Office of the Auditor General of Canada—2019–20 Departmental Results Report

Office of the Auditor General of Canada2019–20 Departmental Results Report

Table of Contents

- Message from the Auditor General of Canada

- Results at a glance and operating context

- Results: What we achieved

- Resources used

- Financial statements

- Additional information

- Organizational profile

- Raison d’être, mandate, and role: Who we are and what we do

- Operating context and risks

- Reporting framework

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Report on staffing

- List of reports

- Organizational contact information

- Appendix A: Strategic framework of the Office of the Auditor General of Canada

- Appendix B: Performance measurement framework of the Office of the Auditor General of Canada

- Appendix C: Definitions

Message from the Auditor General of Canada

Auditor General of Canada

I am pleased to present the 2019–20 Departmental Results Report for the Office of the Auditor General of Canada (OAG), the first of my 10-year mandate.

It is often said that the only thing that is constant is change. This has proven to be especially true for the past fiscal year. Both the start and end of the year saw significant changes. It began with the appointment of Interim Auditor General Sylvain Ricard, following the passing of Auditor General Michael Ferguson, and it ended with the OAG in lockdown because of the COVID-19 pandemic.

Although COVID-19 affected only a few weeks of the fiscal year, the impact on the OAG during that short period was significant. COVID-19 not only has changed the ways in which we carry out our operations, but it also has brought a wholesale change to our short- to medium-term performance audit plan. We have had to adjust our audit approaches to adapt to the constraints of an ongoing pandemic.

In the first 3 months of 2020, Parliament asked the OAG to audit the government’s spending on infrastructure programs and the government’s response to the pandemic. While we agreed to conduct this important work, it cannot be overstated that these requests have come at a time when our capacity to deliver performance audits has already been compromised as a consequence of budgetary pressures in recent years. To deliver on these commitments, we will need to embrace change, as new people, new tools, and new processes will all be required. We are seeking permanent additional funding and a statutory, fixed funding mechanism that ensures stable, long-term, and predictable funding.

While the pandemic has presented tremendous challenges to our operations, it has also generated opportunities for innovation, resourcefulness, and creativity. We are changing the way we think about our work. Our staff has been busy reimagining the “new normal” of our audit work, acquiring new tools and exploring new formats for engaging and communicating with staff at a distance, and developing new ways to support learning, recruitment, and procurement processes.

I have been, and continue to be, inspired by the people who work at the OAG. They are caring, creative, skilled, intelligent, and professional. They are always focused on upholding the highest standards of quality. I am proud of the resilience, perseverance, and kindness that our employees have demonstrated, and I thank them for their ongoing support and patience as we navigate this uncertainty together.

I would like to take this opportunity to thank Sylvain Ricard for his stewardship of the OAG. He provided us with stability and upheld the vision that was articulated by the late Michael Ferguson. He has been a great sounding board as I take on leading the OAG into the future.

Over the past few months, I have come to appreciate that work is something we do—it is not a place where we go. The OAG is much more than its physical locations. It is the amazing people who work together to carry out the mandate that Parliament has entrusted to us.

[Original signed by]

Karen Hogan, Chartered Professional AccountantCPA, Chartered AccountantCA

Auditor General of Canada

15 October 2020

Results at a glance and operating context

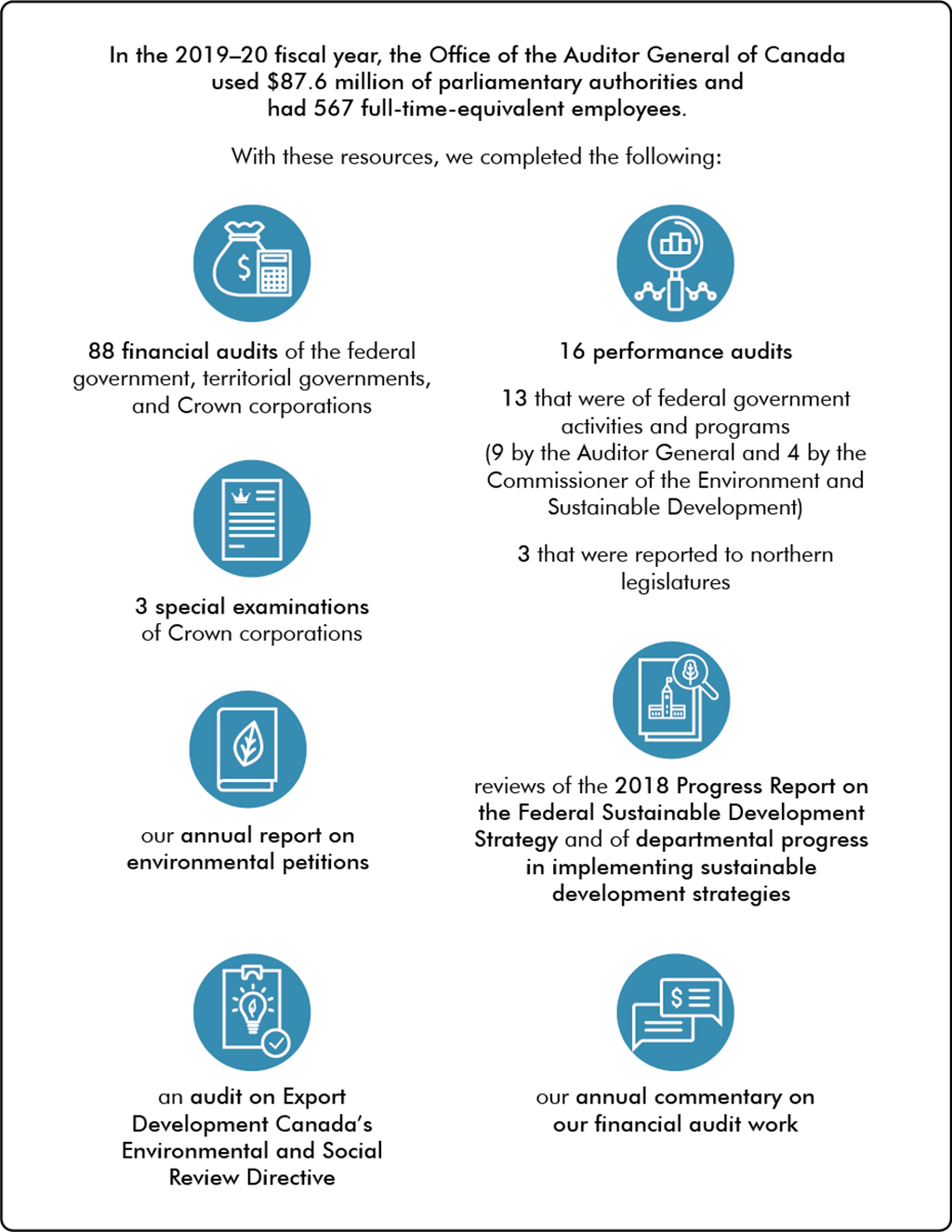

Text version

In the 2019–20 fiscal year, the Office of the Auditor General of Canada used $87.6 million of parliamentary authorities and had 567 full-time-equivalent employees.

With these resources, we completed the following:

- 88 financial audits of the federal government, territorial governments, and Crown corporations

- 3 special examinations of Crown corporations

- our annual report on environmental petitions

- an audit on Export Development Canada’s Environmental and Social Review Directive

- 16 performance audits

- 13 that were of federal government activities and programs (9 by the Auditor General and 4 by the Commissioner of the Environment and Sustainable Development)

- 3 that were reported to northern legislatures

- reviews of the 2018 Progress Report on the Federal Sustainable Development Strategy and of departmental progress in implementing sustainable development strategies

