2024 Reports of the Auditor General of Canada to the Parliament of Canada

Report 1—ArriveCAN

At a Glance

Overall, the Canada Border Services Agency, the Public Health Agency of Canada, and Public Services and Procurement Canada repeatedly failed to follow good management practices in the contracting, development, and implementation of the ArriveCAN application. As a result of the many gaps and weaknesses we found in the project’s design, oversight, and accountability, it did not deliver the best value for taxpayer dollars spent. The enduring benefit of the ArriveCAN application is that it remains available for customs and immigration declarations. As of October 2022, ArriveCAN is no longer used to collect travellers’ contact and health information.

The Canada Border Services Agency’s documentation, financial records, and controls were so poor that we were unable to determine the precise cost of the ArriveCAN application. Using the information that was available, we estimated the cost at approximately $59.5 million. At the onset of the COVID‑19 pandemic, the agency determined that it did not have the resources needed to develop the application and that it would therefore rely on external resources. The agency’s decision to work with external resources, as well as the continued reliance on them throughout the project, increased the cost of ArriveCAN.

The Canada Border Services Agency’s disregard for policies, controls, and transparency in the contracting process restricted opportunities for competition and undermined value for money. We found that the agency had little documentation to support how and why GC Strategies was awarded the initial ArriveCAN contract through a non‑competitive process. We also found that GC Strategies was subsequently involved in the development of the requirements that the agency ultimately included in the request for proposal for its competitive contract. Although departments and agencies were encouraged to be flexible given the urgent need to respond to the pandemic, the need to document decisions and demonstrate transparency and prudent use of public funds remained.

We also found deficiencies in how the Canada Border Services Agency managed the contracts, again raising concerns about value for money. Given the number and value of competitive and non‑competitive contracts used to carry out this project, we are concerned that essential information, such as clear deliverables and required qualifications, was missing. We found that details about the work performed were often missing on invoices and supporting time sheets submitted by contractors that the agency approved.

Key facts and findings

- On 29 April 2020, the Canada Border Services Agency launched the digital application ArriveCAN to collect contact and health information from travellers and assist with quarantine measures.

- 18% of invoices submitted by contractors that we tested did not provide enough information to determine whether expenses related to ArriveCAN or another information technologyIT project. This made it impossible to accurately attribute costs to projects.

- The Canada Border Services Agency added the digital customs and immigration declaration form into the ArriveCAN application at a cost of about $6.2 million, to replace the existing paper-based system. The new digital declaration form remained in use after requirements to collect travellers’ contact and health information stopped in October 2022.

- We estimated that the average per diem cost for the ArriveCAN external resources was $1,090, whereas the average daily cost for equivalent IT positions in the Government of Canada was $675. The Canada Border Services Agency continued to rely on external resources increasing the cost of the application.

