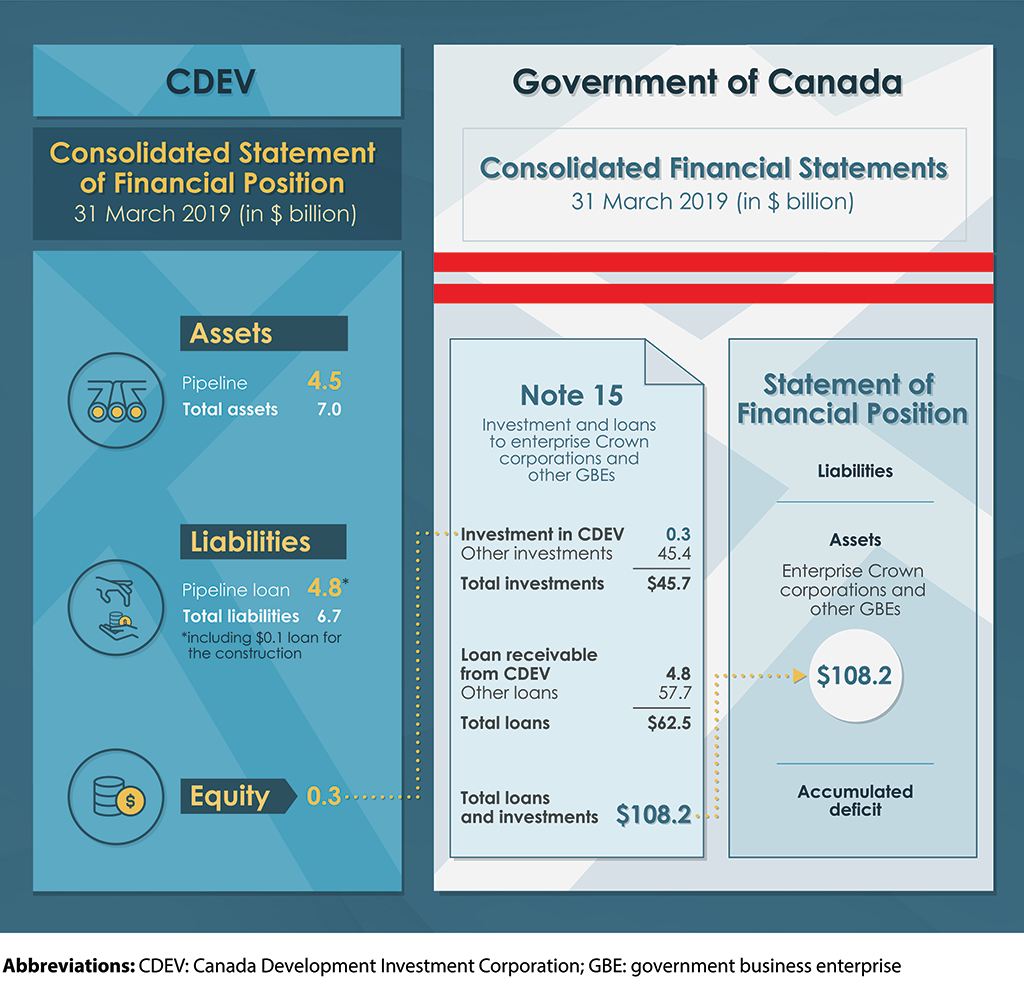

Exhibit 1 has additional information to help parliamentarians understand how the transaction was reflected in the government’s consolidated financial statements.

Exhibit 1—How the Trans Mountain pipeline was reflected in the government’s consolidated financial statements

Exhibit 1—text version

This graphic shows how the Trans Mountain pipeline was reflected in the consolidated financial statements of the Canada Development Investment Corporation and the Government of Canada.

The consolidated statement of financial position of the Canada Development Investment Corporation as of 31 March 2019 showed the pipeline as an asset in the amount of $4.5 billion. This asset was included in the corporation’s total assets of $7.0 billion. Its total liabilities were $6.7 billion, of which $4.8 billion was for a pipeline loan, which included a $0.1 billion loan for the construction. The corporation’s resulting amount of equity was $0.3 billion.

The latest consolidated financial statements of the Government of Canada were from 31 March 2019. Note 15 was about investment and loans to enterprise Crown corporations and other government business enterprises. The note showed the investment in the Canada Development Investment Corporation of $0.3 billion, which was the amount of equity shown in the corporation’s consolidated statement of financial position.

Other investments in government business enterprises amounted to $45.4 billion, resulting in total investments of $45.7 billion.

Note 15 also showed a loan receivable from the Canada Development Investment Corporation of $4.8 billion, plus other loans of $57.7 billion, resulting in total loans of $62.5 billion.

The amount of total loans and investments was $108.2 billion. That amount was shown on the Government of Canada’s consolidated statement of financial position as part of its assets in enterprise Crown corporations and other government business enterprises. The amount of liabilities minus assets equals the government’s accumulated deficit.