- our annual commentary on our financial audit work

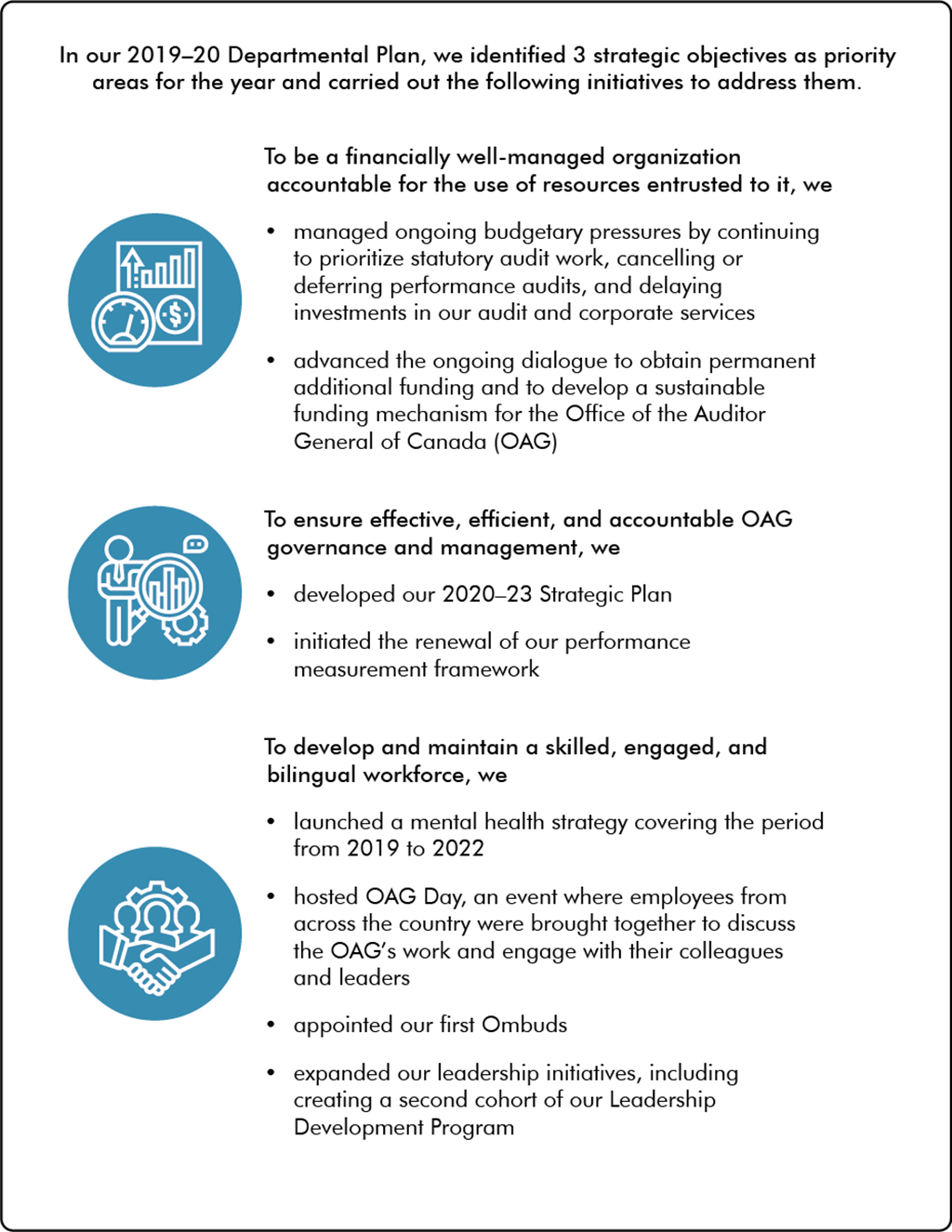

Text version

In our 2019–20 Departmental Plan, we identified 3 strategic objectives as priority areas for the year and carried out the following initiatives to address them.

To be a financially well-managed organization accountable for the use of resources entrusted to it, we

- managed ongoing budgetary pressures by continuing to prioritize statutory audit work, cancelling or deferring performance audits, and delaying investments in our audit and corporate services

- advanced the ongoing dialogue to obtain permanent additional funding and to develop a sustainable funding mechanism for the Office of the Auditor General of Canada (OAG)

To ensure effective, efficient, and accountable OAG governance and management, we

- developed our 2020–23 Strategic Plan

- initiated the renewal of our performance measurement framework

To develop and maintain a skilled, engaged, and bilingual workforce, we

- launched a mental health strategy covering the period from 2019 to 2022

- hosted OAG Day, an event where employees from across the country were brought together to discuss the OAG’s work and engage with their colleagues and leaders

- appointed our first Ombuds

- expanded our leadership initiatives, including creating a second cohort of our Leadership Development Program

Results: What we achieved

Our core responsibility: Legislative auditing

Our audit reports provide objective, fact-based information and expert advice on government programs and activities. With our audits, we assist Parliament in its work on the authorization and oversight of government spending and operations. Our audits are also used by territorial legislatures, boards of Crown corporations, and audit committees to help them oversee the management of government activities and hold them to account for the handling of public funds. Financial audits assess whether the annual financial statements of the Government of Canada, Crown corporations, and others are presented fairly, consistent with applicable accounting standards. Performance audits assess whether government organizations manage with due regard for economy, efficiency, and environmental impact, and measure their effectiveness. Special examinations assess whether Crown corporation systems and practices provide reasonable assurance that assets are safeguarded, resources are managed economically and efficiently, and operations are managed effectively.

Our current results: Audit operations

Being able to deliver quality audits on time and on budget is an essential part of achieving our departmental result: a well-managed and accountable government. In the 2019–20 fiscal year, we were able to deliver on time 97% of audits with statutory deadlines, and we met our planned reporting dates for 93% of audits without statutory deadlines.

Our System of Quality Control was reviewed by our international peers and was determined to be suitably designed and effectively implemented to provide us reasonable assurance that our work complies with relevant professional standards.

Financial audits

The Office of the Auditor General of Canada (OAG) conducts financial audits and related work across various jurisdictions every year, including

- the federal government’s consolidated financial statements, the results of which are published annually in the Public Accounts of Canada

- the consolidated financial statements of the governments of Nunavut, Yukon, and the Northwest Territories, which are each published annually in the public accounts of each of the territories

- the financial statements of most Crown corporations, territorial corporations, and many federal organizations

The objective of our financial audits is to provide opinions on the fair presentation of an entity’s financial statements and on the entity’s compliance with legislative authorities. An unmodified audit opinion indicates that in all material respects, the entity has demonstrated compliance with both the accounting standards and the legislative authorities applicable to its financial transactions. While control over this rests entirely with the entities, we support and encourage their adoption of best practices by working with them to identify opportunities for continuous improvement in their systems of financial reporting and internal control. With this in mind, our target for financial audit reports to be issued with an unmodified opinion is 100%.

Although 97% of our financial audit opinions were unmodified, 3 audit reports we issued required modified audit opinions. Two of these instances related to appointments of officer-directors, which came up during the financial audits of Ridley Terminals incorporatedInc. and the Canada Development Investment Corporation. The third instance (Qulliq Energy Corporation) was for a scope limitation we faced in auditing the corporation’s inventory management systems. Only 1 of the 4 modifications reported in 2018–19 was addressed in 2019–20.

Performance audits

Despite our ongoing budgetary pressures, we were able to complete 16 performance audits in the 2019–20 fiscal year. These included the spring 2020 reports, which were completed by year-end but not tabled until July 2020 because of the COVID-19 pandemic. A reconciliation of planned reports listed in our 2019–20 Departmental Plan with those tabled during the fiscal year appears in the “List of reports” section of this report.

One of the ways in which we assess the impact of our performance audit work is through the level of parliamentary engagement with our reports. Parliamentary committees reviewed 26% of the reports that we presented to Parliament in the 2019–20 fiscal year, compared with 58% in the prior year. This drop can be attributed to the fewer number of sitting days during the year (due to the fall 2019 federal election campaign) and to the temporary suspension of Parliament (due to the COVID-19 pandemic).

Special examinations

Special examinations are a type of performance audit that focuses on the operations of most federal Crown corporations. These audits examine whether a corporation’s systems and practices provide reasonable assurance that its assets are safeguarded, its resources are managed economically and efficiently, and its operations are carried out effectively. Our target is for 100% of the corporations we audit to have no significant deficiencies, and for the significant deficiencies that are identified to be corrected by the time the next special examination is conducted. Although the entities control the outcome of this indicator, our target is based on our expectation that the work we do will promote effective management practices.

Of the 3 entities for which we transmitted special examinations during the 2019–20 fiscal year, we noted significant deficiencies in 2 of them: the National Gallery of Canada (in collection conservation, risk management, and results reporting) and the Canadian Museum of Immigration at Pier 21 (in collection management and protection, and risk management deficiencies). We did not identify any significant deficiencies during the previous special examinations of these 3 entities.

Our current results: Office administration

Effective and efficient support services

Our performance indicator relating to internal service standards involves 5 of our corporate services: human resources, information technology (IT), security, editorial services, and communications. Although 2 of the services met their targets in the 2019–20 fiscal year, the 3 others faced challenges.

The Editorial Services team met its target of printing and publishing 100% of performance audits and special examinations on time. Meanwhile, the Human Resources team met its internal and external staffing target of filling vacant positions in a timely manner.

However, the IT team was faced with 12 priority-1 outages. Three were not resolved within the target of 4 hours: Our corporate document repository, our audit working paper software, and the infrastructure in 1 of our regional offices all experienced outages.