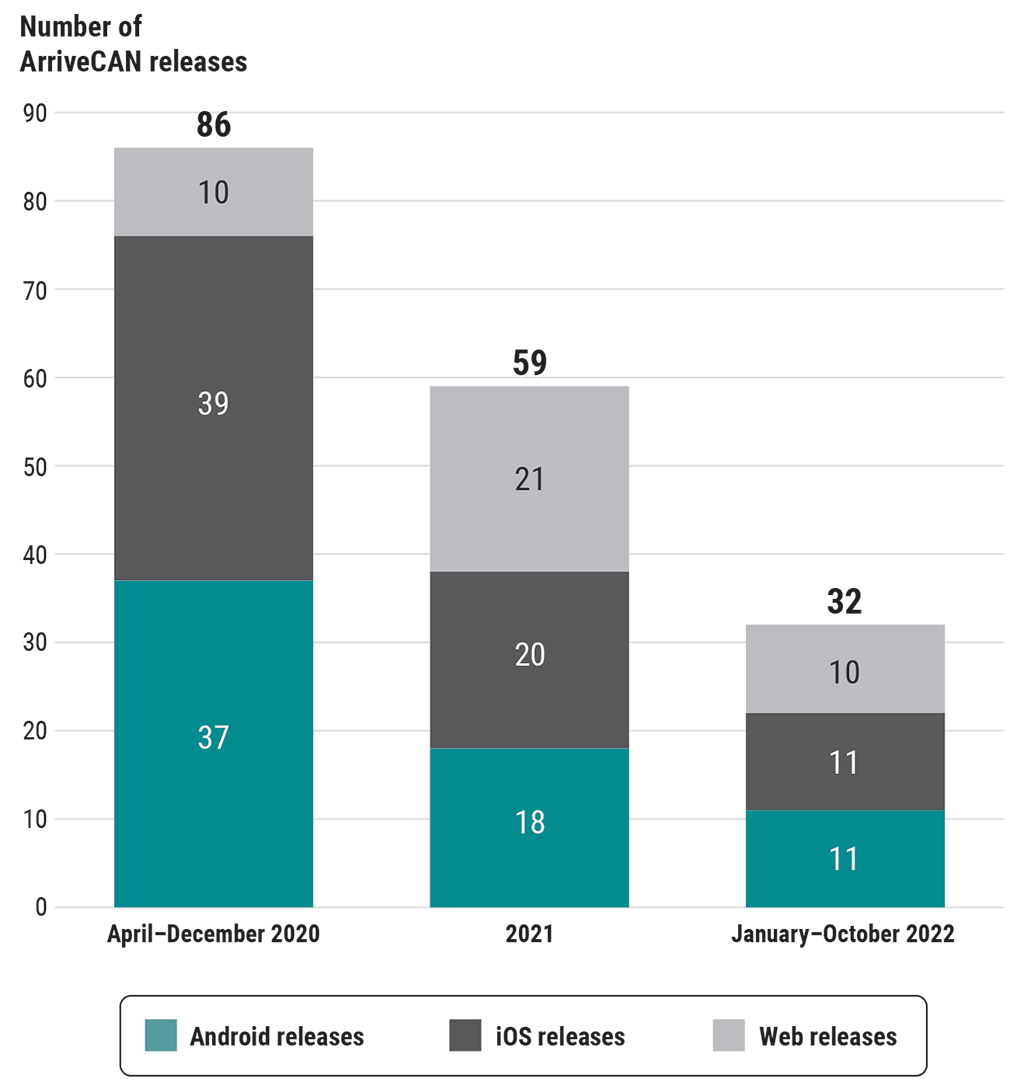

- Between April 2020 and October 2022, the Canada Border Services Agency released 177 versions of ArriveCAN with often little to no documentation of testing. In one update, in June 2022, around 10,000 travellers were wrongly instructed to quarantine.

- There was no formal agreement between the Public Health Agency of Canada and the Canada Border Services Agency from April 2020 to July 2021 to clarify roles and responsibilities. In the absence of a designated lead, good project management practices—such as developing project objectives and goals, budgets and cost estimates, and risk management activities—were not carried out.

- We found no evidence to show that some Canada Border Services Agency employees complied with the agency’s Code of Conduct by disclosing that they had been invited to dinners and other activities by contractors. The agency launched an investigation, and we did not undertake further audit work around ethics and the Code of Conduct to avoid duplicating or compromising this process.

Why we did this audit

- On 2 November 2022, the House of Commons passed a motion that called on the Office of the Auditor General of Canada to conduct a performance audit of the government’s management of the ArriveCAN application.

- Canadians and the Government of Canada need to know whether public funds are being spent considering value for money.

- It provides an opportunity for government organizations to learn where they can improve when managing time‑sensitive initiatives or projects that include multiple or complex contracts.

Highlights of our recommendations

- The Canada Border Services Agency should maintain accurate financial records by correctly allocating expenses to projects. To better support these actions, the agency should work with contractors to obtain invoices that accurately detail the work completed by each resource by project, contract, and task authorization.

- The Canada Border Services Agency and the Public Health Agency of Canada should fully document interactions with potential contractors and the reasons for decisions made during non‑competitive procurement processes and should put in place a process to ensure compliance with the requirements of the contracting policies.