The transaction was mentioned in the government’s financial statements discussion and analysis in Section 1 of Volume I of the Public Accounts of Canada.

Opportunities for improvement noted in the 2018–2019 financial audits

Financial audits identify opportunities for organizations to improve their systems of internal control, streamline their operations, or enhance their financial reporting practices. We issue management letters to inform the organizations about these opportunities and about more serious points, such as inadequate internal controls that can create risks of errors in financial reports.

As part of our annual financial audits, we follow up on the points we have raised in previous years so we can monitor management’s progress in addressing them.

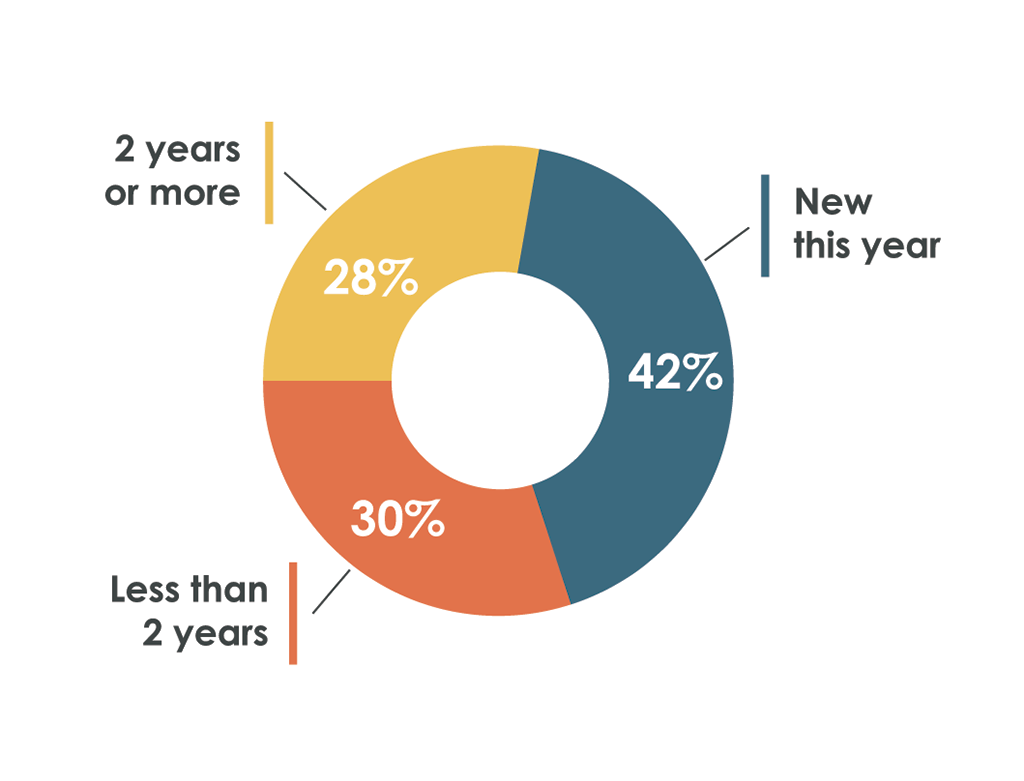

Similar to what we reported last year, of the total management letter points that were unresolved as of 30 June 2019 from our 2018–2019 financial audits, 72% either were newly issued (42%) or had been unresolved for less than 2 years (30%) (Exhibit 2).

Exhibit 2—Unresolved management letter points from the 2018–2019 financial audits

Exhibit 2—text version

This pie chart shows the proportion of all unresolved management letter points from the 2018–2019 financial audits based on length of time outstanding. The chart shows that 42% of the unresolved management letter points from the 2018–2019 financial audits were new this year, 30% had been unresolved for less than 2 years, and 28% had been unresolved for 2 years or more.

We noted opportunities for improvement in various areas, but the most common ones were

- information technology (IT) general controls over systems supporting financial reporting, mainly related to access

- financial reporting and accounting practices

- compliance with government policies, legislation, and regulations

- financial reporting processes and related controls

Similar to what we reported last year, almost half of the unresolved management letter points as of 30 June 2019 resulted from our reviews of IT general controls over systems supporting financial reporting. Such controls included access to programs and data, program development, program changes, and computer operations.

Our reviews are limited to certain financial audits, and the specific controls reviewed depend on the audit approach chosen. In addition, the reviews are not always performed annually and can be limited to following up on previous years’ results.

In the reviews we conducted, we targeted access controls because they are fundamental for the functioning of IT-dependent financial processes. Access controls, however, go beyond financial processes. In an IT environment, they ensure that only authorized individuals can access any electronic data. If those controls are absent or weak, the integrity of the data is at risk.