The Communications team also experienced challenges in the 2019–20 fiscal year because of reduced team capacity and an increased demand for services. Although the team triaged public inquiries and issued responses in a timely manner, the internal process for handling inquiries not requiring a response took longer to complete than the team’s target service standard of 20 days.

Finally, the Security team had 1 security incident during the year: A third party released content from 1 of the OAG’s draft audit reports. The OAG conducted an investigation and immediately put mitigating measures in place.

Progress on annual strategic priority projects

The 3 priority projects outlined in our 2019–20 Departmental Plan all focused on renewing our IT systems. Two of the projects were on track during the year: replacing our aging audit management software and finalizing a detailed IT maintenance and operations plan. However, a third project—replacing our legacy human resource management system—missed its year-end target by 1 month. Because of insufficient resources, we were unable to devote a full-time team to the project until late 2019. The system was launched in May 2020.

Compliance with mandatory training requirements

In the 2019–20 fiscal year, we did not meet our target of 100% compliance with mandatory training. We had identified this as an area for improvement during our 2019 peer review, and we developed an action plan to address it. We enhanced our monitoring of training, and direct supervisors are now notified regularly of any employees at risk of non-compliance. In addition, we offer make-up sessions for certain learning activities to ensure employees can get the training they require.

Progress on 2019–20 priorities

Our 2019–20 Departmental Plan set out the following 3 strategic objectives as priority areas for the year.

Be a financially well-managed organization accountable for the use of resources entrusted to it

The OAG has signaled for several years that its operations have been significantly affected by the absence of sufficient and stable funding. Despite multiple requests, we received only a partial amount of the additional funds we needed in Budget 2018 and no additional funds in Budget 2019.

In the face of increasing operating costs, the OAG has had to make difficult choices. Given our ongoing budgetary pressures, we adopted a systematic approach to allocating our resources. This involves prioritizing our financial audit and special examination work, which are required by law, and cancelling or deferring some performance audits, which are discretionary. It also involves delaying necessary investments to our audit and corporate services, particularly in the areas of our IT systems and architecture.

We continue to actively seek a sustainable and long-term resolution to this situation. Throughout the 2019–20 fiscal year, we continued to advance our dialogue with Parliament and the government to secure additional permanent funding and to develop a funding mechanism that would ensure the OAG’s independence while reflecting increases in the complexity and level of spending in government programs.

Ensure effective, efficient, and accountable OAG governance and management

In the 2019–20 fiscal year, the OAG’s executive team turned its focus toward developing a new strategic plan. The 2020–23 Strategic Plan rests on a set of goals that fall under 3 broad pillars: connecting with stakeholders, modernizing our operations, and caring for our people. Each goal is supported by multiple projects at the corporate level. Projects include undertaking a corporate culture initiative, renewing our talent management plan, updating workspaces, and continuing our efforts in areas such as modernizing our IT architecture, developing an independent and sustainable funding mechanism, and further implementing our mental health strategy.

In late 2019, we launched a renewal of our internal performance measurement framework to better support corporate decision making and ensure that the performance information being provided to management is as timely, complete, and relevant as possible.

Develop and maintain a skilled, engaged, and bilingual workforce

The past few years have been a time of transition and change for OAG staff, and senior management has been sensitive to how challenging it has been. In response, we launched many initiatives to help support employee well-being and engagement:

- Mental Health Strategy 2019 to 2022. Linked to best practices from various organizations, the strategy places an emphasis on supporting and enhancing a balanced culture at the OAG while building capacity through people development to promote positive mental health.

- OAG Day. The 2019 version of the event, themed “Shaping Our Future Together,” brought together staff from across the country. The day focused on multiple employee support initiatives and served as an introduction to our 2020–23 Strategic Plan.

- Ombuds. Created as part of the implementation of the mental health strategy, the role of Ombuds offers support for resolving workplace issues by applying the principles of confidentiality, impartiality, informality, and independence.

- Expanded leadership initiatives. A second cohort of participants in our Leadership Development Program was established in February 2020. The cohort will act as ambassadors of the program and model behaviours of good leadership throughout the OAG.

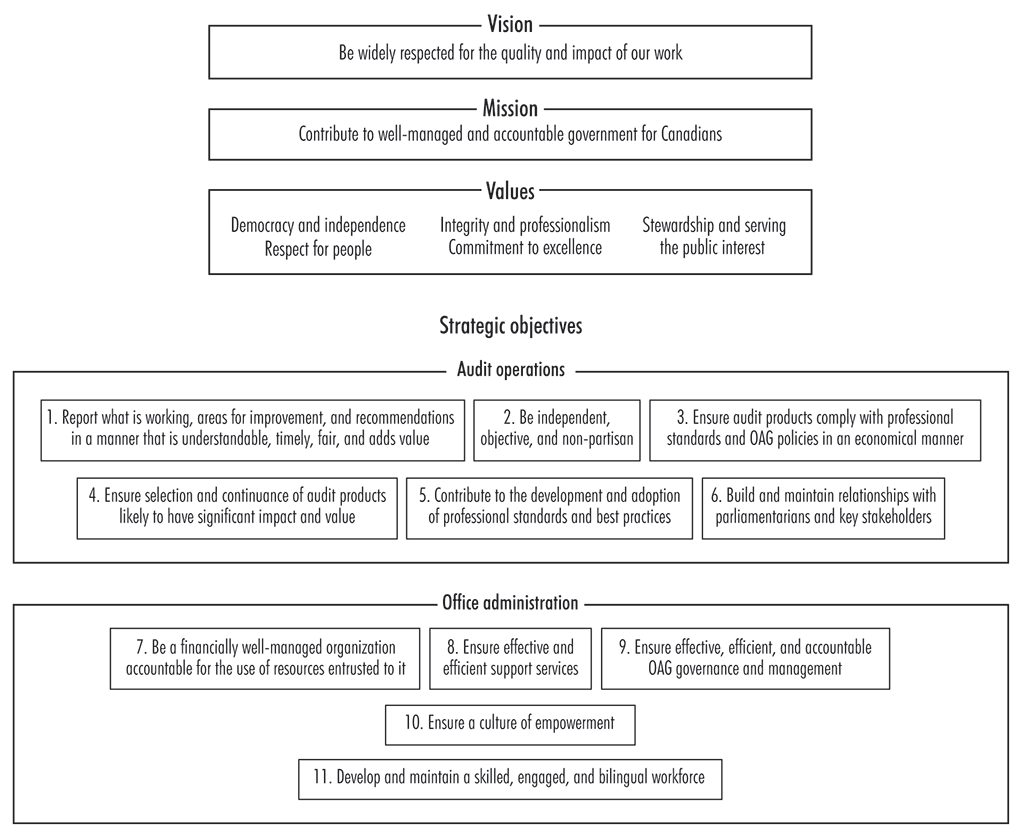

Departmental results framework

In accordance with the Treasury Board’s Policy on Results, we report our results using a departmental results framework. Exhibit 1 presents the OAG’s departmental result, performance indicators, targets, and actual results for the 2017–18, 2018–19, and 2019–20 fiscal years.

We also monitor and report on our operations using a framework that is built around 11 strategic objectives, which guide our audit work and the administration of the OAG (see Appendix A). Our performance measurement framework, presented in Appendix B, establishes our indicators and targets for each of these objectives.

Exhibit 1—Departmental result, performance indicators, targets, and actual results for the 2017–18, 2018–19, and 2019–20 fiscal years

| Departmental result indicators | Target | Date to achieve target | 2017–18 Actual results |

2018–19 Actual results |

2019–20 Actual results |

|---|---|---|---|---|---|

|

Percentage of audit reports on financial statements without qualifications or “other matters” raised |

100% |

Ongoing |

Target not met |

Target not met |

Target not met |

|

Percentage of special examination reports with no significant deficiencies |

100% |

Ongoing |

Target not met |

Target not met |

Target not met |

|

Percentage of audit reports to Parliament that are reviewed by parliamentary committees |

At least |

Ongoing |

Target met |

Target not met |

Target not met |

|

Percentage of audit recommendations or opinions addressed by entities: For financial audits, percentage of qualifications and “other matters” addressed from one financial audit report to the next |

100% |

Ongoing |

Target not met |

Target not met |

Target not met |

|

Percentage of audit recommendations or opinions addressed by entities: For performance audits, percentage of recommendations examined in our performance audit follow-up audits for which progress is assessed as satisfactory |

At least |

Ongoing |

No follow-up conducted |

No follow-up conducted |

No follow-up conducted |

|

Percentage of audit recommendations or opinions addressed by entities: For special examinations, percentage of significant deficiencies reported in our special examination reports that are addressed from one examination to the next |

100% |

Ongoing |

Target met |

Target not met |

Not applicableNote 5 |

|

Percentage of users who find that our audits are understandable, timely, fair, and add value |

At least |

Ongoing |

Target met |

Target met |

Target met |

|

Percentage of senior managers in the organizations we audit who find that our audits are understandable, timely, fair, and add value |

At least |

Ongoing |

Target not met |

Target not met |

Target met |

|

Percentage of audits that meet statutory deadlines, where applicable, or our planned reporting dates: |

|||||

|

100% |

Ongoing |

Target not met |

Target not met |

Target not met |

|

At least |

Ongoing |

Target met |

Target met |

Target met |

Resources used

The Office of the Auditor General of Canada (OAG) reports information about its expenditures on the Government of Canada’s Open Government portal. This information includes all contracts valued at more than $10,000 and all travel and hospitality expenses of the Auditor General, the deputy auditors general, the Commissioner of the Environment and Sustainable Development, and the assistant auditors general. The OAG also publishes quarterly financial reports and annual audited financial statements on its website.