- The Canada Border Services Agency should ensure that potential bidders are not involved in developing or preparing any part of a request for proposal and should put in place controls that will prevent this from occurring.

Please see the full report to read our complete findings, analysis, recommendations and the audited organizations’ responses.

Exhibit highlights

Estimated costs of the main contractors on the ArriveCAN application at 31 March 2023

| Main contractorsNote 1 | Estimated costs attributable to ArriveCAN (in millions) |

|---|---|

| GC Strategies | $19.1 |

| Dalian Enterprises IncorporatedInc. | $7.9 |

| Amazon Web Services, Inc. | $7.9 |

| Microsoft Canada Inc. | $3.8 |

| TEKsystems, Inc. | $3.2 |

| Donna Cona Inc. | $3.0 |

| Business Development OfficeBDO Canada Limited Liability PartnershiLLP | $2.9 |

| MGIS Inc. | $2.4 |

| 49 Solutions | $1.1 |

| Makwa Resourcing Inc. / The Powell GroupTPG Technology Consulting LimitedLtd. | $1.1 |

| Advanced Chippewa Technologies Inc. | $1.0 |

| OtherNote 2 | $6.1 |

| Total | $59.5 |

|

Source: Based on information provided by the Canada Border Services Agency |

|

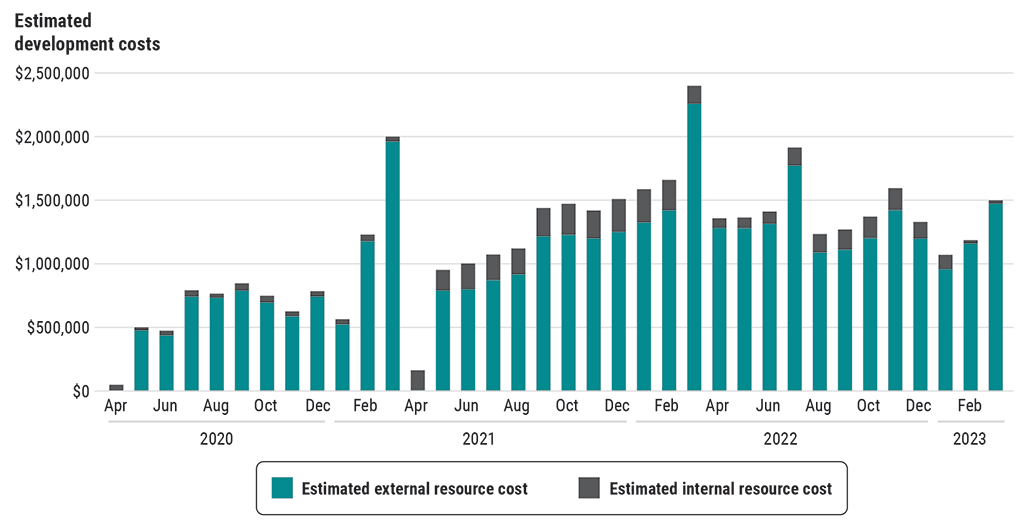

The Canada Border Services Agency continued to rely heavily on external resources to develop ArriveCAN from April 2020 to March 2023

Source: Based on information provided by the Canada Border Services Agency

Text version

This stacked bar chart shows the estimated development costs for the ArriveCAN application for the period of April 2020 to March 2023. Each stacked bar shows the estimated external resource cost and the estimated internal resource cost for each month. The Canada Border Services Agency continued to rely heavily on external resources throughout the period. For example, in May 2020, at the beginning of the period, the estimated external resource cost was $478,628, or 95%, of the total resource cost for that month. However, in March 2023, at the end of the period, the estimated resource cost was $1,479,493, or 98%, of the total resource cost, which was still very high.

