Impacts and results

Impact of the COVID-19 pandemic on our financial audits

The COVID-19 pandemic significantly affected the operations of our office and those of the federal organizations we audit. By mid-March 2020, most of our staff and those of the organizations we audit were working from home and had stopped all travel in response to public health measures. This situation created challenges in communicating with organizations, obtaining audit documentation, and managing the audit process remotely.

Canadian auditing standards require that we gain an understanding of the systems and internal controls of the federal organizations that we audit, particularly those relating to financial reporting. Because of working remotely, many organizations modified their business processes and controls, such as how transactions are approved. For our 2019–2020 financial audits, we used our understanding of these modifications to consider any increased risks of material errors in financial statements. As a result, we changed the way we audited certain processes and controls.

We performed additional audit work in higher-risk areas. The following are examples:

- We examined areas in which the pandemic affected accounting estimates prepared by management, such as allowances for doubtful accounts, provisions for loans, and loan guarantees. We did this because of the uncertainties in establishing key inputs—such as credit risk ratings and discount rates—used to measure certain accounting estimates.

- We examined the federal government’s estimated tax revenues and the related allowance for doubtful accounts. These estimates are based, in part, on the amount of tax payments received and the information in assessed tax returns. The many deadline extensions for tax payments and filings affected key inputs to the estimates.

- We assessed whether significant new benefit programs announced in the COVID-19 Emergency Response Act were recorded in the correct fiscal period.

We expect that the pandemic will continue to have an impact on our 2020–2021 financial audits, mainly the audit of the federal government’s 2020–21 consolidated financial statements (which are included in the Public Accounts of Canada). The consolidated financial statements will contain significant amounts of spending on programs responding to the COVID-19 pandemic. For this reason, we will continue to consider the need to adjust the nature, timing, and extent of our future annual audit work. We will make any adjustments as we plan each financial audit.

Our reduced staff capacity due to the pandemic, beginning in March 2020, meant that we had to reassess our priorities. We made considerable efforts to continue our work despite the challenging circumstances. Among other things, we hired more contract financial auditors to supplement our resources.

We collaborated with the federal organizations we audit and with central agencies. We wanted to understand the challenges they were facing and to determine how to plan our audit work in response to these challenges. In April 2020, we decided to delay some of our financial audits.

We delayed the audits of the following independent agents of Parliament:

- Office of the Chief Electoral Officer

- Office of the Commissioner of Lobbying of Canada

- Office of the Commissioner of Official Languages

- Office of the Information Commissioner of Canada

- Office of the Privacy Commissioner of Canada

- Office of the Public Sector Integrity Commissioner of Canada

There is no legislated deadline for financial reporting for these organizations. We have since resumed work on these audits, and by the end of October 2020, all but 2 were completed. We plan to complete the audit of the Office of the Commissioner of Official Languages and the Office of the Chief Electoral Officer in November 2020.

The financial audits of the following federal Crown corporations were also delayed:

- National Capital Commission

- Telefilm Canada

As a result, these 2 corporations were not able to submit their annual reports to their ministers within the 90 days following their fiscal year-ends as required by legislation. Given the exceptional circumstances of the pandemic, we did not consider these delays to be significant. Therefore, we did not modify our opinions on compliance with authorities in our independent auditor’s reports. We resumed work on these audits and completed our audit of Telefilm Canada in August 2020 and the National Capital Commission in October 2020.

We also had to adjust the timing of our audit work on the federal government’s 2019–20 consolidated financial statements. Both our office and the government adjusted year-end time frames as a result of the impact of the COVID-19 pandemic on the government’s preparation of the consolidated financial statements and on the execution of our work. We completed our audit in October 2020.

Results of our 2019–2020 financial audits

The Office of the Auditor General of Canada provided the Government of Canada with an unmodified audit opinion on its 2019–20 consolidated financial statements. This opinion provides credibility to the government’s financial reporting. Financial reporting is one way the government demonstrates accountability to elected officials and the public. The audit opinion is also an important contribution to meeting Canada’s commitments under the United Nations’ 2030 Agenda for Sustainable Development. In particular, the opinion helps Canada meet sustainable development target 16.6: “Develop effective, accountable and transparent institutions at all levels.”

Overall, we were satisfied with the timeliness and credibility of the financial statements prepared by 68 out of the 69 government organizations we audit, including the Government of Canada. For the organizations for which we postponed audits because of the COVID-19 pandemic, we were satisfied with the timeliness of the financial statements because of the exceptional circumstances and we considered the delay to be temporary. For the audits that were not yet complete, we were satisfied with the credibility of these financial statements on the basis of having completed most of our audit work.

Our audit opinion on National Defence’s Reserve Force Pension Plan remained outstanding. For many years, we had not been able to issue an audit opinion on the plan’s financial statements. This was because of significant and persistent problems with National Defence not having all the documents supporting the data used to estimate pension obligations. After considerable efforts made in the last year, National Defence has gathered the supporting documents needed for us to complete our audit. On the basis of this progress and the audit work we performed to date on the plan’s 31 March 2018 financial statements, we expect to complete the audit in late 2020. Once the 2018 audit is complete, we will start the audit of the 31 March 2019 financial statements, which we expect to complete in 2021.