Most of these unresolved management letter points related to the need to improve controls over the access granted to organizations’ IT systems. Recurring points we noted included access given to people who did not need it, access retained by people who no longer needed it, and lack of controls over access granted between organizations.

We informed organizations of the need to correct these important points because strong access controls are needed to safeguard the integrity of the government’s data.

Follow-up on themes noted in previous special examinations

In addition to conducting annual financial audits of Crown corporations, we conduct special examinations, which are a type of performance audit that strengthens corporate accountability. We conduct a special examination of each corporation at least once every 10 years. In this section, we provide insight on common themes we raised in recent special examinations in the area of corporate governance of Crown corporations.

In May 2018, in our Commentary on the 2016–2018 Performance Audits of Crown Corporations, we reported that timely decisions on corporate plans were a problem in 4 of the 13 Crown corporations we audited between 2016 and 2018. In this report, we provide additional insight on the process for preparing and submitting corporate plans and an update on the timeliness of submissions and approvals of corporate plans.

Importance of corporate plans. Crown corporations operate with considerable independence under the Financial Administration Act. As an important step in their accountability to their shareholder (the Government of Canada), most Crown corporations submit their corporate plans to the responsible ministers every year for approval by the Treasury Board. The plans set out objectives, strategies, and operational and financial performance measures and targets.

The process. In March 2018, the Treasury Board of Canada Secretariat updated its Guidance for Crown Corporations on Preparing Corporate Plans and Budgets. The updated guidance provides more details on key milestones and the accountability of Crown corporations to the government (Exhibit 3).

Exhibit 3—Key steps and time frames for submitting and approving Crown corporations’ corporate plans

Source: Based on information from the Treasury Board of Canada Secretariat’s Guidance for Crown Corporations on Preparing Corporate Plans and Budgets

Exhibit 3—text version

This flow chart shows the key steps and time frames for submitting and approving Crown corporations’ corporate plans. The chart shows three key steps for submitting and approving Crown corporations’ corporate plans.

The first step is the submission of the draft corporate plan to the portfolio department. It is suggested by Treasury Board of Canada Secretariat guidance that this happen 3.5 months before the next fiscal year begins.

The second step is the submission of the final corporate plan to the responsible minister. It is required by regulations that this happen 8 weeks before the next fiscal year begins.

The third step is the submission of the corporate plan to Treasury Board. The timing is based on planned Treasury Board meetings.

Source: Based on information from the Treasury Board of Canada Secretariat’s Guidance for Crown Corporations on Preparing Corporate Plans and Budgets

Timeliness of submissions and approvals. We reviewed the submissions of corporate plans during our 2018–2019 financial audits of the 35 Crown corporations subject to this requirement. We found that 6 of 35 (17%) Crown corporations as of 30 June 2019 had not yet submitted their corporate plans to their responsible ministers within the timeline required by regulations. Furthermore, 4 of 35 (11%) corporate plans as of 30 June 2019 had not yet been approved by the Treasury Board. For Crown corporations to move forward with any changes necessary to continue to fulfill their mandates, they need ongoing communication from the government about the status of their plans. They also need the government’s timely decisions on the strategies and objectives in these plans.

In May 2018, in our Commentary on the 2016–2018 Performance Audits of Crown Corporations, we reported delays in the appointments of members to the boards of directors for 8 of the 13 (62%) Crown corporations we audited between 2016 and 2018. As a follow-up, we reviewed the status as of 12 July 2019 of the appointments of external members for the 42 parent Crown corporations we audit.

Importance of a board of directors. Each Crown corporation is governed by a board of directors, or a similar governing body. The Financial Administration Act places the board of directors at the centre of the governance regime for Crown corporations. Under this regime, the board oversees the management of each corporation and holds management responsible for its performance. The board is responsible for establishing the corporation’s strategic direction, safeguarding the corporation’s resources, monitoring corporate performance, and reporting to the government and Parliament. Delays in appointments affect the board’s ability to fulfill its important governance role.

Process for board appointments. The maximum number of members on each board of directors is defined in the corporation’s legislation. For most Crown corporations, the minister is responsible for appointing the directors with the approval of the Governor in Council. Each director is appointed for a specific term. These appointments are expected to ensure, as far as possible, that not more than half of the directors’ terms will expire in any given year. For the majority of Crown corporations, once a director’s initial appointment term has ended, the director continues in office until a successor is appointed.

Delays in appointments. We found that 13 of the 42 (31%) Crown corporations we reviewed had delays in appointments. This meant that directors either continued to sit on boards after their terms expired while they awaited the government’s decision on whether to reappoint or replace them, or the positions became vacant. Of these 13 corporations, 4 had at least 1 sitting director whose term had been expired for at least 1 year, and in some cases, for at least 2 years.

We also noticed that an additional 9 Crown corporations had appointments expiring in the upcoming 6 months and that these directors had not yet been replaced or reappointed.

As shown above, the problem of delays in appointing board members persisted.