The breakdown of the estimated development costs is as follows.

| Month and year | Estimated external resource cost | Estimated internal resource cost |

|---|---|---|

| April 2020 | $0 | $49,248 |

| May 2020 | $478,628 | $25,200 |

| June 2020 | $439,334 | $37,324 |

| July 2020 | $744,349 | $52,347 |

| August 2020 | $735,605 | $34,032 |

| September 2020 | $791,511 | $60,042 |

| October 2020 | $697,391 | $55,725 |

| November 2020 | $589,889 | $39,912 |

| December 2020 | $747,155 | $42,383 |

| January 2021 | $524,928 | $42,675 |

| February 2021 | $1,183,682 | $52,681 |

| March 2021 | $1,970,592 | $40,261 |

| April 2021 | $5,658 | $158,368 |

| May 2021 | $792,425 | $164,838 |

| June 2021 | $804,341 | $203,920 |

| July 2021 | $875,905 | $202,959 |

| August 2021 | $921,550 | $205,013 |

| September 2021 | $1,222,975 | $223,792 |

| October 2021 | $1,233,272 | $247,003 |

| November 2021 | $1,206,917 | $220,204 |

| December 2021 | $1,256,613 | $261,294 |

| January 2022 | $1,330,589 | $265,353 |

| February 2022 | $1,427,640 | $241,292 |

| March 2022 | $2,269,627 | $143,470 |

| April 2022 | $1,288,096 | $77,524 |

| May 2022 | $1,286,963 | $84,370 |

| June 2022 | $1,320,587 | $98,016 |

| July 2022 | $1,781,415 | $143,352 |

| August 2022 | $1,094,047 | $147,007 |

| September 2022 | $1,115,204 | $161,554 |

| October 2022 | $1,208,138 | $170,450 |

| November 2022 | $1,429,336 | $174,664 |

| December 2022 | $1,202,545 | $134,329 |

| January 2023 | $963,086 | $113,161 |

| February 2023 | $1,166,303 | $26,893 |

| March 2023 | $1,479,493 | $28,275 |

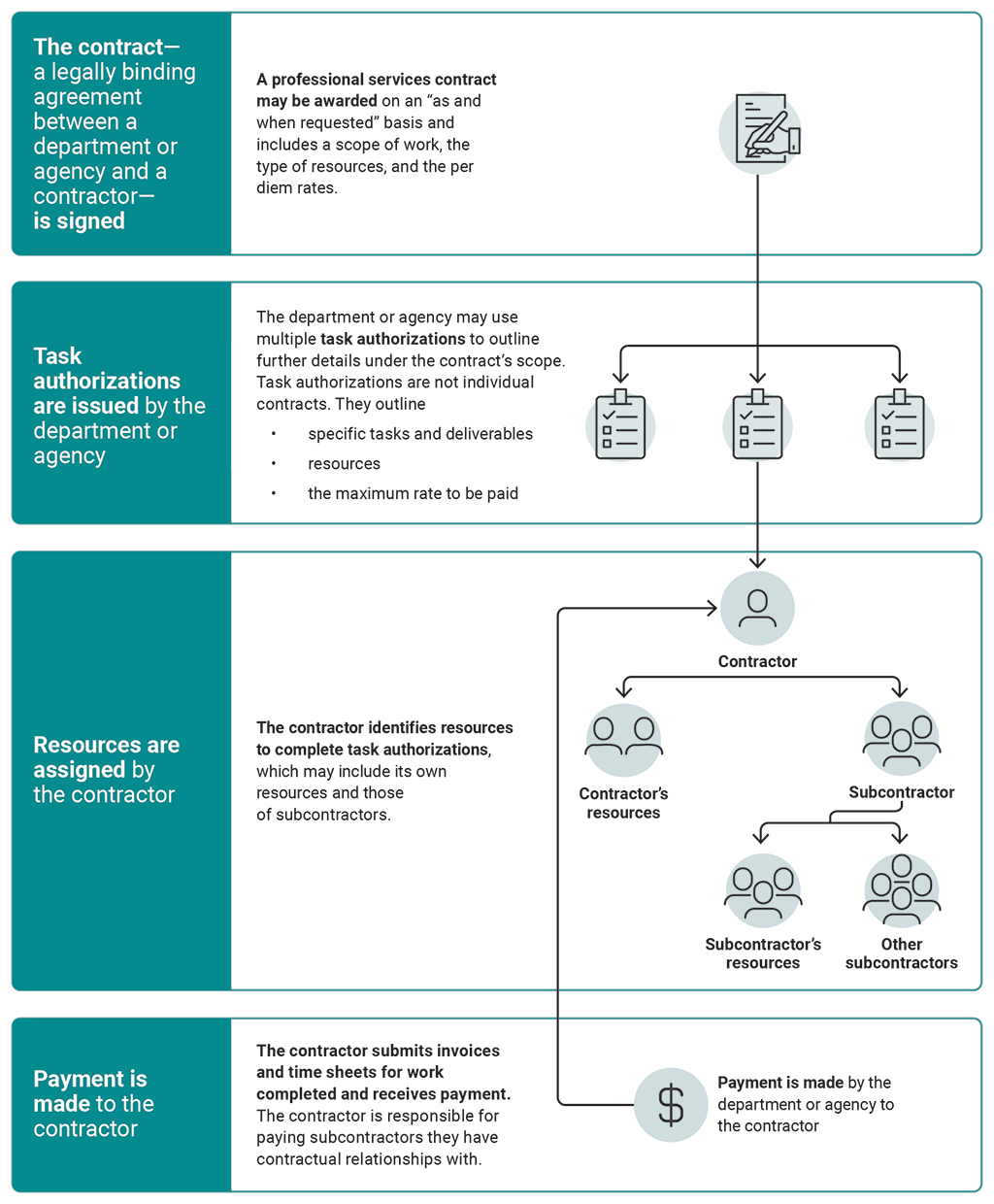

Under the federal government’s process for task authorization, payments are made to contractors, not subcontractors

Source: Based on information provided by Public Services and Procurement Canada

Text version

This flow chart shows the federal government’s task authorization process, which is as follows.

First, the contract—a legally binding agreement between a department or agency and a contractor—is signed. A professional services contract may be awarded on an “as and when requested” basis and includes a scope of work, the type of resources, and the per diem rates.