Parliamentary authorities provided and used

Parliament provided the OAG with up to $90.4 million in parliamentary authorities, which consisted of $88.2 million in Main Estimates authorities and $2.2 million in adjustments and transfers, which for the most part were routine in nature—for example, carry-forward funding from the previous year and an adjustment to the contributions to employee benefit plans (Exhibit 2).

Exhibit 2—Budgetary financial resources (millions of dollars)

| 2019–20 Main Estimates |

2019–20 Planned spending |

2019–20 Total authorities available for use |

2019–20 Actual spending (authorities used) |

2019–20 Difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 88.2 | 88.2 | 90.4 | 87.6 | (0.6) |

In the 2019–20 fiscal year, $87.6 million was charged against our total parliamentary authorities of $90.4 million. This resulted in the lapsing of $2.8 million of the OAG’s parliamentary authorities provided in the 2019–20 fiscal year. The OAG may carry forward up to 5% of its operating budget (on the basis of Main Estimates program expenditures) into the next fiscal year, subject to parliamentary approval. This carry forward comprises a combination of either lapsed authorities and/or credits for certain pay-related amounts for which authorities were not provided in the current year. We expect to carry forward $4.0 million into the 2020–21 fiscal year.

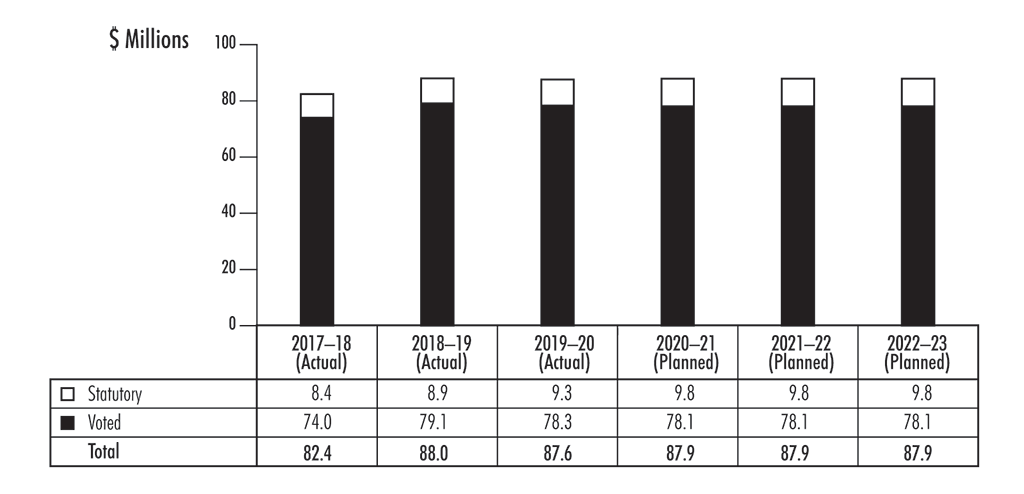

Exhibit 3 shows the trend in our spending based on parliamentary authorities used for the 2017–18 to 2022–23 fiscal years, and Exhibit 4 shows our budgetary performance summary for the 2017–18 to 2021–22 fiscal years.

Exhibit 3—Trend in authorities used

Exhibit 3—text version

| 2017–18 (Actual) |

2018–19 (Actual) |

2019–20 (Actual) |

2020–21 (Planned) |

2021–22 (Planned) |

2022–23 (Planned) |

|

|---|---|---|---|---|---|---|

| Statutory | 8.4 | 8.9 | 9.3 | 9.8 | 9.8 | 9.8 |

| Voted | 74.0 | 79.1 | 78.3 | 78.1 | 78.1 | 78.1 |

| Total | 82.4 | 88.0 | 87.6 | 87.9 | 87.9 | 87.9 |

Exhibit 4—Budgetary performance summary (millions of dollars)

| 2019–20 Main Estimates |

2019–20 Planned spending |

2020–21 Planned spending |

2021–22 Planned spending |

2019–20 Total authorities available for use |

2017–18 Actual spending (authorities used) |

2018–19 Actual spending (authorities used) |

2019–20 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|

| 88.2 | 88.2 | 87.9 | 87.9 | 90.4 | 82.4 | 88.0 | 87.6 |

Human resources

In the 2019–20 fiscal year, the OAG planned to use 580 full-time-equivalent employees but actually used 567.

Exhibit 5 shows the trend in our full-time equivalents.

Exhibit 5—Human resources (full-time equivalents)

| 2017–18 Actual |

2018–19 Actual |

2019–20 Actual |

2019–20 Planned |

2020–21 Planned |

2021–22 Planned |

|---|---|---|---|---|---|

| 568 | 552 | 567 | 580 | 585 | 595 |

Expenditures by vote

For information on the OAG’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2019–2020.

Government of Canada spending and activities

Information on the alignment of the OAG’s spending with the Government of Canada’s spending and activities is available in the GC InfoBase.

Financial statements

Statement of Management Responsibility

Including Internal Control Over Financial Reporting

Management of the Office of the Auditor General of Canada (OAG) is responsible for the preparation of the accompanying financial statements for the year ended 31 March 2020, and for all information contained in these statements, in accordance with Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management’s best estimates and judgment and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the OAG’s financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in the OAG’s Departmental Results Report, is consistent with these audited financial statements. In preparing the financial statements, management is responsible for assessing the OAG’s ability to continue as a going concern; disclosing matters related to going concern; and using the going concern basis of accounting, as applicable.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR), which is designed to provide reasonable assurance that financial information is reliable; that assets are safeguarded; and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities, and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through the careful selection, training, and development of qualified staff; through organizational arrangements that provide appropriate divisions of responsibility; through communications aimed at ensuring that regulations, policies, standards, and managerial authorities are understood throughout the OAG; and through an annual assessment of the effectiveness of the system of ICFR.

The system of ICFR is designed to mitigate risks to a reasonable level and may not prevent or detect all misstatements. It is based on an ongoing process designed to identify key risks, to assess the effectiveness of associated key controls, and to make any necessary adjustments.

The effectiveness and adequacy of the OAG’s system of internal control are reviewed through the work of internal audit staff, who conduct periodic audits of different areas of the OAG’s operations. Also, financial services staff annually monitor ICFR. As a basis for recommending approval of the financial statements to the Auditor General, the OAG’s Audit Committee reviews management’s arrangements for internal controls and the accounting policies employed by the OAG for financial reporting purposes. The Audit Committee also meets independently with the OAG’s internal and external auditors to consider the results of their work.

A risk-based assessment of the system of ICFR for the year ended 31 March 2020 was completed in accordance with the Treasury Board’s Policy on Financial Management. The results and action plans are summarized in the 2019–20 Annex to the Statement of Management Responsibility Including Internal Control Over Financial Reporting.

Raymond Chabot Grant Thornton limited liability partnershipLLP Chartered Professional Accountants, Licensed Public Accountants, the independent auditor for the OAG, has expressed an opinion on the fair presentation of the financial statements of the OAG in conformity with Canadian public sector accounting standards, which does not include an audit opinion on the annual assessment of the effectiveness of the OAG’s ICFR.

[Original signed by]

Karen Hogan, Chartered Professional AccountantCPA, Chartered AccountantCA

Auditor General of Canada

[Original signed by]

Lucie Cardinal, Chartered Professional AccountantCPA, Chartered AccountantCA

Assistant Auditor General and

Chief Financial Officer

Ottawa, Canada

11 September 2020

Independent Auditor’s Report

To the Speaker of the House of Commons:

Report on the Financial Statements

Opinion

We have audited the financial statements of the Office of the Auditor General of Canada (the “Office”), which comprise the statement of financial position as at 31 March 2020, and the statements of operations, change in net debt and cash flow for the year then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Office as at 31 March 2020, and the results of its operations, the change in its net debt and its cash flows for the year then ended in accordance with Canadian public sector accounting standards.