We noted 3 recurring instances of non-compliance with the Financial Administration Act during 2 financial audits of Crown corporations this year. We first reported on these persisting situations in our Commentary on the 2017–2018 Financial Audits. Two of these instances related to appointments of officer-directors, which came up during the financial audits of Ridley Terminals incorporatedInc. and the Canada Development Investment Corporation. The third instance related to the remuneration of the President and Chief Operating Officer of Ridley Terminals Inc.

For Ridley Terminals Inc., the instances of non-compliance persisted until 19 December 2019, the end of the period that we audited. After the audit period, the government sold Ridley Terminals Inc. As a result, the corporation is no longer subject to the Financial Administration Act. No annual report was published for 2019. However, the financial statements and our auditor’s report were sent to the minister responsible.

For more details about the financial audit of the Canada Development Investment Corporation, refer to our independent auditor’s report in the corporation’s 2019 annual report.

Opportunities for improvement noted in our 2019–2020 financial audits

Financial audits identify opportunities for organizations to improve their systems of internal control, streamline their operations, or enhance their financial reporting practices. We issue management letters to inform the organizations about these opportunities and about more serious points, such as inadequate internal controls that can create risks of errors in financial reports.

As part of our annual financial audits, we follow up on the points we have raised in previous years so that we can monitor management’s progress in addressing them.

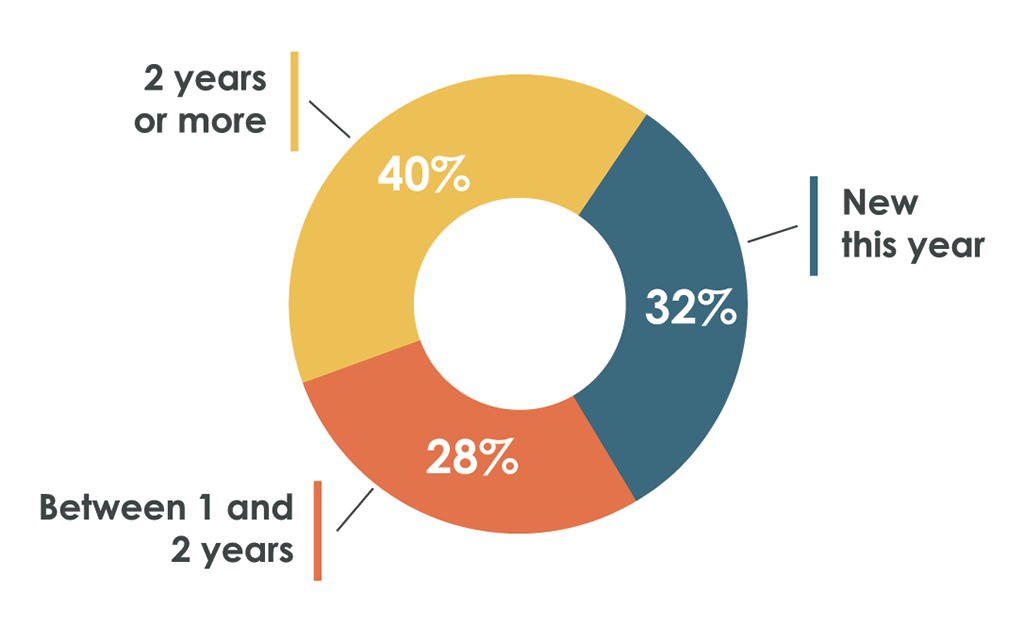

Our 2019–2020 financial audits have raised management letter points, some of which were not resolved within the year. Of the total management letter points that were unresolved as of 30 June 2020, 40% have been unresolved for 2 years or more, 28% have been unresolved for between 1 and 2 years, and another 32% were newly issued within the past year (Exhibit 1).

Exhibit 1—Unresolved management letter points from our 2019–2020 financial audits

Exhibit 1—text version

This pie chart shows the proportion of all unresolved management letter points from the 2019–2020 financial audits based on length of time outstanding. The chart shows that 40% of the unresolved management letter points from the 2019–2020 financial audits had been unresolved for 2 years or more, 32% were new this year, and 28% had been unresolved for between 1 and 2 years.

We noted opportunities for improvement in various areas. Similar to last year, the most common were the following:

- information technology (IT) general controls over systems supporting financial reporting, mainly related to access

- internal controls related to financial reporting

- compliance with government policies, legislation, and regulations

- accounting and financial reporting practices

Similar to what we reported last year, more than one third of the unresolved management letter points as of 30 June 2020 resulted from our reviews of IT general controls over systems supporting financial reporting. Such controls included access to programs and data, program development, program changes, and computer operations.

Our reviews are limited to certain financial audits, and the specific controls reviewed depend on our audit approach. We targeted access controls because they are fundamental for financial processes that depend on IT. Access controls, however, go beyond financial processes. In an IT environment, access controls ensure that only authorized individuals can access electronic data. If those controls are absent or weak, the data’s integrity is at risk.

Most of these unresolved management letter points related to the need to improve controls over the access granted to organizations’ IT systems. Recurring points we noted included access given to people who did not need it, access retained by people who no longer needed it, and weaknesses in the controls over access granted between organizations.

We informed organizations of the need to correct these important points because strong access controls are needed to safeguard the integrity of the government’s data.