Next, task authorizations are issued by the department or agency. The department or agency may use multiple task authorizations to outline further details under the contract’s scope. Task authorizations are not individual contracts. They outline specific tasks and deliverables, resources, and the maximum rate to be paid.

Next, resources are assigned by the contractor. The contractor identifies resources to complete task authorizations, which may include its own resources and those of subcontractors.

Finally, payment is made by the department or agency to the contractor. The contractor submits invoices and time sheets for work completed and receives payment. The contractor is responsible for paying subcontractors they have contractual relationships with.

The Canada Border Services Agency released 177 versions of ArriveCAN from April 2020 to October 2022

Source: Based on information provided by the Canada Border Services Agency

Text version

This stacked bar chart shows the total number of ArriveCAN releases during 3 periods: April to December 2020, 2021, and January to October 2022. It also shows the number of Android, iOS, and web releases during these periods. The breakdown is as follows.

| Type of release | Number released during the April to December 2020 period | Number released in 2021 | Number released during the January to October 2022 period |

|---|---|---|---|

| Android | 37 | 18 | 11 |

| iOS | 39 | 20 | 11 |

| Web | 10 | 21 | 10 |

| Total | 86 | 59 | 32 |

Related information

Entities

Tabling date

- 12 February 2024

Related audits

- 2021 Reports of the Auditor General of Canada to the Parliament of Canada,

Report 8—Pandemic Preparedness, Surveillance, and Border Control Measures - 2021 Reports of the Auditor General of Canada to the Parliament of Canada

Report 15—Enforcement of Quarantine and COVID-19 Testing Orders—Public Health Agency of Canada

Parliamentary hearings

- 7 March 2024—Standing Committee on Public Accounts

- 6 March 2024—Standing Committee on Public Accounts

- 27 February 2024—Standing Committee on Public Accounts

- 21 February 2024—Standing Committee on Public Accounts

- 20 February 2024—Standing Committee on Public Accounts

- 14 February 2024—Standing Committee on Government Operations and Estimates

- 13 February 2024—Standing Committee on Public Accounts

- 12 February 2024—Standing Committee on Public Accounts