Basis for Opinion

We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the “Auditor’s responsibilities for the audit of the financial statements” section of our report. We are independent of the Office in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Responsibilities of Management and Those Charged with Governance for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Office’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Office or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Office’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control;

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Office’s internal control;

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management;

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Office’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Office to cease to continue as a going concern;

- Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Report on Compliance with Specified Authorities

Opinion

In conjunction with the audit of the financial statements, we have audited transactions of the Office coming to our notice for compliance with specified authorities. The specified authorities for which compliance was audited are the Financial Administration Act and its regulations and the Auditor General Act.

In our opinion, the transactions of the Office that came to our notice during the audit of the financial statements have complied, in all material respects, with the specified authorities referred to above.

Responsibilities of Management for Compliance with Specified Authorities

Management is responsible for the Office’s compliance with the specified authorities named above, and for such internal control as management determines is necessary to enable the Office to comply with the specified authorities.

Auditor’s Responsibilities for the Audit of Compliance with Specified Authorities

Our audit responsibilities include planning and performing procedures to provide an audit opinion and reporting on whether the transactions coming to our notice during the audit of the financial statements are in compliance with the specified authorities referred to above.

[Original signed by]

Raymond Chabot Grant Thornton Limited Liability PartnershipLLP

Chartered Professional Accountants,

Licensed Public Accountants

Ottawa, Canada

11 September 2020

Office of the Auditor General of Canada

Statement of Financial Position

as at March 31

| 2020 | 2019 | |

|---|---|---|

| Financial assets | ||

|

Due from the Consolidated Revenue Fund

|

6,964 | 10,841 |

|

Accounts receivable (note 4)

|

2,336 | 1,939 |

|

Accounts receivable held on behalf of the Government of Canada (note 4)

|

(183) | (213) |

| 9,117 | 12,567 | |

| Liabilities | ||

|

Accounts payable and accrued liabilities (note 5)

|

9,052 | 12,405 |

|

Vacation pay

|

7,073 | 5,055 |

|

Sick leave benefits (note 6b)

|

2,807 | 2,934 |

|

Severance benefits (note 6c)

|

2,026 | 2,205 |

|

Maternity/parental leave benefits (note 6d)

|

654 | 647 |

| 21,612 | 23,246 | |

| Net debt | (12,495) | (10,679) |

| Non-financial assets | ||

|

Tangible capital assets (note 7)

|

2,334 | 2,214 |

|

Prepaid expenses

|

619 | 283 |

| 2,953 | 2,497 | |

| Accumulated deficit | (9,542) | (8,182) |

Contractual obligations (note 11)

The accompanying notes are an integral part of these financial statements.

Approved by

[Original signed by]

Karen Hogan, Chartered Professional AccountantCPA, Chartered AccountantCA

Auditor General of Canada

[Original signed by]

Lucie Cardinal, Chartered Professional AccountantCPA, Chartered AccountantCA

Assistant Auditor General and

Chief Financial Officer

Ottawa, Canada

11 September 2020

Office of the Auditor General of Canada

Statement of Operations

for the year ended March 31

| 2020 | 2020 | 2019 | |

|---|---|---|---|

| Budget (Note 13) |

Actual | Actual | |

| Expenses (note 8) | |||

|

Financial audits of Crown corporations, territorial governments, and other organizations, and of the consolidated financial statements of the Government of Canada

|

52,400 | 55,924 | 49,823 |

|

Performance audits and studies

|

32,700 | 30,715 | 32,310 |

|

Special examinations of Crown corporations

|

4,300 | 4,127 | 5,062 |

|

Sustainable development monitoring activities and environmental petitions

|

2,000 | 1,584 | 1,703 |

|

Professional practices

|

11,200 | 11,187 | 10,854 |

| Total cost of operations | 102,600 | 103,537 | 99,752 |

| Revenues | |||

|

International audits

|

1,600 | 1,140 | 1,079 |

|

Other

|

— | 221 | 300 |

|

Revenues earned on behalf of the Government of Canada

|

— | (199) | (200) |

| Net revenues | 1,600 | 1,162 | 1,179 |

| Net cost of operations before government funding and transfers | 101,000 | 102,375 | 98,573 |

| Government funding and transfers (note 3) | |||

|

Net cash provided by the Government of Canada

|

— | 91,522 | 84,643 |

|

Change in Due from the Consolidated Revenue Fund

|

— | (3,877) | 2,148 |

|

Services provided without charge (note 10b)

|

— | 13,370 | 12,726 |

| Total government funding and transfers | 103,620 | 101,015 | 99,517 |

| Annual (deficit)/surplus | 2,620 | (1,360) | 944 |

| Accumulated deficit, beginning of year | (8,182) | (8,182) | (9,126) |

| Accumulated deficit, end of year | (5,562) | (9,542) | (8,182) |

The accompanying notes are an integral part of these financial statements.

Office of the Auditor General of Canada

Statement of Change in Net Debt

for the year ended March 31

| 2020 | 2020 | 2019 | |

|---|---|---|---|

| Budget (Note 13) |

Actual | Actual | |

| Annual (deficit)/surplus | 2,620 | (1,360) | 944 |

| Acquisition of tangible capital assets (note 7) | (2,750) | (679) | (1,032) |

| Amortization of tangible capital assets (notes 7 and 8) | 480 | 559 | 481 |

| 350 | (1,480) | 393 | |

| Increase in prepaid expenses | — | (336) | (151) |

| (Increase)/decrease in net debt, during the year | 350 | (1,816) | 242 |

| Net debt, beginning of year | (10,679) | (10,679) | (10,921) |

| Net debt, end of year | (10,329) | (12,495) | (10,679) |

The accompanying notes are an integral part of these financial statements.

Office of the Auditor General of Canada

Statement of Cash Flow

for the year ended March 31

| 2020 | 2019 | |

|---|---|---|

| Operating transactions | ||

|

Cash paid for

|

||

|

Employee salaries, wages, and benefits

|

(69,856) | (64,609) |

|

Services, transportation, communication, and other expenses

|

(15,678) | (14,516) |

|

Statutory contributions to employee benefit plans

|

(10,154) | (9,197) |

| (95,688) | (88,322) | |

|

Cash received from

|

||

|

Salaries and benefits recovered

|

1,768 | 2,984 |

|

International audits

|

1,288 | 212 |

|

Sales tax recovered

|

1,232 | 1,284 |

|

Other

|

426 | 271 |

| 4,714 | 4,751 | |

|

Cash used by operating transactions

|

(90,974) | (83,571) |

| Capital transactions | ||

|

Cash used to acquire tangible capital assets

|

(548) | (1,072) |

|

Cash applied to capital transactions

|

(548) | (1,072) |

| Net cash provided by the Government of Canada (note 3c) | (91,522) | (84,643) |

The accompanying notes are an integral part of these financial statements.

Office of the Auditor General of Canada

Notes to the financial statements for the year ended 31 March 2020

1. Authority and objective

The Auditor General Act, the Financial Administration Act, and a variety of other acts and orders-in-council set out the duties of the Auditor General and the Commissioner of the Environment and Sustainable Development.

The core responsibility of the Office of the Auditor General of Canada (OAG) is legislative auditing and consists of performance audits and studies of departments and agencies; the audit of the consolidated financial statements of the Government of Canada; financial audits of Crown corporations, territorial governments, and other organizations; special examinations of Crown corporations; and sustainable development monitoring activities and environmental petitions.

Pursuant to the Financial Administration Act, the OAG is a department of the Government of Canada. It is listed in Schedule I.1 of the act as a division or a branch of the federal public administration, and in Schedule V of the act as a separate agency. The OAG is not subject to income taxes under the provisions of the Income Tax Act.

2. Significant accounting policies

a) Basis of presentation

The financial statements of the OAG have been prepared by management in accordance with Canadian public sector accounting standards (PSAS).

b) Parliamentary authorities

The OAG is funded by the Government of Canada through parliamentary authorities. Financial reporting of authorities provided to the OAG does not parallel financial reporting according to PSAS, since authorities are primarily based on cash flow requirements. Consequently, items recognized in the Statement of Operations and in the Statement of Financial Position are not necessarily the same as those provided through authorities from Parliament. Note 3a provides a reconciliation between the 2 bases of reporting.

c) Revenues

Revenues are from international audits and from other activities, such as audit professional services provided to members of the Canadian Council of Legislative Auditors.

Revenues are recognized in the period in which services are rendered or in the period in which the underlying transaction or event that gave rise to the revenue takes place.

Revenues that are considered to be earned on behalf of the Government of Canada are not available for discharging the OAG’s liabilities. Although the OAG is expected to maintain accounting control, it has no authority regarding the disposition of those revenues. As a result, revenues earned on behalf of the Government of Canada are presented as a reduction of the OAG’s gross revenues.

d) Net cash provided by the Government of Canada

The OAG operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the OAG is deposited to the CRF, and all cash disbursements made by the OAG are paid from the CRF. The net cash provided by the Government of Canada is the difference between all cash receipts and all cash disbursements, including transactions between departments of the Government of Canada.

e) Due from the Consolidated Revenue Fund

Amounts due from or to the CRF are the result of timing differences at year-end between when a transaction affects authorities and when it is processed through the CRF. Amounts due from the CRF represent the net amount of cash that the OAG is entitled to draw from the CRF, without further parliamentary authorities to discharge its liabilities. This amount is not considered to be a financial instrument.

f) Accounts receivable and Accounts receivable held on behalf of the Government of Canada

Accounts receivable are stated at the lower of cost and net recoverable value. A valuation allowance is recorded for accounts receivable where recovery is considered uncertain.

Accounts receivable held on behalf of the Government of Canada are presented as a reduction to the financial assets on the Statement of Financial Position because they are not available to discharge the OAG’s liabilities.

g) Tangible capital assets

Tangible capital assets are recorded at historical cost less accumulated amortization. The OAG capitalizes the costs associated with the development of software used internally, such as installation costs, professional service contract costs, and salary costs of employees directly associated with these projects. The costs of software maintenance, project management and administration, data conversion, and training and development are expensed in the year incurred.

When conditions indicate that a tangible capital asset no longer contributes to the OAG’s ability to provide services, or that the value of future economic benefits associated with the tangible capital asset is less than its net book value, the cost of the tangible capital asset is reduced to reflect the decline in the asset’s value. Any write-downs of tangible capital assets are accounted for as expenses in the Statement of Operations and are not subsequently reversed.

The cost of work in progress is transferred to the applicable asset class in the year the assets are put into service.

Amortization of tangible capital assets begins when assets are put into use and is recorded using the straight-line method over the estimated useful lives of the assets as follows:

| Tangible capital asset class | Useful life |

|---|---|

| Leasehold improvements | Lesser of the remaining term of the lease or the useful life of the improvements |

| Furniture and fixtures | 10 years |

| Informatics software | 5 years |

| Informatics Hardware and Infrastructure | 5 years |

| Office equipment | 4 to 10 years |

| Motor vehicle | 5 years |

| Work in progress | In accordance with asset class, once in service |

h) Accounts payable and accrued liabilities

Accounts payable and accrued liabilities represent obligations of the OAG for salaries and wages, for material and supply purchases, and for the cost of services rendered to the OAG.

Salary-related accrued liabilities are primarily determined using employees’ salaries at year-end. Accounts payable and accrued liabilities are measured at cost.

i) Vacation pay

Vacation pay is accrued as the benefit is earned by the employees under their respective labour contracts and conditions of employment. The liability represents all unused vacation pay benefits accruing to employees. The employees’ salaries at year-end determine the amount of these accrued vacation pay benefits.

j) Employee benefits

i) Pension benefits

All eligible employees participate in the Public Service Pension Plan, a plan administered by the Government of Canada. The OAG’s contributions are currently based on a multiple of an employee’s required contributions and may change over time, depending on the experience of the plan. The OAG’s contributions are expensed during the year in which the services are rendered and represent its total pension obligation. The OAG is not required to make contributions with respect to any actuarial deficiencies of the plan.

ii) Health and dental benefits

The Government of Canada sponsors employee benefit plans (health and dental) in which the OAG participates. Employees are entitled to health and dental benefits, as provided for under labour contracts and conditions of employment. The OAG’s contributions to the plans, which are provided without charge by the Treasury Board of Canada Secretariat, are recorded at cost based on a percentage of the salary expenses and charged to personnel expenses in the year incurred. They represent the OAG’s total obligation to the plans. Current legislation does not require the OAG to make contributions for any future unfunded liabilities of the plans.

iii) Sick leave benefits

Employees are eligible to accumulate sick leave benefits until the end of employment, according to their labour contracts and conditions of employment. Sick leave benefits are earned based on employee services rendered and are paid upon an illness or injury-related absence. These are accumulating non-vesting benefits that can be carried forward to future years, but are not eligible for payment on retirement or termination, nor can these be used for any other purpose. A liability is recorded for unused sick leave credits expected to be used in future years in excess of future allotments, based on an actuarial valuation using an accrued benefit method. Changes in actuarial assumptions and any variance between the expected and the actual experience of the sick leave benefit plan give rise to actuarial gains or losses. These gains or losses are amortized on a straight-line basis over the expected average remaining service life of the employees, starting in the fiscal year following the one in which they arose.

iv) Severance benefits

The accumulation of severance benefits for employees ceased in the 2012–13 fiscal year. The accrued benefit obligation is determined using employees’ salaries at year-end and the number of weeks earned but unpaid for employees who have elected to defer the receipt of their full or partial severance benefits payment.

v) Maternity/parental leave benefits

Employees are entitled to maternity/parental leave benefits as provided for under labour contracts and conditions of employment. The benefits earned are event-driven, meaning that the OAG’s obligation for the cost of the entire benefit arises upon occurrence of a specific event, being the commencement of the maternity/parental leave. The accrued benefit obligation and benefit expenses are based on management’s best estimates.

k) Related party transactions

i) Inter-entity transactions

The OAG is related as a result of common ownership to all Government of Canada departments, agencies, and Crown corporations. The OAG enters into transactions with these organizations in the normal course of business. These transactions are measured as follows:

- Inter-entity transactions are measured at the exchange amount when undertaken on similar terms and conditions to those adopted if the entities were dealing at arm’s length, or where transactions are allocated costs and recoveries.

- Common services provided without charge by other government departments are recorded as operating expenses by the OAG at the carrying amount of the providing department. A corresponding amount is reported as government funding in the Statement of Operations.

- Other inter-entity transactions are measured at the carrying amount of the providing department.

ii) Other related party transactions

Related parties include key management personnel who have the authority and responsibility for planning, directing, and controlling the activities of the OAG. Related parties also include the close family members of these personnel. The OAG has defined its key management personnel to be the Executive Committee members and parties related to them.

The OAG is also related to the Canadian Council of Legislative Auditors through the sharing of responsibilities for planning and directing its operations (see note 9b).

Related party transactions, other than inter-entity transactions, are recorded at the exchange amount.

l) Allocation of expenses

All direct expenses related to the delivery of audits and professional practice projects, such as salary, professional services, travel, and other associated costs, are allocated to each audit and professional practice project. All other expenses, including services provided without charge, are treated as overhead and are allocated to audits and professional practice projects on the basis of the direct staff cost charged to them.

m) Measurement uncertainty

These financial statements are prepared in accordance with PSAS. These standards require management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues, government funding and transfers, and expenses during the reporting period. The amount of services provided without charge, the assumptions underlying the liability calculation for sick leave benefits, and the estimated useful lives of tangible capital assets are the most significant items for which estimates are used. Actual results could differ significantly from the estimates. These estimates are reviewed annually, and as adjustments become necessary, they are recognized in the financial statements in the period in which they become known.

In March 2020, the World Health Organization declared the global outbreak of COVID-19 a pandemic. Responses to the spread of COVID-19 have resulted in a significant impact on the Canadian and global economies. In preparing our financial statements, we have assessed the impact of the economic uncertainty due to COVID-19 and have determined that it did not have a significant impact on our financial operations, control environment, estimates, going concern assessment, or asset valuation.

3. Parliamentary authorities

The OAG is funded through annual parliamentary authorities. Items recognized in the Statement of Operations in one year may be funded through parliamentary authorities in prior, current, or future years. Accordingly, the OAG has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables.

a) Reconciliation of net cost of operations to current year authorities used

| 2020 | 2019 | |

|---|---|---|

| Net cost of operations before government funding and transfers | 102,375 | 98,573 |

| Adjustments for items recorded as part of net cost of operations but not affecting current year authorities: | ||

|

Services provided without charge by other government departments

|

(13,370) | (12,726) |

|

(Increase)/decrease in liabilities not charged to authorities

|

(1,816) | 242 |

|

Amortization of tangible capital assets

|

(559) | (481) |

|

Adjustment to previous year accruals

|

161 | 351 |

| Total items recorded as part of net cost of operations but not affecting current year authorities | (15,584) | (12,614) |

| Adjustments for items not recorded as part of net cost of operations but affecting current year authorities: | ||

|

Acquisition of tangible capital assets

|

679 | 1,032 |

|

Increase in prepaid expenses

|

336 | 151 |

|

(Recoveries from prior year’s revenues) / revenues available for spending in future years

|

(214) | 817 |

|

Other

|

62 | 43 |

| Total items not recorded as part of net cost of operations but affecting current year authorities | 863 | 2,043 |

| Current year authorities used | 87,654 | 88,002 |

b) Authorities provided and used

| 2020 | 2019 | |

|---|---|---|

| Main Estimates | ||

|

Vote 1—Program expenditures

|

78,085 | 69,028 |

|

Statutory amounts—Contributions to employee benefit plans

|

10,154 | 9,197 |

| Total Main Estimates | 88,239 | 78,225 |

| Supplemental operating authorities | 2 | 12,651 |

| Authorities carried forward from previous year | 2,987 | 1,772 |

| Adjustment to statutory contributions to employee benefit plans | (820) | (294) |

| Current year authorities provided | 90,408 | 92,354 |

| Less: Lapsed authorities | (2,754) | (4,352) |

| Current year authorities used | 87,654 | 88,002 |

The OAG may carry forward up to 5% of its operating budget (based on Main Estimates program expenditures) into the next fiscal year, subject to parliamentary approval. We expect to carry forward $4.0 million ($3.5 million in 2018–19).

c) Reconciliation of net cash provided by the Government of Canada to current year appropriations used

| 2020 | 2019 | |

|---|---|---|

| Net cash provided by the Government of Canada | 91,522 | 84,643 |

| Change in Due from the Consolidated Revenue Fund | ||

|

Increase in Accounts receivable and Accounts receivable held on behalf of the Government of Canada

|

(427) | (69) |

|

(Decrease)/increase in liabilities charged to authorities

|

(3,450) | 2,217 |

| Total—Change in Due from the Consolidated Revenue Fund | (3,877) | 2,148 |

|

(Recoveries from prior year’s revenues) / revenues available for spending in future years

|

(214) | 817 |

|

Adjustment to previous year accruals

|

161 | 351 |

|

Other

|

62 | 43 |

| Current year authorities used | 87,654 | 88,002 |

4. Accounts receivable

The following table presents details of the OAG’s accounts receivable:

| 2020 | 2019 | |

|---|---|---|

| International audits and audit-related professional services | 1,059 | 1,177 |

| Other government departments and agencies | 1,081 | 473 |

| Other | 196 | 289 |

| Gross accounts receivable | 2,336 | 1,939 |

| Accounts receivable held on behalf of the Government of Canada | (183) | (213) |

| Net accounts receivable | 2,153 | 1,726 |

5. Accounts payable and accrued liabilities

The following table presents details of the OAG’s accounts payable and accrued liabilities:

| 2020 | 2019 | |

|---|---|---|

| Accrued employee salaries | 6,495 | 10,573 |

| Due to others | 2,557 | 1,832 |

| Total | 9,052 | 12,405 |

6. Employee benefits

a) Pension benefits

The OAG’s eligible employees participate in the Public Service Pension Plan, which is established and governed by the Public Service Superannuation Act, and sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2% per year of pensionable service, times the average of the best 5 consecutive years of earnings. The benefits are integrated with Canada/Québec Pension Plan benefits, and they are indexed to inflation.

Both the employees and the OAG contribute to the cost of the Public Service Pension Plan. Because of the amendment of the Public Service Superannuation Act following the implementation of provisions related to Economic Action Plan 2012, employee contributors have been divided into 2 groups: Group 1 relates to existing plan members as of 31 December 2012, and Group 2 relates to members joining the Public Service Pension Plan as of 1 January 2013. Each group has a distinct contribution rate.

The 2019–20 expense amounts to $6.5 million ($6.2 million in 2018–19). For Group 1 members, the expense represents approximately 1.01 times (1.01 times in 2018–19) the employee contributions and, for Group 2 members, approximately 1.00 times (1.00 times in 2018–19) the employee contributions.

The OAG’s responsibility with regard to the Public Service Pension Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the plan’s sponsor.

b) Sick leave benefits

Employees are credited, based on service, a maximum of 15 days annually for use as paid absences due to illness or injury. The sick leave benefit obligation is unfunded and will be paid from future parliamentary authorities.

The most recent actuarial valuation of the sick leave accrued benefit obligation performed for accounting purposes was done as at 31 March 2019 and extrapolated to 31 March 2020. Actuarial assumptions are used to determine the obligation. They are reviewed at March 31 of each year and are management’s best estimate based on an analysis of the historical data up to the reporting date. The key assumptions used are a discount rate of 1.0% (1.7% in 2018–19), which is based on an average yield of government borrowings over the expected average remaining service life of employees of 9 years (9 years in 2018–19); a rate of salary increase of 3.5% (3.5% in 2018–19); an average turnover rate of 7.4% (7.4% in 2018–19); and an average retirement age of 58 (58 in 2018–19) for Group 1 members and 61 (61 in 2018–19) for Group 2 members.

Information about the sick leave benefits as at March 31 is as follows:

| 2020 | 2019 | |

|---|---|---|

| Accrued benefit obligation, beginning of year | 2,583 | 2,278 |

|

Current year benefit costNote 1

|

414 | 343 |

|

Interest on the accrued benefit obligationNote 1

|

47 | 55 |

|

Benefits paid

|

(511) | (684) |

|

Actuarial loss

|

130 | 591 |

| Accrued benefit obligation, end of year | 2,663 | 2,583 |

| Unamortized accumulated actuarial gain, beginning of year | 351 | 1,084 |

|

Actuarial loss for the year

|

(130) | (591) |

|

Amortization of actuarial gain recognized in the yearNote 1

|

(77) | (142) |

| Unamortized accumulated actuarial gain, end of year | 144 | 351 |

| Accrued benefit liability | 2,807 | 2,934 |

Changes in assumptions can result in significantly higher or lower estimates of the accrued benefit obligation. The following table illustrates the possible impact of a change in the actuarial assumptions on the accrued benefit obligation as at March 31:

| Assumptions | Increase (decrease) in the accrued benefit obligation |

|

|---|---|---|

| 2020 | 2019 | |

| Discount rate | ||

|

Increase by 1%

|

(182) | (161) |

|

Decrease by 1%

|

207 | 183 |

| Salary increase rate | ||

|

Increase by 1%

|

160 | 151 |

|

Decrease by 1%

|

(147) | (136) |

| Retirement age | ||

|

Increase by 1 year

|

266 | 259 |

|

Decrease by 1 year

|

(261) | (254) |

| Turnover rate | ||

|

Increase factors by 10%

|

(91) | (87) |

|

Decrease factors by 10%

|

99 | 93 |

| Sick leave utilization rates | ||

|

Increase factors by 10%

|

336 | 322 |

|

Decrease factors by 10%

|

(320) | (307) |

c) Severance benefits

The OAG’s severance benefit obligation is unfunded and will be paid from future parliamentary authorities.

The following table presents information about severance benefits, measured as at March 31:

| 2020 | 2019 | |

|---|---|---|

| Accrued benefit obligation, beginning of year | 2,205 | 2,736 |

|

Current year benefit cost

|

180 | 109 |

|

Benefits paid

|

(359) | (640) |

| Accrued benefit obligation, end of year | 2,026 | 2,205 |

d) Maternity/parental leave benefits

Management determined the accrued benefit obligation and benefit expenses of maternity/parental leave benefits based on the difference between 93% of the employee’s weekly rate of pay and the weekly maternity/parental leave benefit the employee is entitled to receive under the Employment Insurance program or the Québec Parental Insurance Plan. The maternity/parental leave benefit obligation is unfunded and will be paid from future parliamentary authorities.

The following table presents information about maternity/parental leave benefits, measured as at March 31:

| 2020 | 2019 | |

|---|---|---|

| Accrued benefit obligation, beginning of year | 647 | 441 |

|

Current year benefit cost

|

1,299 | 1,099 |

|

Benefits paid

|

(1,292) | (893) |

| Accrued benefit obligation, end of year | 654 | 647 |

7. Tangible capital assets

| Cost | Accumulated amortization | 2020 Net book value |

2019 Net book value |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Opening balance | Acquisitions | Transfers | Disposals | Closing balance | Opening balance | Amortization | Disposals | Closing balance | |||

| Leasehold improvements | 3,470 | 14 | — | — | 3,484 | 3,293 | 82 | — | 3,375 | 109 | 177 |

| Furniture and fixtures | 4,384 | 9 | — | 25 | 4,368 | 4,341 | 8 | 25 | 4,324 | 44 | 43 |

| Informatics software | 4,275 | 129 | 694 | — | 5,098 | 4,076 | 231 | — | 4,307 | 791 | 199 |

| Informatics hardware and infrastructure | 2,325 | 80 | — | 16 | 2,389 | 1,479 | 167 | 16 | 1,630 | 759 | 846 |

| Office equipment | 1,181 | 30 | — | 9 | 1,202 | 1,049 | 66 | 9 | 1,106 | 96 | 132 |

| Motor vehicle | 25 | — | — | — | 25 | 10 | 5 | — | 15 | 10 | 15 |

| Work in progress | 802 | 417 | (694) | — | 525 | — | — | — | — | 525 | 802 |

| Total | 16,462 | 679 | 50 | 17,091 | 14,248 | 559 | 50 | 14,757 | 2,334 | 2,214 | |

8. Expenses by object

The summary of expenses by object for the year ended March 31 is as follows:

| 2020 | 2019 | |

|---|---|---|

| Personnel | 81,845 | 79,034 |

| Rentals | 8,469 | 8,253 |

| Professional and special services | 6,713 | 5,857 |

| Transportation and communications | 3,736 | 3,789 |

| Small machinery and equipment | 1,028 | 1,196 |

| Information | 715 | 677 |

| Amortization of tangible capital assets | 559 | 481 |

| Utilities, materials, and supplies | 231 | 235 |

| Repairs and maintenance | 194 | 175 |

| Interest on the sick leave accrued benefit obligation | 47 | 55 |

| Total cost of operations | 103,537 | 99,752 |

The total cost of operations includes services provided without charge by other government departments as disclosed in note 10b.

9. Funded organizations

a) Canadian Audit and Accountability Foundation

The OAG is a member of the Canadian Audit and Accountability Foundation (CAAF), a not-for-profit corporation dedicated to promoting and strengthening public-sector performance audit, oversight, and accountability in Canada and abroad through research, education, and knowledge sharing.

In the 2019–20 fiscal year, the OAG paid fees and provided in-kind services to the CAAF totalling $0.7 million ($0.9 million in 2018–19), which represents 18% (26% in 2018–19) of the CAAF’s total revenues of $3.8 million ($3.4 million in 2018–19). As at 31 March 2020, the OAG held approximately 46% (47% in 2018–19) of the member voting rights of the CAAF and did not have any staff representation on the Board of Directors of the CAAF.

The OAG does not control the CAAF; therefore, the CAAF is not consolidated in these financial statements. The CAAF’s audited financial statements are included in its annual report, which is publicly available.

b) Canadian Council of Legislative Auditors

The OAG is a member of the Canadian Council of Legislative Auditors (CCOLA). The CCOLA is devoted to sharing information and supporting the continued development of auditing methodology, practices, and professional development. The CCOLA’s membership consists of all the provincial and federal legislative audit offices. The CCOLA has 1 associate member (the Office of the Auditor General of Bermuda) and 1 observer (the Office of the Auditor General of the Cayman Islands).

The OAG contributes to the CCOLA through the provision of secretariat and various administrative and support services. The CCOLA reports annually on its operations for the period from October 1 to September 30. For the year ended 30 September 2019, the OAG provided $0.4 million in services ($0.4 million in 2017–18) to the CCOLA. This amount represents approximately 50% of the CCOLA revenues of $0.8 million (50% of the $0.8 million in 2017–18).

The OAG does not control the CCOLA; therefore, the CCOLA is not consolidated in these financial statements.

10. Related party transactions

a) Inter-entity transactions

During the year, the OAG entered into inter-entity transactions as follows:

| 2020 | 2019 | |

|---|---|---|

| Expenses—Other government departments and agencies | 10,817 | 10,436 |

| Accounts receivable—Other government departments and agencies | 1,081 | 473 |

| Accounts payable—Other government departments and agencies | 263 | 92 |

Expenses disclosed in the table above exclude common services provided without charge, which are disclosed in the next table. The most significant components of the expenses are related to the statutory contributions to employee benefit plans, translation services, security services, and network services.

b) Common services provided without charge by other government departments

During the year, the OAG received the following services without charge from certain common service organizations. The expenses related to these services have been recorded in the Statement of Operations and are disclosed in note 8.

| 2020 | 2019 | |

|---|---|---|

| Office accommodation—Public Services and Procurement Canada | 7,212 | 7,149 |

| OAG contribution to the health and dental insurance plans—Treasury Board of Canada Secretariat | 6,158 | 5,577 |

| Services provided without charge | 13,370 | 12,726 |

The Government of Canada has centralized some of its administrative activities for efficiency, cost-effectiveness purposes, and economic delivery of programs to the public. As a result, the government uses central agencies and common services organizations so that one department performs services for all other departments and agencies without charge. The costs of these services, such as the payroll and cheque-issuance services provided by Public Services and Procurement Canada, are not included in the Statement of Operations, as they are not significant.

c) Common services provided without charge to other government departments

During the year, the OAG provided services without charge to federal departments and agencies, Crown corporations, and other government organizations. These services were related to the conduct of independent audits. The costs of these services are reflected in the Statement of Operations.

11. Contractual obligations

The nature of the OAG’s activities can result in contracts and obligations whereby the OAG will be obligated to make future payments when the services/goods are received. Contractual obligations estimated as at 31 March 2020 are summarized as follows:

| 2021 | 2022 | 2023 | 2024 | Total | |

|---|---|---|---|---|---|

| Goods and services | 1,513 | 515 | 416 | — | 2,444 |

| Professional services | 3,740 | 241 | 86 | 23 | 4,090 |

| Operating leases | 93 | 23 | — | — | 116 |

| Total | 5,346 | 779 | 502 | 23 | 6,650 |

Contractual obligations with related parties total $0.4 million and are included in the above table.

12. Financial instruments

The following analysis presents the OAG’s exposure to credit and liquidity risks at the reporting date.

a) Credit risk

The OAG is exposed to credit risk resulting from the possibility that parties may default on their financial obligations to pay the OAG. Management believes that the risk of loss on its accounts receivable balances is low because of the credit quality of these parties. Accounts receivable balances are managed and analyzed on an ongoing basis. Accordingly, management believes that all accounts receivable will be collected and has determined that a valuation allowance is not required.

b) Liquidity risk

Liquidity risk is the risk that the OAG will encounter difficulty in meeting its obligation associated with financial liabilities. The OAG’s objective for managing liquidity risk is to manage operations and cash expenditures within the authorities approved by Parliament. Management believes that this risk is low.

13. Planned results

The planned results amounts in the “Expenses” and “Revenues” sections of the Statement of Operations are the amounts reported in the Future-Oriented Statement of Operations included in the 2019–20 Departmental Plan. The planned results amounts on the line “Total government funding and transfers” of the Statement of Operations and in the Statement of Change in Net Debt were prepared for internal management purposes and have not been previously published.

14. Comparative figures

Certain 2018–19 comparative figures have been reclassified to conform to the presentation adopted for the 2019–20 fiscal year.

Additional information

Organizational profile

Auditor General of Canada: Karen Hogan, Chartered Professional AccountantCPA, Chartered AccountantCA

Main legislative authorities:

Auditor General Act, Revised Statutes of CanadaR.S.C. 1985, c. A-17

Financial Administration Act, R.S.C. 1985, c. F-11

Year established: 1878

Minister: The Honourable Chrystia Freeland, Privy CouncillorP.C., Member of ParliamentM.P., Minister of FinanceNote *

Raison d’être, mandate, and role: Who we are and what we do

“Raison d’être, mandate, and role: Who we are and what we do” is available on the Office of the Auditor General of Canada’s (OAG’s) website.

Operating context and risks

Information on operating context and key risks is available on the OAG’s website.

Reporting framework

The OAG’s departmental results framework and program inventory of record for the 2019–20 fiscal year are shown in Exhibit 6.

Exhibit 6—Departmental Results Framework and Program Inventory

Core responsibility: Legislative auditing

|

Description Our audit reports provide objective, fact-based information and expert advice on government programs and activities. With our audits, we assist Parliament in its work on the authorization and oversight of government spending and operations. Our audits are also used by territorial legislatures, boards of Crown corporations, and audit committees to help them oversee the management of government activities and hold them to account for the handling of public funds. Financial audits assess whether the annual financial statements of the Government of Canada, Crown corporations, and others are presented fairly, consistent with applicable accounting standards. Performance audits assess whether government organizations manage with due regard for economy, efficiency, and environmental impact, and measure their effectiveness. Special examinations assess whether Crown corporation systems and practices provide reasonable assurance that assets are safeguarded, resources are managed economically and efficiently, and operations are managed effectively. |

Result and indicators |

|

Well-managed and accountable government:

|

|

|

Program inventory |

|

|

Supporting information on the program inventory

Financial, human resources, and performance information for the OAG’s program inventory is available in the GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on the OAG’s website:

Federal tax expenditures